One Of The Surprises In 2025 Could Develop In The Oil Market

Photo by Timothy Newman on Unsplash

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Happy New Year, dear readers!

We wish you a healthy and successful 2025!

Pretiorates is already one year old and the new year raises the question of what lies ahead. Here's an idea...

When US fracking oil flooded the oil market around 10 years ago, the oil price fell massively. That was a problem for the OPEC countries. They need an oil price of at least USD 90 to keep their own budgets more or less in balance.

The OPEC countries therefore also turned on their production taps, which immediately put pressure on the over-indebted US fracking companies with their much higher production costs - and forced them out of the market to a large extent. The oil price then rose again to the level desired by the OPEC countries.

In the meantime, oil prices have returned to a (relatively) low level, which is causing headaches for the OPEC countries. China in particular needs less oil. The Chinese economy continues to stutter and the success of the EV is having a growing negative impact on demand for oil.

US fracking companies, on the other hand, now have much healthier and very strong balance sheets. The OPEC countries have already realized that repeating the same strategy as 10 years ago would no longer work.

As a result, the oil market is in an unusual balance: The OPEC countries are very willing to produce less so that the oil price does not fall any further. If it falls anyway, the US fracking companies also reduce their quota because production is no longer worthwhile due to the higher extraction costs.

If, on the other hand, the oil price rises more sharply, the US fracking companies immediately increase their production again. However, supply is also increasing due to the OPEC countries, which could lift their reduced production quota again - as fossil fuels are often still responsible for a large proportion of these countries' income.

The market is therefore assuming that the oil price will experience a very quiet period in the new year. Calmer than ever, despite the many trouble spots, particularly in the Middle East.

We need not fear a much lower oil price. Supply is likely to dry up quickly. The shares of oil companies have already corrected more sharply and their high dividend yields should act as a support for the share price as well as providing a nice income.

However, should an (undesirable) development in geopolitics jeopardize oil shipments, the oil price will react immediately. The supply from the Middle East could then also come under threat - which could suddenly cause the upside potential of the oil markets to rise sharply. It is therefore reasonable to think that one of the surprises of 2025 could occur in the oil price...

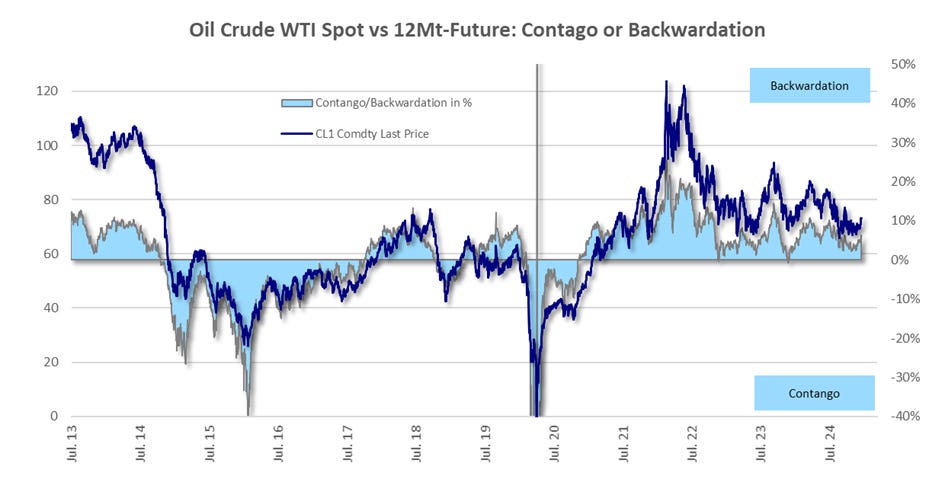

The oil futures market is still in 'backwardation', i.e. spot prices are higher than later delivery dates. This shows that despite the current calm, the oil market is not in a state of abundance.

