How The Developing Drought In Argentina Is Helping Some Commodities Prices To Explode

GRAINS: GROWING ARGENTINA DROUGHT HELPS CORN AND BEAN PRICES RECOVER

One of the best trades I had over the last month or so was buying soybeans 2-3 weeks ago on my ideas of post-harvest demand and the potential for reduced yields in South America over the next two months. This is a critical time of the year for South American grain crop development and there is no room for error given the tight stocks situation.

Heavy rains in Northern Brazil and drought in southern Brazil and Argentina will threaten millions of hectares of soybeans and corn farms over the next 8 weeks. If things change, I will of course update my clients ahead of time to take some potential big profits in certain futures and option spreads I have recommended.

However, the combination of something we call a positive Antarctic Oscillation Index (not just La Nina) and a warm Tropical South Atlantic point to the potential of a 5-10% reduction in corn and soybean production in Brazil and Argentina these next few months. This comes at a time when the potential also exists for a drought in Texas and Oklahoma to expand north. This drought is already hurting the U.S. wheat crop and will be important to watch next spring.

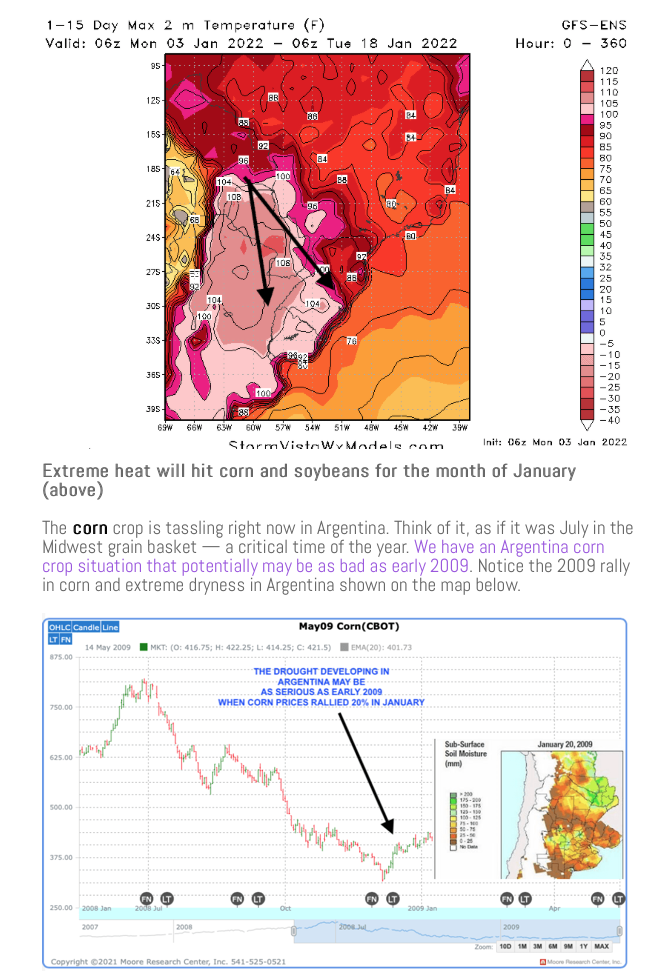

Below is an excerpt of some of the information prior to the grain price explosion.

SOURCE: JIM ROEMER'S WEATHER WEALTH NEWSLETTER

I like to draw comparisions of certain global weather patterns to those of the past and to to look at historical price action. The image above points to the potential early 2009 analog and how corn prices rallied 25% during the critical Argentina pollination state in January.

The bottom line is that these will be exciting times for agricultural commodities and a basket of diversfied ETFs such as (WEAT), (CORN), and (SOYB) should make sense in the longer term picture.

Please feel free to download one of Jim Roemer's sample newsletters here and let us help you have an inside scoop to how weather can increase your ...

more