Silver, The Next Chapter

Image Source: Pixabay

No one – including us – was really aware that our thoughts from January 14 had published one of the most important charts of recent years. The bubble chart indicated that the air would become very thin for the silver price above the US$100 mark.

(Click on image to enlarge)

In fact, the chart now shows exactly the development that could have been anticipated, but which people preferred to ignore. Such bubble charts do not appear often, but when they are confirmed, they almost always end the same way: after a sharp correction in a very short period of time, the asset in question usually needs a longer breather before it calms down and returns to a sustained upward trend.

(Click on image to enlarge)

This chart basically explains why Kevin Warsh’s appointment as Fed chairman is not primarily responsible for the massive correction in precious metals and cryptos. Let’s be honest: two classic patterns emerged again that investors should never have fallen for. Almost everyone was sitting on lavish book profits in silver. At the same time, everyone knew that the market was massively overbought and overheated. So some were just waiting for the final trigger to secure their profits—which then usually comes too late... Others continued to dream of further advances that would catapult the price of silver to previously unimagined heights.

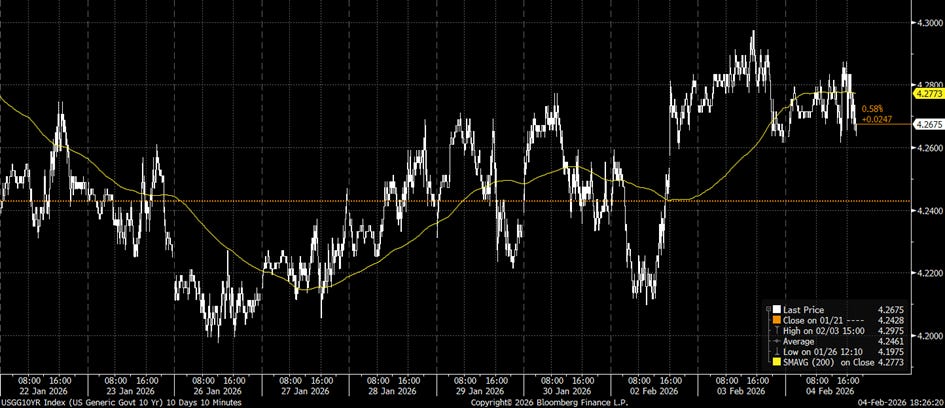

Kevin Warsh’s nomination may have been a trigger, but it was not responsible for the sell-off. If that had been the case, not only precious metals and cryptos would have reacted significantly, but also the bond market. However, the us yields remained surprisingly calm.

(Click on image to enlarge)

But even a lack of reaction can send a clear message: Kevin Warsh is known for opposing lower interest rates and, as a Fed governor under then-Fed Chairman Ben Bernanke in 2010, he openly opposed quantitative easing. With this stance, he would naturally be anything but a desirable candidate for precious metal investors.

However, the world has changed in the meantime – and so has Kevin Warsh, it seems. He is now actually in favor of lower interest rates, as he believes that AI-driven productivity gains could have deflationary effects. This is entirely correct. With such interest rate prospects, precious metals should actually rise – in theory.

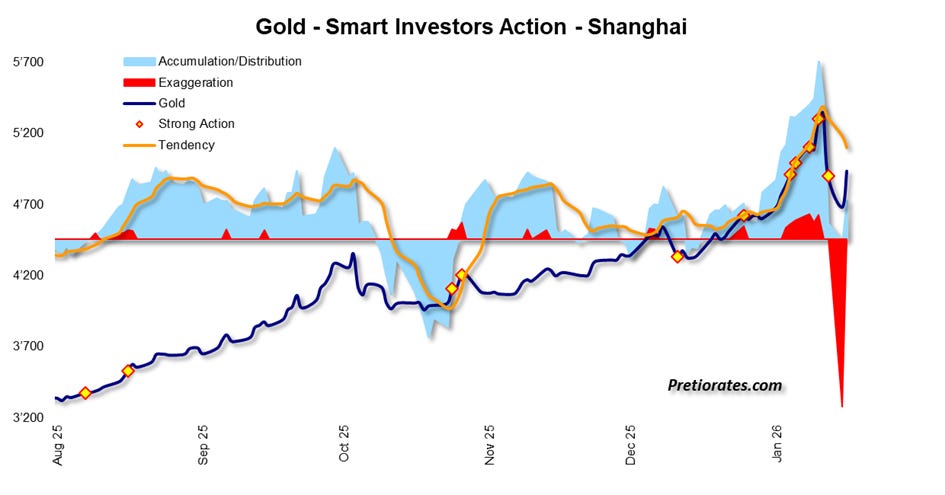

Physical gold trading in Shanghai was already showing signs of significant overheating before the sell-off: whenever the yellow dots, known as «strong actions», appear at the same time as the red areas, known as «exaggerations», the end of a short-term trend is usually not far off. The sharp sell-off was followed by a pronounced «exaggeration» on the selling side, which heralded the technical recovery we are currently seeing.

