Digesting The Post-Election / Fed Moves

Image Source: Pexels

Election out of the way. Fed out of the way. Q3 earnings season is mostly over. Not many catalysts for a while. And that’s just the way I like it. Markets need to calm down and digest. Investors’ emotions need to recover. It’s been a whirlwind.

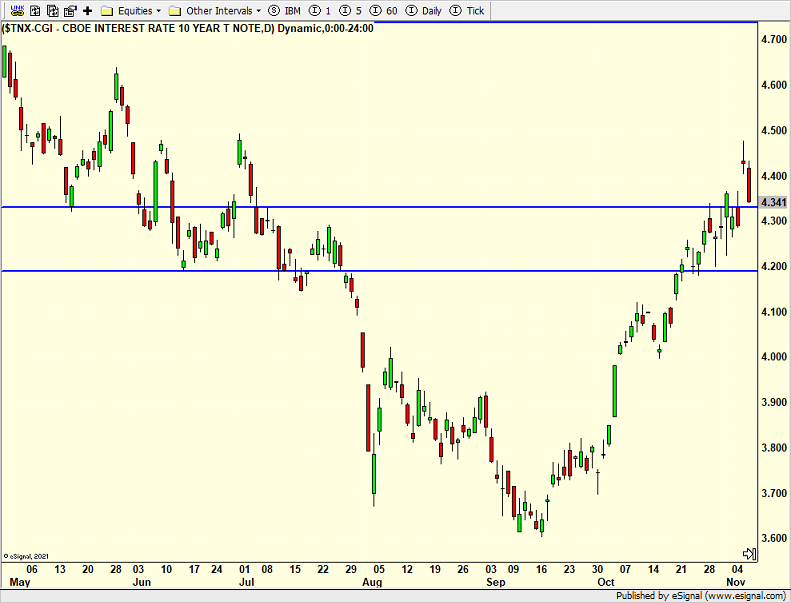

As expected the Fed cut interest rates on Thursday and Jay Powell said he would not resign if Trump asked him. Markets didn’t really seem to care. The Fed made a mistake by cutting 0.50% last time. They seem to be front-loading the cuts. I think they are closer to being done.

Post-election and Fed reaction has been severe. Lots winners and lots of losers. It has certainly not been a rising tide lifting all ships. And it won’t be ahead either. The bond market has been hit. Although the Fed cut rates by 0.25% intermediate and long-term bond yields have risen.

Stock market sectors sensitive to bonds have fallen. REITs, staples and utilities. Solar stocks are being sold. Homebuilders are under more pressure as is gold. I am looking for a pause or some giveback in both directions from the more extreme moves.

Between the election and two trips to UCONN basketball games, I am in need of some catch-up on sleep and couch R&R. Tonight is the annual gala for Friends of Yale Children’s Hospital gala where my wife and son serve on the board. Lots of hard work by a great group for a great cause. And then there’s a social night for the parents for high school baseball. More fun and socializing. And the UCONN teams see more action. I guess it’s another busy weekend waiting for Mother Nature to stop the drought and record warmth. No skiing in sight.

On Wednesday we bought more PFF and TSM. We sold some TGNA. On Thursday we bought JNK, PCY, EMB, DXHYX, more TAN, and more MQQQ. We sold SPYB, some RSPN, some QQQW, and some PDBC.

More By This Author:

Markets Looking Bullish Post-ElectionElection Model Tightens With Weak Employment And Market Selloff

Markets Firm As Election Draws Closer – Some Model Inputs

Please see HC's full disclosure here.