Fast-Tracking Uranium Changes Everything

↵

Image Source: Pixabay

Uranium’s momentum has been building for nearly two years.

If you’ve been following along here at Prinsights, you’ve been tapped into this trend.

The bipartisan laws of 2023 and 2024 set the stage for the next leg of uranium’s uptrend. In 2025, that framework has shifted into more specific execution.

Uranium prices are holding above seventy dollars a pound. Meanwhile, U.S. utilities have yet to secure all the long-term supply needed to meet growing demand, as existing contracts expire and new agreements lag behind.

But the most profound signal that things have shifted is what has unfolded in Washington D.C. as leaders there just placed one of the largest uranium facilities on the same permitting fast‑track as American pipelines and defense assets.

That is a game-changer for uranium processing in the country.

Understanding how we got to this moment and what happens from there can leave you well-positioned to take advantage of the trend, as we detail below.

From Groundwork to Action

Russia’s invasion of Ukraine in March 2022 lit a fire under the D.C. beltway’s inertia on nuclear energy policy. That’s because nuclear power generates approximately 20% of U.S. electricity.

The first Trump administration launched a 232 investigation into uranium’s role as a key energy provider and whether it was intrinsic to national defense in July 2019. Yet, the situation took several more years of shifting policy, together with that escalation for legislation on the Hill, to form a cornerstone of 21st-century nuclear policy.

The first shoe to drop in a deluge of new U.S. uranium and legislative actions was the Nuclear Fuel Security Act. It became law in December 2023, tucked into the National Defense Authorization Act, for assured passage.

I have met directly with leaders and those involved in policymaking. Based on my time on the Hill over the months leading up to that landmark move with bipartisan members of the Energy and Commerce Committee, I can tell you that this is a window of opportunity. That’s because there was a growing bipartisan consensus working to push it forward, which remains in play. That’s because the demand for energy and its impact on the grid is very real – and legislative leaders are not only aware of this, but know that they must take action to meet the moment.

The next central turning point came in May 2024, when the Prohibiting Russian Uranium Imports Act became law. The Act phases out Russian uranium by 2028, fully by 2040, with only limited waivers.

Then, only a few weeks later, the ADVANCE Act was signed in July 2024. The move was another bipartisan-supported piece of legislation that worked to rewrite nuclear licensing, speed up timelines and clear paths for advanced reactor deployment.

