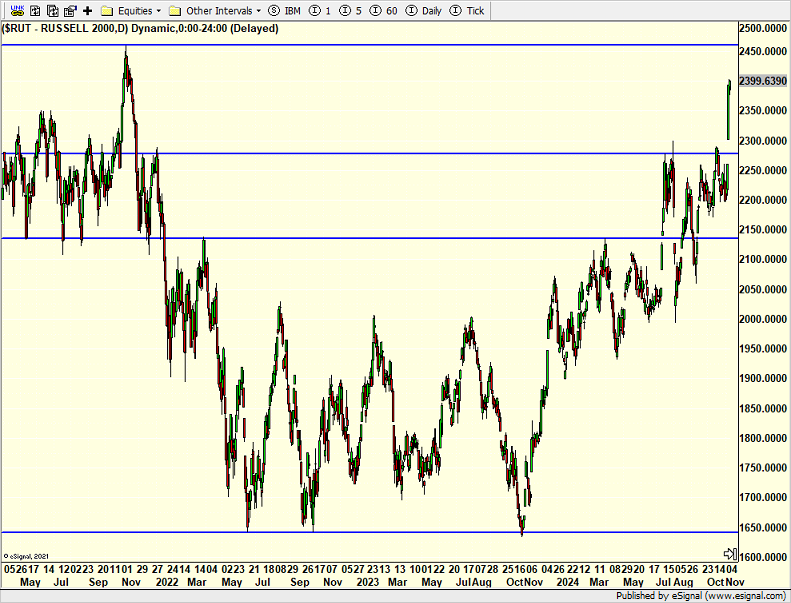

Post Rally Continues – Small Caps Poised For ATHs

Image Source: Unsplash

The post-election, post-Fed rally continued on Friday. It is clear that the election released another round of animal spirits in the markets. While I definitely enjoyed seeing portfolios increase, I have been at this too long to believe this is one of those times to close your eyes and buy everything. And nor do I ever believe the markets are seeing a “new paradigm”. These are not political statements. It’s based on 35 years of experience in the markets.

Someone challenged my view and told me that I am “sore because I missed this monster rally”. Au contraire mon ami which means to the contrary my friend. I suggested he review our trades that I post here and on Twitter which showed an increasing tolerance for risk before the election. That wasn’t because we were positioning for an election outcome which is just plain stupid. We follow our models and our process.

Taking stock as the markets enter a new week, we have fresh all-time highs in all major stock market indices except the Russell 2000. Care to guess which chart is below? That’s right. It’s the aforementioned small cap index which I continue to believe will be at all-time highs this quarter.

And you know what index led the market last week?

Those same aforementioned small caps which were up more than 6%. It’s difficult to buy more when they just went vertical, but there are also billions of dollars who hedged the election and are now stuck way underinvested and short the Russell 2000. That’s an uncomfortable position to have.

(Click on image to enlarge)

The stock market remains on solid footing, but there are certainly big winners and losers since the election. While that trend should continue, I also think the markets are due for a few days of quieter action.

On Veteran’s Day, THANK YOU to all those who serve or have served to protect our freedom!

On Friday we bought XLF, SDS and more XBI. We sold TLRY, RYFIX, GDX, PMPIX and some TAN.

More By This Author:

Digesting The Post-Election / Fed Moves

Markets Looking Bullish Post-Election

Election Model Tightens With Weak Employment And Market Selloff

Please see HC's full disclosure here.