(Click on image to enlarge)

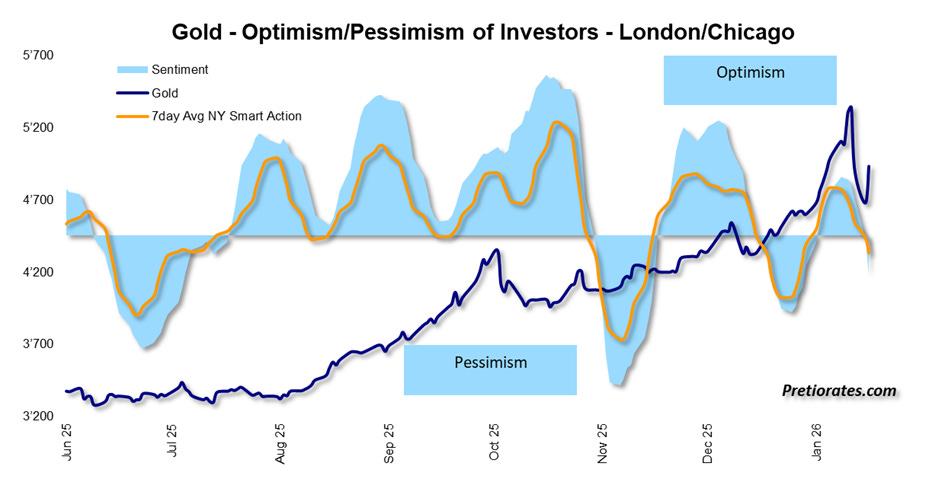

Meanwhile, optimism in the market has disappeared. What’s more, a palpable pessimism has spread and is likely to prevent gold and silver prices from immediately returning to a strong upward trend.

(Click on image to enlarge)

