Surviving The Fed Vs Wall Street (Again)

Image Source: Pexels

Last week, the Federal Reserve moved further toward an accommodative mode. Chairman Jerome Powell uncomfortably noted the Fed was “driving in the fog” while heading into the 5th week of the government shutdown. The Fed executed back-to-back 25-basis point rate cuts and ended quantitative tightening while flying blind.

To recap, at its October 28-29 meeting, the Fed lowered rates by another 25-basis points to 3.75-4.00 %, following its September cut to 4.00-4.25 %. The policy move passed on a 10-2 vote, with one dissent for a larger 50 bp cut and another against any cut. That brings the 2025 total to 50-basis points so far.

This cut was also attributed to waning conditions in the labor market, which, as Powell affirmed, “appear to be gradually cooling.” That’s visible in recent data, including the ADP report that private sector payrolls fell by 32,000 in September, and this year’s layoffs outpacing those during the 2020 pandemic.

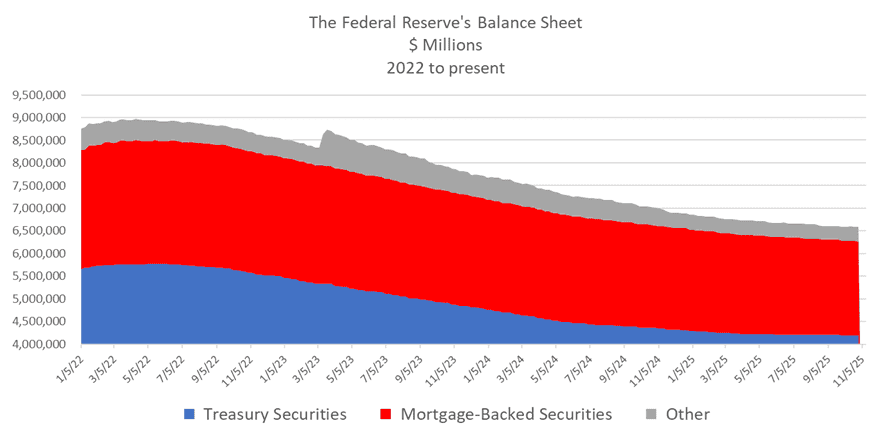

More importantly, the Fed announced that quantitative tightening (QT), its balance-sheet runoff operation, will stop on December 1.

To put the Fed’s balance sheet size in perspective: at $6.5 trillion, the Fed’s balance sheet is roughly $2 trillion larger than at the height of the post-crisis era, and about $2.5 trillion smaller than its Covid-era peak.

(Click on image to enlarge)

Now, under ordinary circumstances, this is a sign that the Fed can ease monetary policy without losing control of inflation. But these aren’t ordinary circumstances. And these are not ordinary times.

That’s because the federal government is in its fifth week of shutdown, meaning the Fed is being forced to make its policy decisions with little to no new economic data provided by the U.S. government.

On the other hand, we believe the government shutdown had little to no bearing on the Fed’s decision.

More Bank Liquidity Problems Brewing

So, what gives?

What’s really driving this decision isn’t job growth management, it’s bank liquidity fear. The Fed is easing policy this time to stabilize the system itself.

To put it plainly, Wall Street needs cash.

While the markets and mid-term elections might still be making headlines, the mechanics beneath the hood are showing signs of concern.

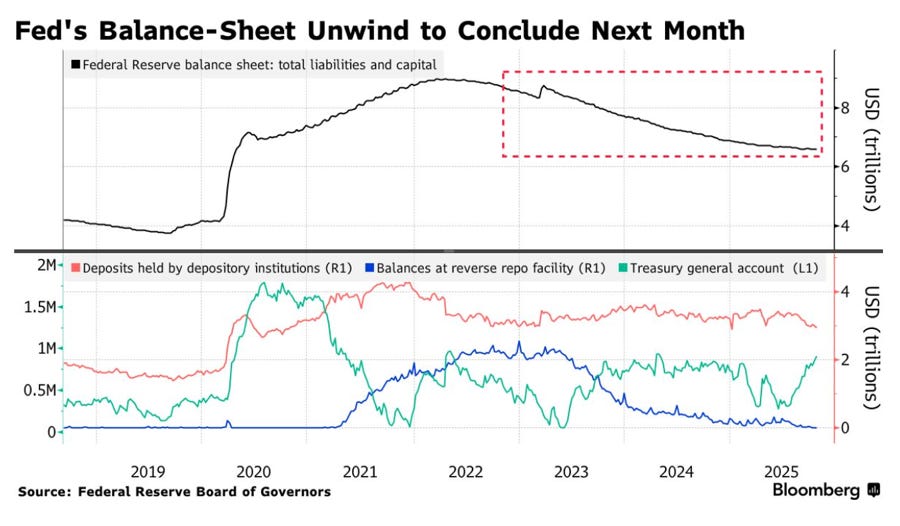

We know this because on October 31, banks drew a record $50.35 billion from the Standing Repo Facility, the highest use since it was created in the wake of the pandemic.

