The 2026 Power Play: Why The Grid Is The Trade That Matters

Image Source: Unsplash

While the headlines and financial media have spent the last year focused on the day-to-day tech rallies or the latest DC-Beltway distractions, a massive shift is underway in the real economy. It’s a shift that some of the biggest players from Silicon Valley to Washington are beginning to sound the alarm about, but one that savvy investors can capitalize on. You see, we are heading into a storm.

As the U.S. approaches the 2026 midterm elections, the immediate and obvious narrative will be dominated by inflation, social hot-button issues and geopolitical tensions. But as we saw emerge in bellwether elections in states like New Jersey and Virigina, something else is bubbling up to the top of voters’ minds – energy utility costs.

Beneath the noise, there is a physical reality that no amount of money printing or political posturing can wish away: The United States is facing an electric power problem.

For decades, the U.S. has taken the humble utility sector for granted. It was the “boring” trade. Safe, slow, predictable. Often, investing in utilities was seen as a way to earn a nice dividend and an option to hedge against potential volatility. Today, that era is over.

We are now entering a period that you could call a “Great Energy Disconnect.” At its core is the widening gap between the energy the U.S. has and the emerging energy that the new AI-driven economy demands.

Investor-owned utilities (IOUs) know this, and increasingly investors are beginning to come to terms with this disconnect. That’s because 2026 will not be just another election year. 2026 will be a foundational opportunity. It is the year when the infrastructure, the pipes, the wires and the energy generation sources begin to meet the road for the U.S. power grid.

Yet, despite the mounting challenges, which range from aging infrastructure and regulatory bottlenecks to voter-focused public outcries over rising bills, we remain bullish on the energy sector over the long term.

As we detailed for Prinsights Pulse Premium members in our latest monthly issue, leading utilities like Duke Energy, Georgia Power, TVA, and AEP Ohio all took nearly unprecedented moves to revise their 2025 forecasts and capital spending plans upward – showing a bullish signal for the sector.

Below, we detail three key reasons why the smart money will continue moving into power generation, along with transmission and distribution, now – and why investors should consider opportunities in the sector before the rest of the market fully catches up.

I: The AI “Power Binge” is Non-Negotiable

Some of the biggest tech giants, Microsoft, Google, Amazon, are in a “digital arms race.” That’s because they are expanding and building out data centers at a pace that’s impacting electricity at a scale we have never seen. What you should know is that these warehouses are not just massive drivers of AI capabilities, they are insatiable energy behemoths.

And while the narrative from tech leaders and Wall Street insiders in love with the tech story is that AI will “optimize” our energy grid, the reality is that it’s draining it.