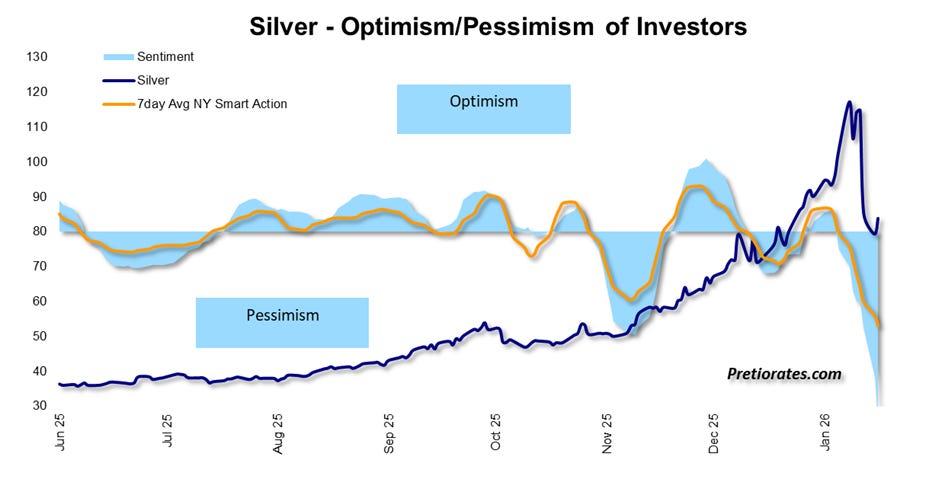

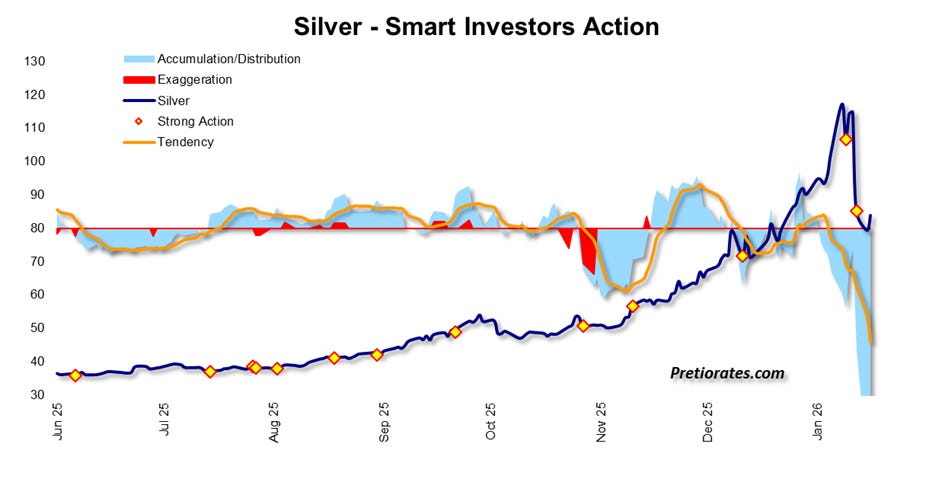

This disillusionment is already much more advanced in the silver market. Accordingly, it can be assumed that processing this shock will take time – and will most likely result in a continuation of consolidation.

(Click on image to enlarge)

In addition, it appears that «smart investors» had already distributed heavily before the peak prices were reached.

(Click on image to enlarge)

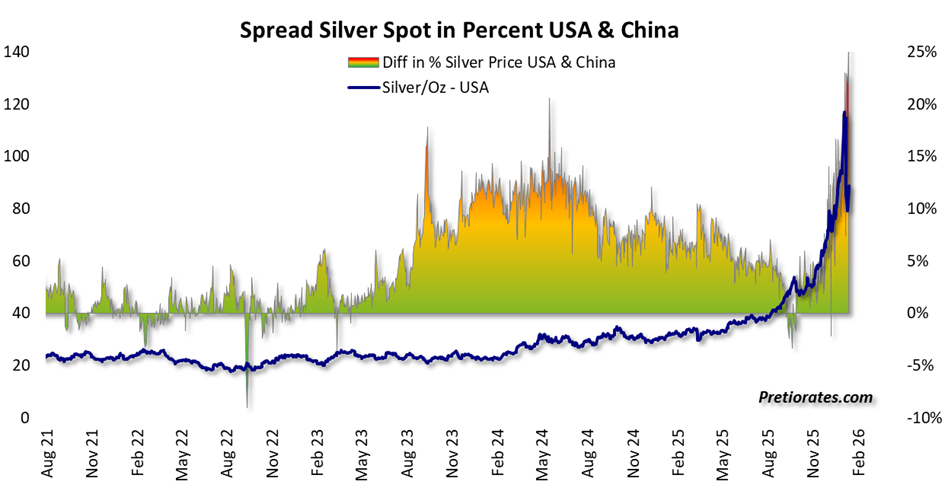

In the Chinese silver market, however, there has been little sign of disillusionment so far. The buying mood remains unbroken: market participants are still willing to pay premiums of up to 15% for an ounce of silver.

(Click on image to enlarge)

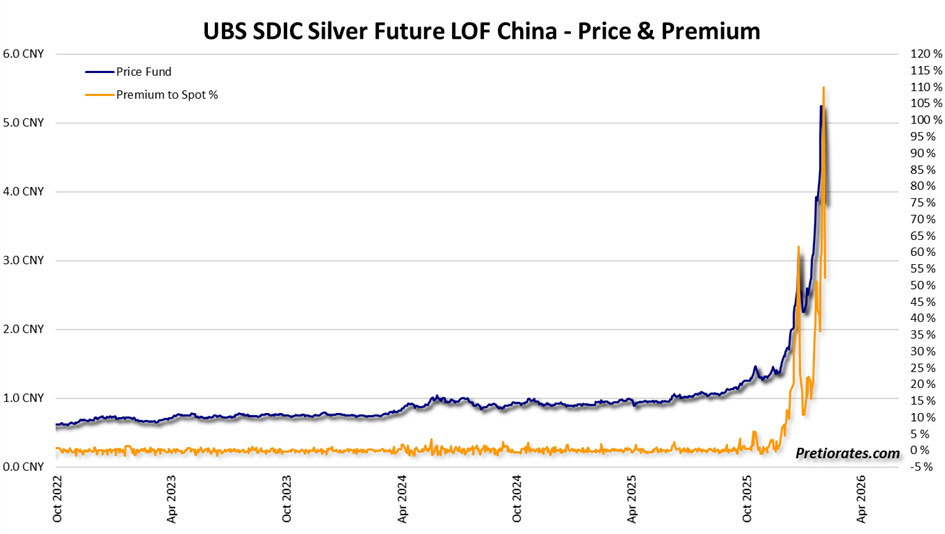

The premiums on the only silver ETF available in China are even more spectacular: the premium is currently just over 50%, and in recent days has at times even exceeded 100%.

