What Wall Street Knows About This Fed

Image Source: Pexels

The size of U.S. debt has tipped beyond the $37 trillion mark. The Federal Reserve is one of the largest holders of that debt. Now, other buyers are stepping in for the next easing phase – as we’ll detail below.

First, let’s recap where we are in the White House vs. the Fed monetary policy shuffle.

On August 7, 2025, President Trump appointed Stephen Miran to the Federal Reserve Board to fill the vacancy created by Governor Adriana Kugler’s resignation, effective August 8. Fed governors serve a 14-year period, so new appointments have a long-term impact and can matter to investors and those in the markets over time.

The Senate confirmed him quickly, giving Trump his first direct imprint on the Fed since returning to office. Miran has long criticized crisis-era Fed interventions and argued for stronger executive oversight. Yet, his arrival marked a deliberate shift in the balance of the Board, tilting it toward interest rate cuts and potentially quantitative easing (QE).

Note: Quantitative easing is where the Fed has been able to provide trillions of dollars of stimulus to the banking system and financial markets through a bond-buying program, wonkily known as “quantitative easing” or QE.

That shift was already underway at the July FOMC meeting, when Governors Christopher Waller and Michelle Bowman voted for a quarter-point cut, while the target band was left unchanged at 4.25%–4.50%. It was the most open dissent in decades. With Miran confirmed, three of seven governors now lean toward QE and a policy of easing, adding visible political pressure from inside the Fed itself.

Markets responded quickly. Futures-implied probabilities of a September cut of 25 basis points have surged to 99.9%, up from near 50% before Miran’s appointment.

That certainty reflects a mix of softening data, recent comments from Treasury Secretary Scott Bessent that, “Rates are too constrictive...We should probably be 150 to 175 basis points lower.”

✅ Founders+ Readers: Check out your brand-new monthly issue packed with analysis and two opportunities with publicly traded companies in the uranium space that could be poised for takeoff.

Our research unpacks why these two publicly traded companies are tapped into a larger trend that’s delivering real solutions for the energy transformation – all being pushed forward by AI, quantum computing and more.

As we reported as far back as May, it reflects a Board where Trump’s appointees now represent a dovish bloc large enough to alter expectations or at least put Powell under pressure for the first time since he became Chair. Now, because of the latest changes, Powell faces the prospect of being the deciding vote – or even outnumbered – on rate policy.

On Wall Street, traders have been adjusting positioning to account for this. Even Fed Funds futures are showing a 25-50 basis point cut.

But the more consequential moves are coming from the banks.

Banks Acting Ahead of Policy

While futures markets are making sense of the odds, Wall Street’s largest institutions are locking in their bets. According to regulatory research firm, BankRegData, JPMorgan Chase and Goldman Sachs are leading the Wall Street pack in position for the next easing period.

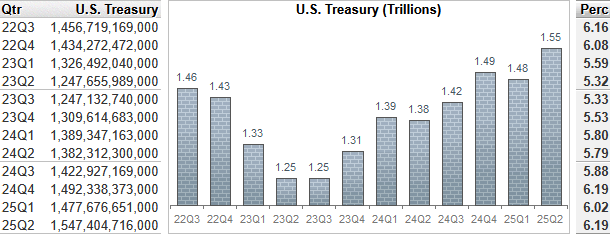

My former employer has quietly increased its Treasury holdings by $71.41 billion in the second quarter, or by 21%, lifting its total to an all-time high of $411.03 billion, or nearly 11% of its assets. Across the U.S. banking sector, Treasuries rose by $69.7 billion, accounting for 84% of total securities growth, taking aggregate holdings to a record $1.547 trillion.

As Bill Moreland, a Partner at BankRegData, put it to me, “JPM realizes the Fed is going to have to cut, so it is loading up on USTs. Effectively, they are front running the Fed.”

The data bears his perspective out.

Instead of short-term positioning, the reallocation is happening directly on the balance sheets of major banks. Major banks are committing record sums to buying Treasuries. Another one of my former employers, Goldman Sachs has been expanding its Treasury book as well, by about 20% in Q2 vs. Q1 2025, reinforcing the structural move into long-term government paper.

The U.S. Treasury itself has amplified that bid through its revived buyback program. August operations targeted on-the-run maturities, providing liquidity at the long end and reinforcing demand.

The combined effect, banks repositioning and the Treasury anchoring liquidity, has created a powerful floor for U.S. government debt just as the Fed’s independence is facing its moment of monetary measure.

Jackson Hole and the Question of Authority

The next stage of this pivot to a broader easing could arrive at the annual Fed-hosted central bank shindig at Jackson Hole, August 21–23, 2025. The annual gathering, officially known as the Jackson Hole Economic Policy Symposium, gives central bankers, policymakers, academics and economists from around the world a chance to pontificate over the economy.

This year, it’s telling that the theme is “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.” That gives Powell cover to use weakening labor data as a reason to push aside his inflation focus and cut rates

At his much-anticipated speech on Friday this week, Powell is going to have to walk a fine line. That’s because he will have to balance softer labor data and tariff-driven price pressures, while also defending the Fed’s autonomy under intensifying political scrutiny – all at a time when his internal Fed power base could be eroding.

The last easing arc began at the last Jackson Hole conference. On August 23, 2024, Powell signaled that “the time has come for policy to adjust.”

Three cuts followed: 50 bps in September 2024, 25 bps in November, and 25 bps in December, leaving rates at 4.25%–4.50% by year-end, for a total of 100 bps in easing.

That sequence set the precedent for markets to expect key changes toward the end of 2025.

In the meantime, gold and the dollar support that view. Gold is trading around $3,336 per ounce, near record highs, and in a solid band, awaiting the next rate cut cycle.

The U.S. Dollar Index (DXY) stands near 97.9, That’s down from above 110 at the start of the year. The dollar’s erosion reflects both the easing cycle that began last year, expectations that Trump’s influence will accelerate it, and that tariffs will encourage more trade settlements outside the U.S. dollar.

(Click on image to enlarge)

The convergence of factors pointing to the next prolonged easing period are striking.

Gold is holding records. The dollar has slid by double digits year-to-date. Banks are stockpiling Treasuries. And the Treasury Department itself is supporting the debt market.

That’s why Jackson Hole this year is a pivotal moment for the Fed. It will test whether Powell can reassert the Fed’s authority – or whether the path is already set. The tilt toward easing has already taken hold. It’s in the Fed’s composition, in market pricing, and on the balance sheets of the largest banks.

What Wall Street can see is that Powell is the only one still holding the line. We expect he will succumb to the pressure, and that the September 16-17 meeting will deliver the next rate cut.

One of the best ways to position for the next easing cycle is through gold and gold miners. As we’ve detailed in our Premium and Founders+ model portfolios, there are specific miners poised to take advantage of the upside trends, along with gold, on this next move. For now, we’ll stay tuned for Friday – as will investors on Wall Street.

More By This Author:

Fast-Tracking Uranium Changes Everything

Here's What Trump Vs Powell Means

Trump’s Tariffs On Brazil And Their Effects

Disclosure: None.