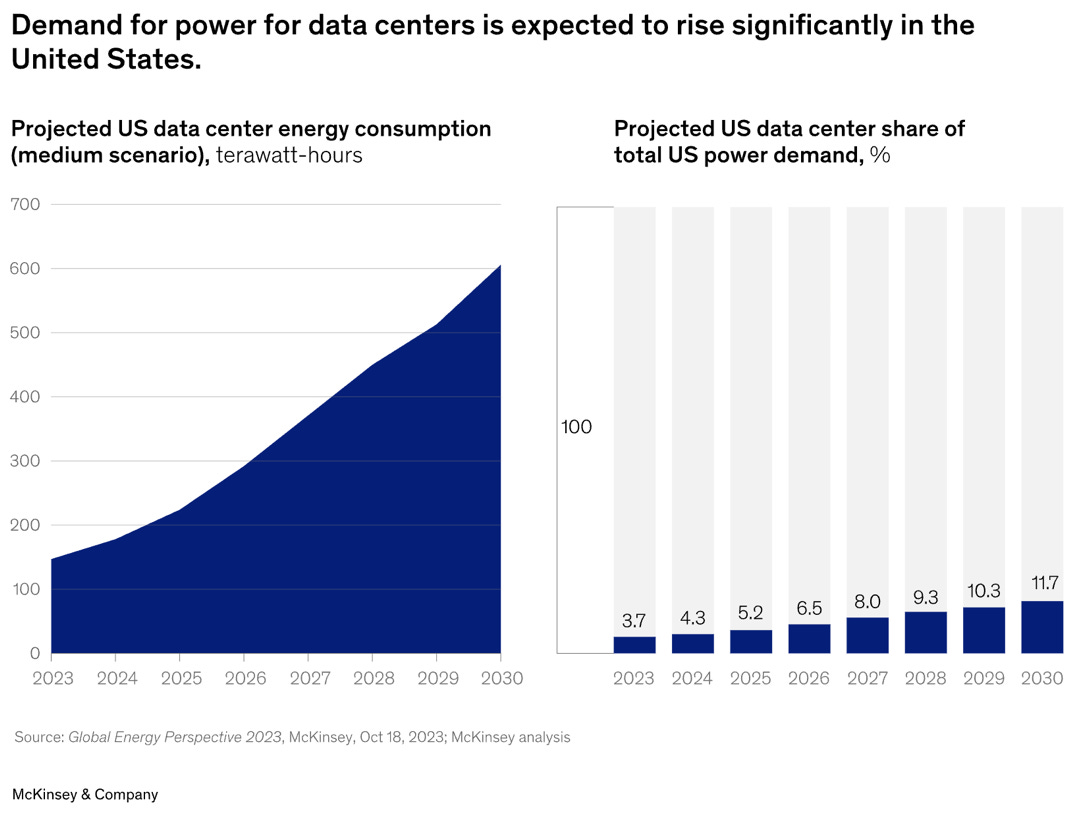

McKinsey projects that data center power demand in the U.S. will reach more than 600 terawatt-hours by 2030. To put that in perspective, that’s nearly 12% of the total U.S. power demand. That is the consumption equivalent to adding entire countries’ demand levels to the U.S. grid, all from AI-driven demands, in the span of only a few years.

This demand is inelastic – meaning that tech giants will need the electricity so intensely that they will buy it regardless of how much the price increases. Tech giants have hundreds of billions of dollars in CAPEX riding on their AI models to deliver for businesses and governments. Ultimately, they cannot afford a blackout or diminished abilities to power their demands. What this also means is that it is shifting the leverage investors are focused on away from the tech consumer and squarely into the hands of the power producers.

The IOUs that own energy generation and the IOUs that operate the transmission lines holding this system (also known as the grid) together are sitting on a modern-day “goldmine” of demand – all while also maintaining regular business functions for residential and commercial customers.

II: The Supply Crunch Creates Pricing Power

For years, investors on Wall Street have been told that energy demand was flat or in decline and that energy efficiency and sustainability deliverables would be the next opportunity. At best, that was a critical miscalculation.

After a decade of stagnation, Wood Mackenzie, a global leader in analytics across the entire energy and natural resources landscape, reported that U.S. power demand is now set to grow by between 4% and 15% through 2029, driven almost entirely by data centers which alone will require 59 GW of new load.

But there is a warning alarm that both tech giants and energy leaders are sounding. The U.S. is not building energy supply fast enough. Morgan Stanley has warned of a potential 20% power shortfall by 2028, tapping into that “Great Energy Disconnect” at an estimated gap of nearly 44 gigawatts (the equivalent of 4 New York Cities running at maximum capacity).

What you should know is that in the world of commodities, scarcity equals value.