(Click on image to enlarge)

The continued willingness of Chinese investors to accept considerable premiums for silver can certainly be interpreted as a bullish signal by observers. At the same time, however, such premiums are also a classic sign of overheating and greed – and thus rather a warning sign to exercise caution.

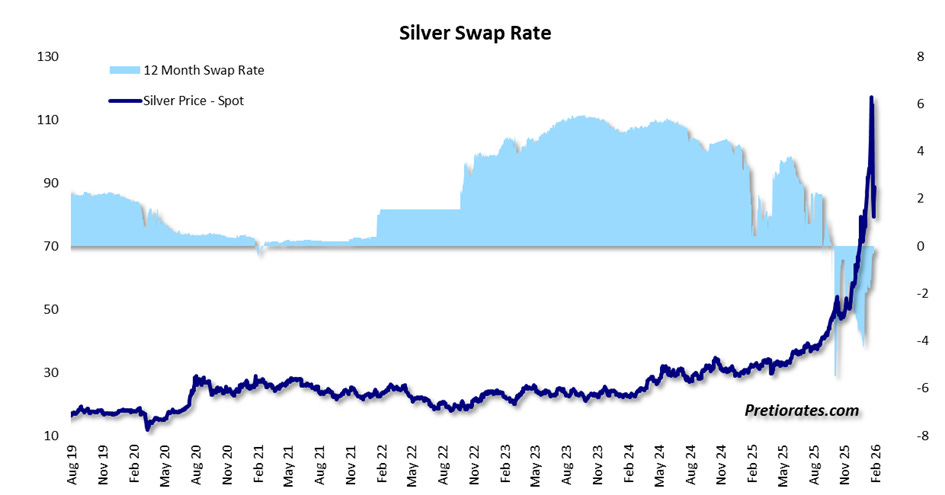

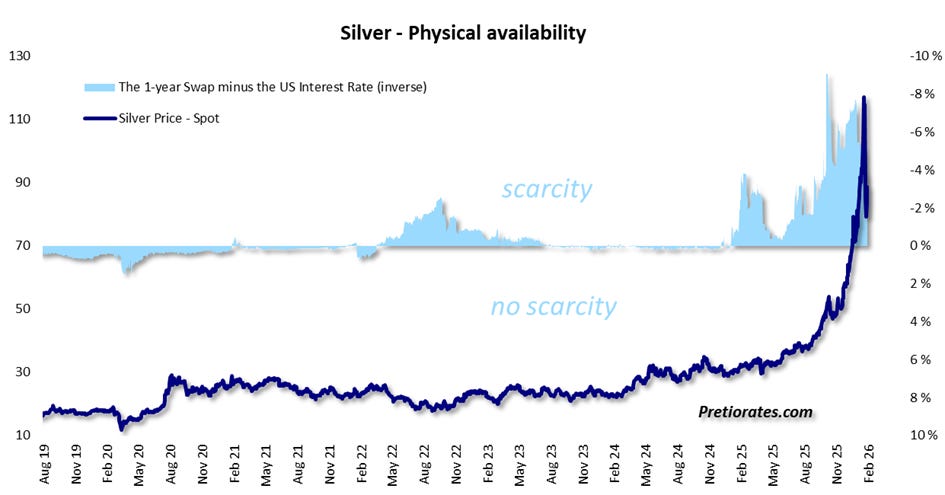

In fact, it is also apparent that the swap rate in Western trading has now calmed down,

(Click on image to enlarge)

as has the lease rate: while not so long ago, significantly higher interest rates were paid for borrowing physical silver, this has now fallen back to around 1.1%.

(Click on image to enlarge)

This basically confirms that the previously tense situation in the physical silver market has eased noticeably. Our corresponding indicator also clearly signals this: the availability value is now only -2.9 points, after previously standing at -8 points.

(Click on image to enlarge)

Bottom line: the massive correction and the associated sales have noticeably defused the previously tense situation in the physical silver market. This is a further indication that the silver market will not immediately return to a strong upward trend in the coming weeks, but is more likely to bottom out. In the short and possibly also in the medium term, the still high volatility should gradually decrease. However, we stand by our assessment of the long-term problem of physically available silver for industry.

The structural supply deficit is likely to continue to mean that demand cannot be fully met. Sooner or later, this will lead to renewed tensions—and probably a repeat of the developments of recent weeks. No one knows exactly when this will be. But if it brings the same returns, that is also secondary.

More By This Author:

The Dollar Is Our Currency, But It’s Your Problem

Is The Japanese Bond Market Now Pulling The Plug?

Silver, Spreads, And Beads Of Sweat

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more