Q3 Asset Class Performance

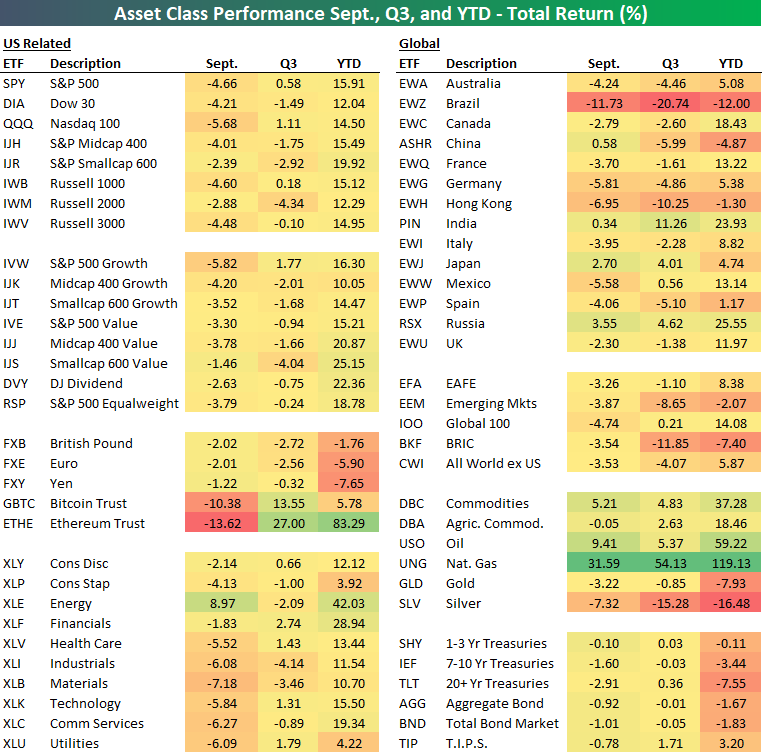

Q3 and the month of September are now in the books, and it was not a great period for US equities. As shown in our asset class performance matrix below, the sole portion of the US equity market that was higher in September was the energy sector.

Every other sector, theme, and major index was lower on the month. As for global equities, performance was more mixed with declines ranging from 11.73% for Brazil (EWZ) to a 3.55% gain for Russia, though most country ETFs were lower on the month.

Commodities had a good month, particularly in the energy space -- with crude oil (USO) gaining 9.41% and natural gas (UNG) rising an astounding 31.59%. That lifted the total gain in Q3 to 54.13% while it has returned almost 120% year-to-date, serving as the best performer for both time periods.

Precious metals, namely silver (SLV), on the other hand, were hit particularly hard. As for cryptos, Ethereum (ETH-X) was another top performer year-to-date and in Q3, but September pared those gains. Ethereum fell 13.62% in September while Bitcoin (BITCOMP) also fell by double-digit percentages.

Disclaimer: For more global markets and macroeconomic coverage, make sure to check out Bespoke’s Morning Lineup and nightly Closer notes, as well as our ...

more