How April Can Be The Cruelest Month For Some Commodities

Natural gas (UNG), corn, and wheat prices have rallied over the last week or so in response to a weakening U.S. dollar, tight global supplies of grains, a drought in Brazil affecting their 2nd corn crop, and the potential for frost damage to wheat early this week from Nebraska to Texas.

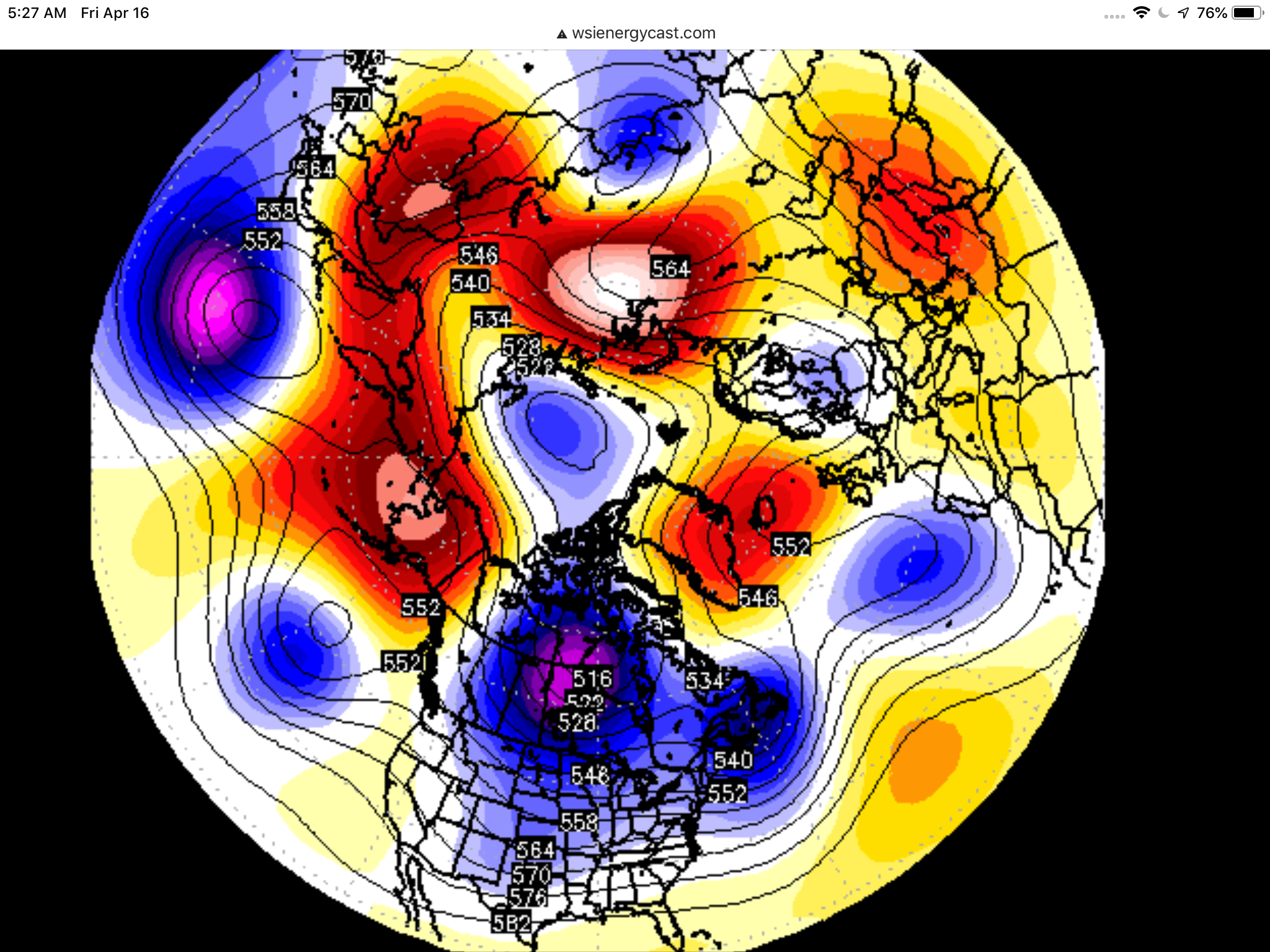

The big red block over Alaska (first map below) is forcing what we call the “Arctic Pig” to make an unusual comeback this late in the season for much of the U.S. Plains and Midwest, there may even be a surprise New England snowstorm before the end of the month. We discussed this with our Weather Wealth newsletter clients more than 10 days ago.

Lately, EIA numbers for natural gas have been friendlier as LNG exports soar. The blue polar Vortex you see on the map (above) next week has already been anticipated by the natural gas market and has resulted in nearly a 10% rally in prices. When you have something like this and everyone is short the market, this is a perfect example of how bearish traders then run for the hills.