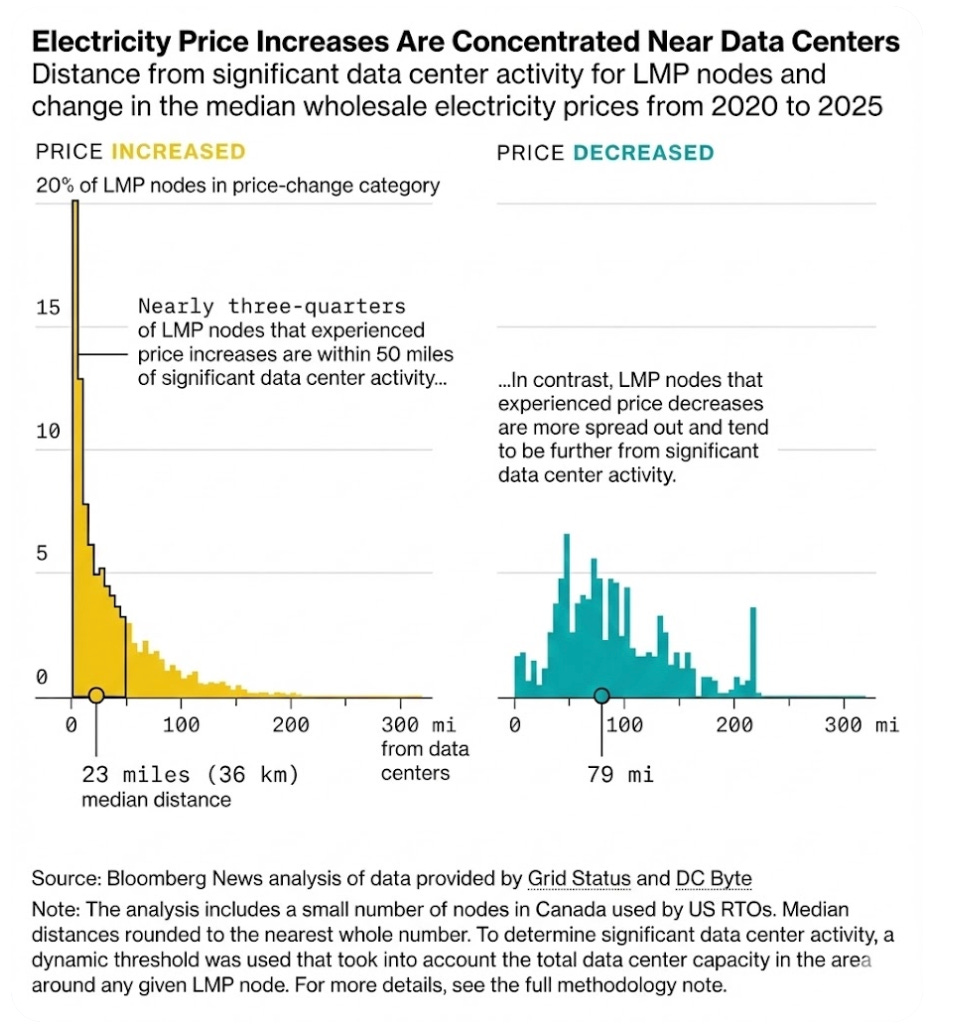

When supply is diminished and demand is skyrocketing “non-linearly,” prices go up. According to Bloomberg data and reporting, wholesale electricity prices near major data center hubs have spiked by as much as 267%.

While this shift is hitting the average household (a point we have made repeatedly here at Prinsights), for investors looking into utility companies for opportunities, this pricing power is a signal.

It means that companies with established generation assets, and as our analysis shows, those with nuclear energy within their portfolio, are set to see their profit margins expand. That’s because they are able to both keep the lights on for residents while also bolstering and driving the AI revolution forward.

III: The 2026 Midterm Signals

After years of in-depth conversations with elected leaders on policies ranging from financial reform to infrastructure, I can tell you first-hand that politics is a messy business. 2026 will be no exception.

But there is one bipartisan truth in the U.S. that could emerge even louder as we head toward November: grid reliability and resilience is national security.

No political leader, Democrat or Republican, wants to run for re-election amid a blackout. Just like no political figure wants to navigate explaining higher bills with no real solutions.

As the electric grid continues to face negative strains brought on by the weight of AI, a massive pivot in policy is set to take place.

We are already seeing the groundwork for this as those at the state and local level highlight a “reliability” consensus. That’s because businesses, from Main Street to Silicon Valley, depend on power. This opens the door for continued infrastructure spending.

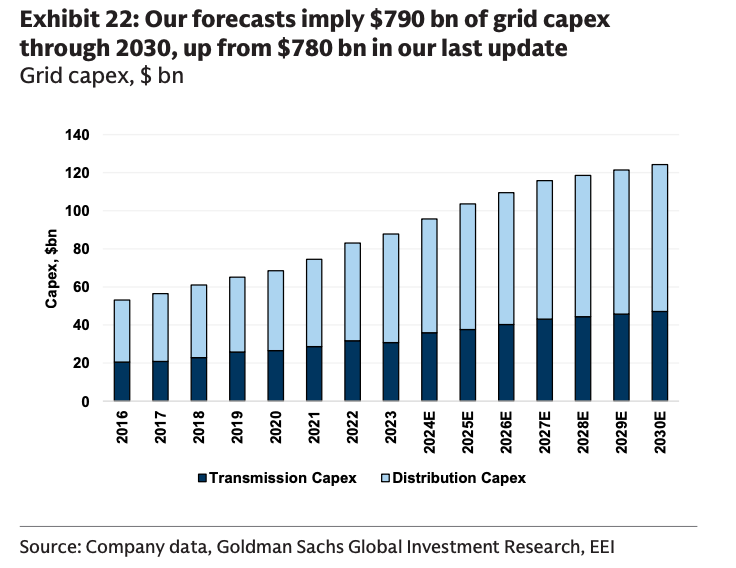

Goldman Sachs estimates that $790 billion in grid upgrades through 2030 will be required to support this new load. This isn’t just government spending, it’s rate-base growth for IOUs. In the regulatory world, utilities make money by spending money on approved infrastructure.

The coming wave of policy will trigger a greenlight for a massive CAPEX boom for transmission and distribution companies, allowing them to grow their earnings base with potential state and local government approvals.

But, the next twelve months are critical.

While other sectors might hold in a wait-and-see pattern ahead of the midterm election cycle, energy companies will be announcing new transmission lines, signing long-term power generation agreements with tech giants and solidifying their role as the backbone of the U.S. economy.

The Bottom Line

While the focus on leading AI stocks like NVIDIA and Microsoft has been well deserved, the foundational opportunity for 2026 isn’t chips or algorithms at this point, it’s the electron.

The disconnect between the energy we need and the energy we have is the opportunity that will continue to play out in 2026.

More By This Author:

The $12,000 Signal: This Massive Disconnect Is Fueling A Copper SupercycleNuclear Power Is Having Its Moment (And Most Investors Are Missing It)

The DC Energy Bill Investors Are Watching Next

Disclosure: None.