Participation Not As Strong

The post-election, post-Fed rally has slowed. As I have said, this is nothing like 2016 and I do not believe 2025 will look anything like 2017. Markets sometimes rhyme, but rarely repeat. I don’t think they are even rhyming.

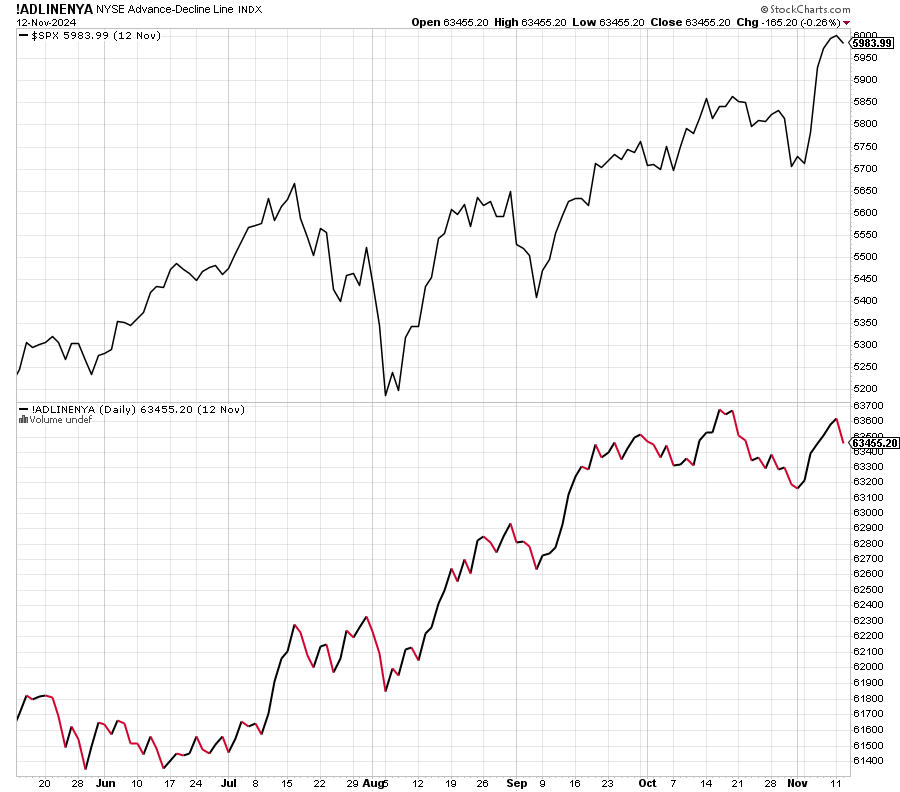

Through the middle of October participation in the rally was strong and confirmed the advance. Since then it has weakened as bond proxies that trade on the exchange have been hurt by falling bond prices. The chart below is the S&P 500 in the upper panel and NYSE Advance/Decline Line in the lower which is one way to see participation. Bulls want to see both panels scoring fresh new highs at the same time.

(Click on image to enlarge)

Heading into the election I heard from a number of folks who were “hedging their bets”. One asset I was firm against using was gold. I thought it was a sucker’s play because it had rallied smartly into the election and a true hedge would have done the opposite.

Some of those folks just asked what they should do with the gold they bought right before the election. First, I would have stopped out when the metal traded against my thesis. Nothing ever wrong with cutting losses and coming back to fight another day. Second, gold looks like it’s coming into a position to look for at least a bounce. We shall see in the coming days.

(Click on image to enlarge)

On Monday we sold FSTA, FJAN, FDEC, some TSLA, some COIN and some PLTR. On Tuesday we bought SPYB and more XLF. We sold SDS, XLRE and some QQQW.

More By This Author:

Post Rally Continues – Small Caps Poised For ATHs

Digesting The Post-Election / Fed Moves

Markets Looking Bullish Post-Election

Please see HC's full disclosure here.