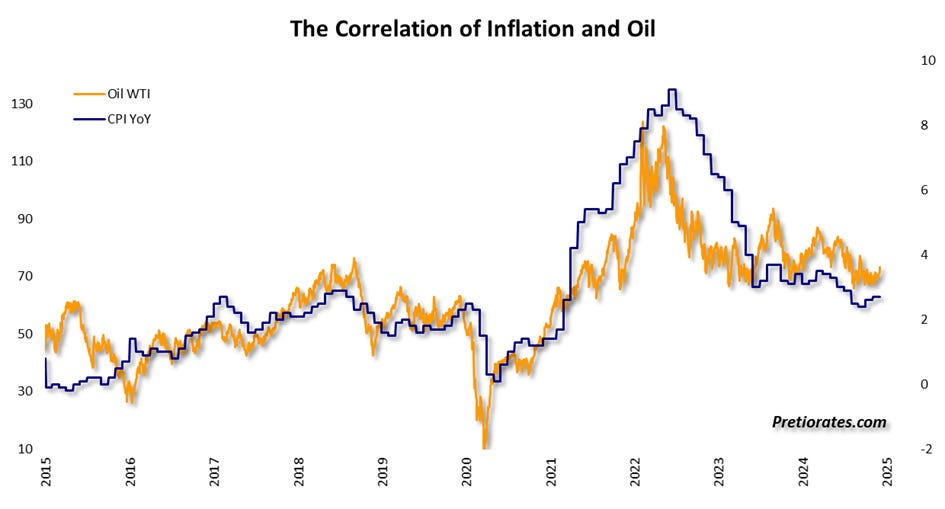

The oil market also correlates very strongly with the consumer price index, i.e. inflation. A higher oil price would therefore also mean higher inflation again...

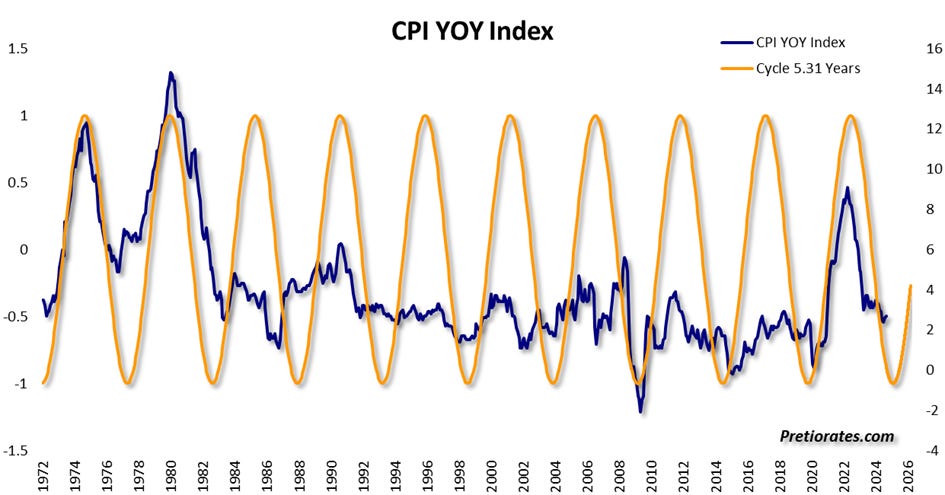

This would confirm what has recently been pointed out again and again in Pretiorates' thoughts: The cycle of inflation indicates a current low...

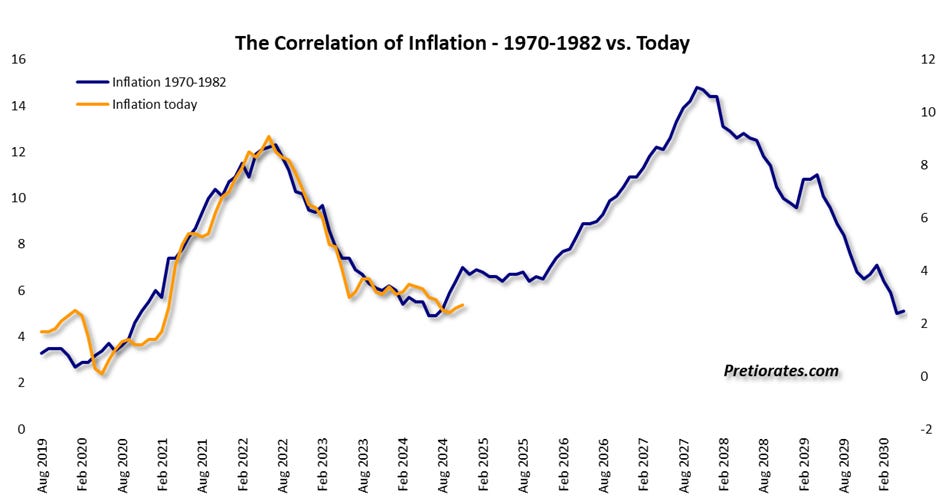

And another reminder: the development of inflation over the last few years has shown a very similar DNA to that of 50 years ago...

That’s it for today!

More By This Author:

Up With The Escalator, Down With The Elevator...Hurray, China Is Buying Gold Again

It Is The Last Month Of 2024

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more