The Fed also injected $29.4 billion in overnight repos to offset a drop in reserves that have now fallen to $2.8 trillion, the lowest level in four years.

(Click on image to enlarge)

With those moves taken together, this current bank liquidity upheaval is reminiscent of the fall of 2019. That’s when the Fed resurrected QE again (though Powell insisted that it wasn’t QE), which saw the Fed’s balance sheet grow by nearly 15% as banks rushed to the repo facility.

Yes, the move was to offset budding loan problems. Delinquencies are indeed rising. As the Mortgage Bankers Association recently reported commercial mortgage delinquencies are rising 6.3%.

But what the moves suggest is that the Fed is ending QT not because inflation is tamed or job market fears or even because growth is slowing in the overall economy, but because banks need liquidity. Repo demand is surging. And reserves, which often serve as the lifeblood of the banking system, are shrinking.

Ending QT under those conditions isn’t an act of stimulus. It’s an act of pre-emptive survival. The Fed is in a struggle versus Wall Street once again.

Yet, Powell framed the latest moves as “insurance.” And that’s an appropriate term, but not in the way it sounds. The Fed isn’t insuring the economy; it’s insuring Wall Street. Again.

That distinction matters. “Insurance” implies the Fed is buying protection against an unlikely downturn. But with the frequency of these interventions, back-to-back cuts, the early end to QT, emergency-style repo injections – they all reflect something more ominous lurking. Smoke is never far away from fire. And the Fed’s “insurance” actions are never too far away from crisis.

What Recent U.S. Elections Signal

This week in the U.S., Democrats won state governor seats in both New Jersey and Virginia while New York City will have a Democratic Socialist take over one of the financial hubs of the world.

So, why does this matter to the Fed or Wall Street?

Because it signals that stretching from the White House and Congress to the halls of the Federal Reserve, policymakers that view their fight against inflation are largely now in step with what voters on Main Street feel. And while the economy might be just above water today, that does not mean much for the future.

With grocery prices in the U.S. still up nearly 30% since the start of 2020, and energy prices up by as much as 40%, the reality is that a continued squeeze lingers on consumers.

What a Crisis of Confidence and Monetary Policy Reversals Mean

Overlaying all of this is fiscal and financial turmoil.

The shutdown has entered its fifth week, and U.S. debt has now surpassed $38 trillion. The Treasury department is still issuing record volumes of paper, and investor and foreign appetite is increasingly waning on fiscal policy uncertainty.

Yesterday’s U.S. elections, the first statewide contests held during an active federal shutdown, amplified that perception. They underscored voter sweeping frustration with economic management. The truth is that Washington’s dysfunction is now a market variable, not a political one. It is also a problem that stems from the D.C. beltway and is now stretching to everyday people on Main Street.

Yet the Fed’s actions also reveal a liquidity problem over on Wall Street. The election results highlight a confidence problem in Washington. Both point to the same conclusion. Financial and political risk remain in play and both are relying on printing money in some manner – as the end of QT and possibly a foray into QE or printing debt looms.

When that happens, investing in what’s real, as we’ve noted repeatedly, provides long-term security. Right now, especially given the recent dip in prices, that’s why we recommend buying real assets like gold, with physical gold brokers that provide liquidity security and accreditation such as our friends at Asset Strategies International or Bullion Star. Or, going a step further, that you consider investing in shares in a low-expense physical gold-backed ETF such as the iShares Gold Trust (IAU).

Other avenues like silver, copper, uranium, and rare earths, things that are real and providing underlying value to the future of the economy, can also be a crucial step to diversifying a portfolio over the long term.

More By This Author:

Rare Earths War Is Heating UpHere’s Why Silver’s Moment Is Coming

Nuclear Momentum: September Signals That Can’t Be Ignored

Disclosure: None.