From Action to Acceleration

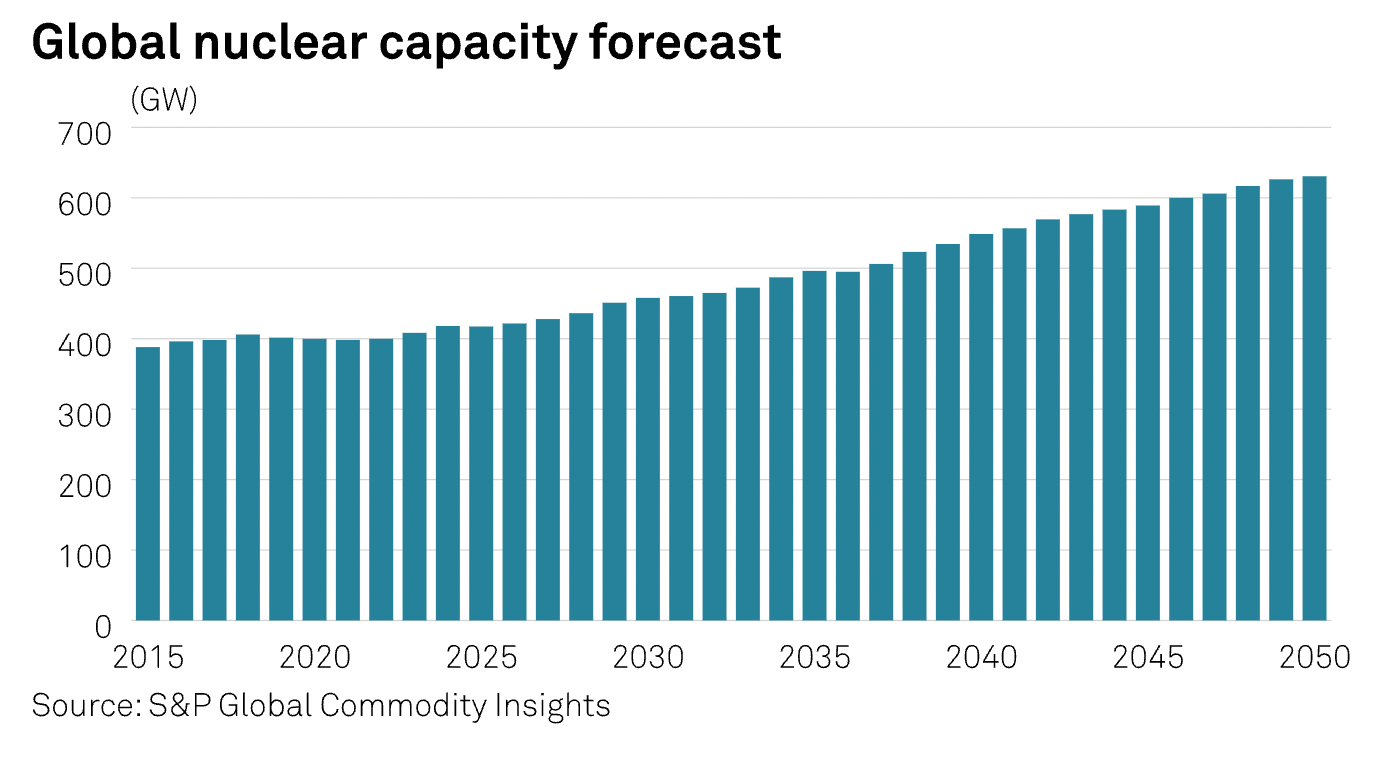

By early 2025, the policy trends had morphed into strategic execution. On May 23, a series of executive orders set aggressive goals: quadruple U.S. nuclear capacity to 400 GW by 2050, have ten new reactors under construction by 2030, and restart and get idle plants back online.

In action, the trend could be seen with Three Mile Island’s Nuclear Generation station being shut down in 2019, only to begin restarting the facility last year after a deal with Microsoft. Now, after federal support it recently announced that it is ahead of schedule to fully restart by 2027.

The case shows how the White House put the Nuclear Regulatory Commission (NRC) on shorter licensing and permitting timelines at a national level. Because of the executive orders, the NRC and White House have invoked the Defense Production Act to rebuild the fuel supply chain.

By mid-July, the DOE launched its Fuel Line Pilot Program, with applications issued and contracts awarded in early August for TRISO fuel facilities in Tennessee and Idaho. DOE approval allows fast-tracked NRC licensing later and unlocks private capital.

On August 6, the Department of Energy announced Standard Nuclear as the first conditional selectee in its Fuel Line Pilot Program, the first step in rebuilding a domestic advanced fuel supply chain.

Standard Nuclear will build and operate TRISO fuel lines in Tennessee and Idaho, entirely self-funded but operating under DOE authority.

The Fuel Line Pilot supports the Reactor Pilot Program, which aims to bring at least three advanced reactor designs to operational criticality by July 4, 2026.

