Surviving The Worst First Half For Stocks In Sixty Years

A destroyed building in Borodyanka, Ukraine. Ales Ustsinaў/Pexels.

An Awful First Half For Stocks

The first half of 2022 featured a perfect storm of headwinds for stocks: by January, inflation was at a 40-year high.

Then came Russia's invasion of the Ukraine in late February, and, following that, Western sanctions on Russia that exacerbated already-high inflation.

Add to that the Fed raising interest rates at the fastest pace in years, and we got the worst first half for the S&P 500 in sixty years.

How Our Approach Fared

There are essentially two components to our hedged portfolio method:

- Selecting securities that we estimate are likely to do well over the next six months, relative to the cost of hedging them.

- Hedging them in case we end up being wrong about them doing well.

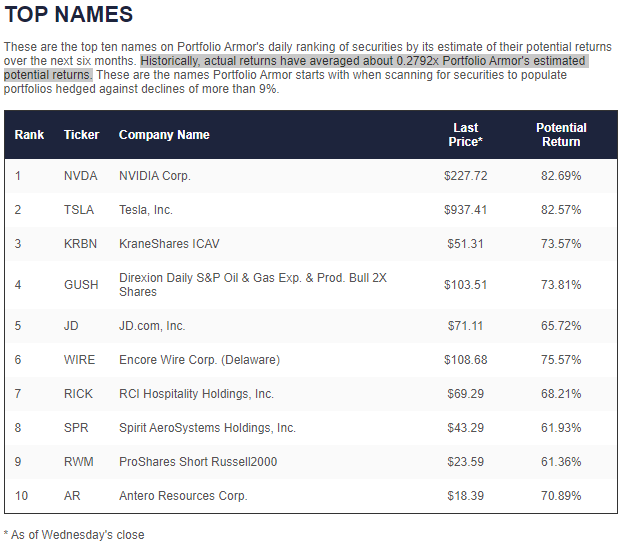

By late January, our system started selecting securities such as the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2x Shares (GUSH), Antero Resources (AR), and ProShares Ultra Short Russell2000 (RWM) which would do well in the rest of the first half. Those two oil names and the inverse small cap ETF were three of our top ten names on January 26th, that we shared in a post at the time (Fit to be Fat).

Screen capture via Portfolio Armor on 1/26/2022.

So, by late January, the security selection component of our approach had started to click into gear. That wasn't the case at the beginning of the year though.

Selecting The Wrong Securities at the End of 2021

As 2021 ended, we got the security selection component completely wrong. You can see this from this hedged portfolio our system presented to users on December 30th of 2021:

Screen captures via Portfolio Armor on 12/30/2021.

That portfolio was designed for investors unwilling to risk a decline of more than 9% over the next six months. Only two of the underlying securities in it, Enphase Energy, Inc. (ENPH) and the iPath Series B Bloomberg Coffee Subindex Total Return ETN (JO), posted positive returns in the first half; other names there, such as Nvidia, Inc. (NVDA) plummeted (by about 50%, in Nvidia's case).

Protection Against Being Wrong

Fortunately, being hedged acted as protection against being wrong. Here's how that portfolio did over the first half. Net of trading and hedging costs, we were down 5.79%, while the market-tracking SPDR S&P 500 Trust ETF (SPY) was down 20.53% over the same period.

You can tell from the "Put Option Value" column above that ENPH and JO finished in the green, because the put options on them were worthless at the end. In contrast, the position with highest put option value at the end, Affirm Holdings, Inc. (AFRM), was down about 80% in the first half.

Hopefully, we won't need protection against being wrong in the second half, but it's good to have it in case we are.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more