Permitting Raises the Stakes

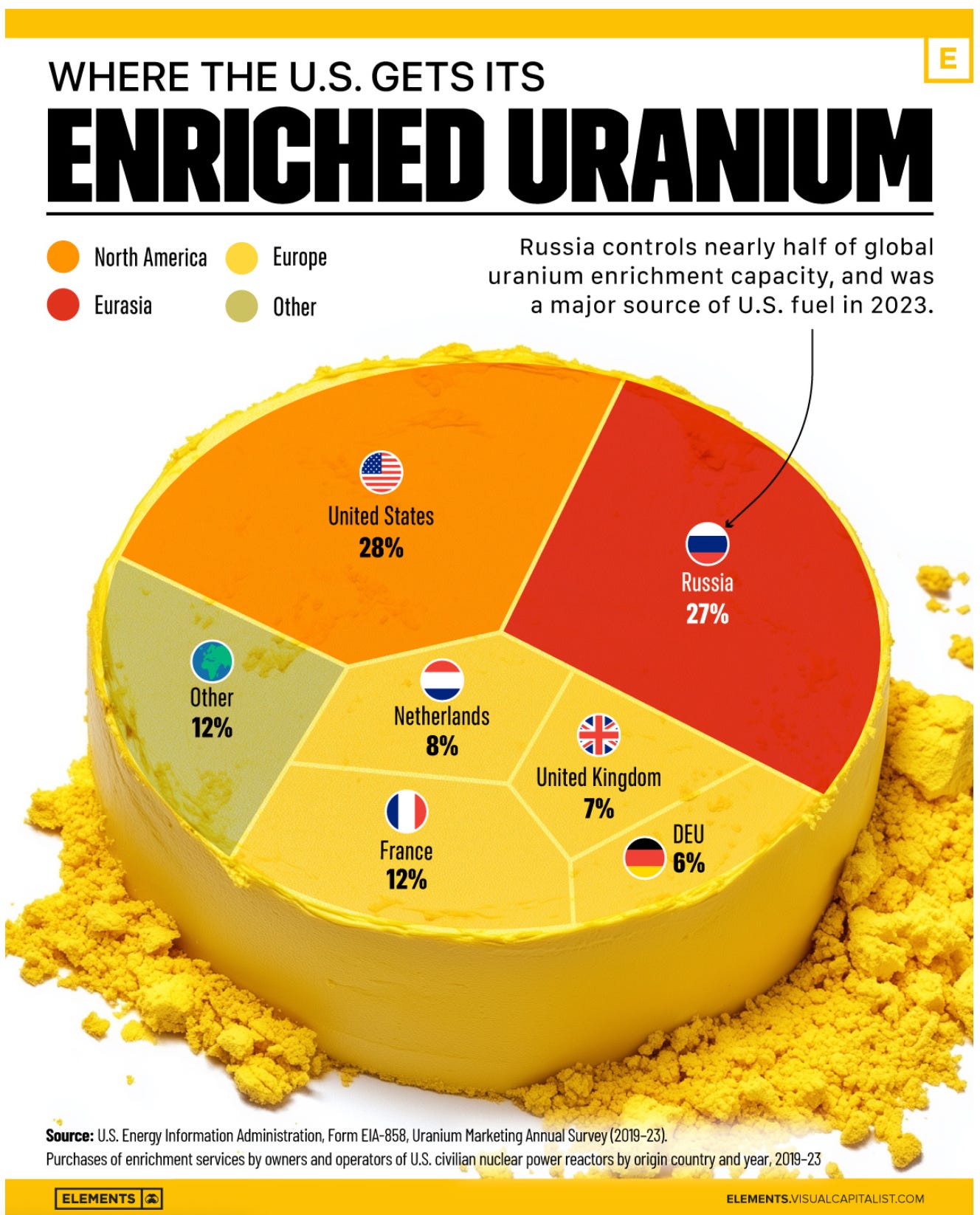

But with all of the momentum, the data shows that the U.S. still gets the bulk of its enriched uranium from other countries.

But now, the government just put considerable weight behind domestic uranium processing capacity.

On August 5, the Department of Energy placed Uranium Energy Corp. (UEC’s) Sweetwater uranium complex on the federal FAST‑41 permitting track. This status elevates Sweetwater, to national-critical classification.

What you should know is that FAST-41 is no joke. FAST-41 imposes strict federal deadlines, forces coordination across agencies, and adds White House-level oversight through the Federal Permitting Improvement Steering Council.

It’s a rarely used designation and has only been tapped for infrastructure deemed nationally significant. It has been applied to LNG terminals, grid expansions, and military supply hubs, but never before for a uranium project. Sweetwater is capable of processing both ISR feed and conventional ore.

Sweetwater’s elevation signals another momentum shift. Uranium fuel is being moved to the same strategic category as pipelines and defense infrastructure. So, what happens at Sweetwater now sets precedent. If the permitting process proceeds on a fixed, accountable timeline, and private capital responds, other nuclear fuel infrastructure and FAST-41 designation projects could follow.

Our contacts and analysis suggest that this will be the case.

Global and Corporate Stakes at Play

Even after the Russian import ban, Moscow still controls a large share of the global enrichment network. Meanwhile, China continues to build nuclear reactors faster than the rest of the world combined.

With over 440 reactors in operation worldwide and 69 under construction, the International Atomic Energy Agency and OECD now project that nuclear power output could triple by 2050. But their latest “Red Book” warns that without significant new uranium development, global supply could fall dangerously short.

The private sector has been responding by securing their own supply. Remember the opening of Three Mile Island? The same company that owns that site, Constellation Energy, in June 2025, signed a 20‑year power agreement with Meta to lock in nuclear output from Illinois starting in 2027. That’s a clear sign that big tech views nuclear energy as an essential piece to powering its AI-scale energy demand.

Together, these trends signal the rush to secure uranium processing is just beginning.

What You Need to Know NOW

Readers who have been around Prinsights over the last 12 months know that we have recommended some key companies for our Prinsights Pulse Premium model portfolio in anticipation of such policy shifts. In fact, those that followed our Premium and Founders+ recommendations in this space could have doubled their returns in less than a year. Now, we don’t mention these to brag. It is simply an affirmation that the trend is meeting the moment – and there are real ways for investors to potentially take advantage.

Now, as we continue to watch this space closely, our analysis shows that uranium is entering a phase of acceleration. Prices are strong, contracting remains behind, and critical facilities are now being politically fast‑tracked.

⚡ This week, in our Aug 14 Founders+ issue, we will profile two companies ideally positioned to benefit from these latest moves. They offer a distinct pathway into uranium’s next phase.

These are names you’ll want to have on your radar before the next policy or major price move.

More By This Author:

Here's What Trump Vs Powell Means

Trump’s Tariffs On Brazil And Their Effects

The New Gold Hub? Here’s Why Singapore Storage Is Rising

Disclosure: None.