(Notice the major blue cold wave that helped natural gas, wheat and corn prices to rally last week) Source of the map: WSI

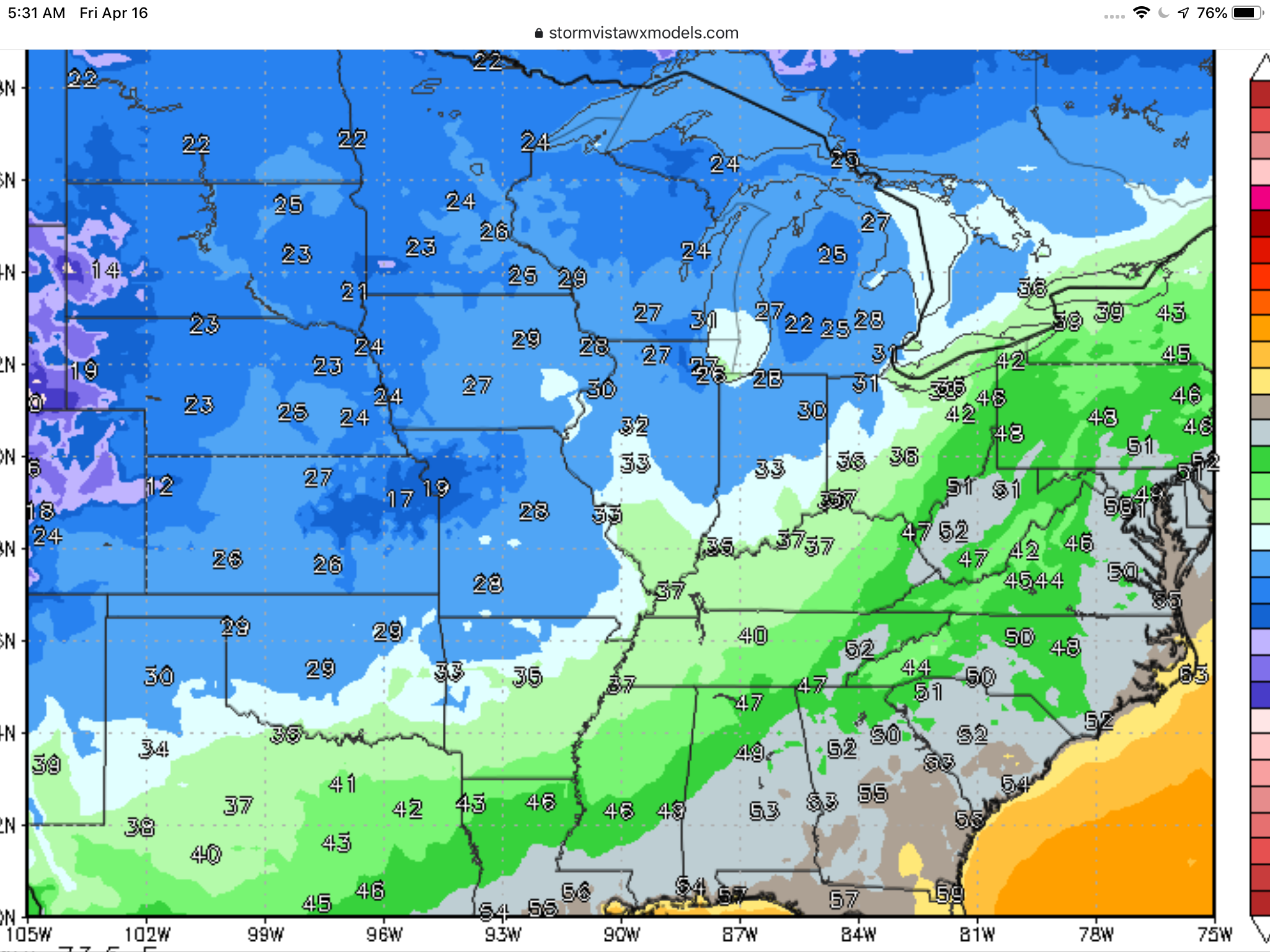

The second map (below) shows projected low Midwest temperature by April 21st. These cold temps may cause some freeze damage to Plains wheat and is slowing Midwest corn preparation for planting. However, following a major bull market in grains the last few months and a big rally in grain ETF's such as corn (CORN), wheat (WEAT), soybeans (SOYB), and the all Agricultural ETF (JJG), what happens with the weather around the world will be "key" for many agricultural markets from May-August.

SOURCE OF MAP: STORMVISTA. (Provided by Jim Roemer on Friday, April 16th. This map helped to rally new crop corn and wheat prices last week on fears of cold temperatures. But will it last? That is the key.

You know you’ve heard about April being the cruelest month because the famous poem The Waste Land by T.S Eliot is out there in the ether, and can’t be put back in the bottle. It begins:

April is the cruelest month / Breeding lilacs out of the dead land, / Mixing memory and desire, / Stirring dull roots with spring rain.

In the commodities business, April (and October) are the shoulder months, in which weather is not that much of a factor in commodities. However, they can be full of surprises and this April's cold spell is certainly one unusual month.

What may the cold April imply for commodities going forward? Typically, a cold April results in some hot, dry summer weather for grain and natural gas markets. While this is not written in stone, I think that La Nina could hold on longer than other weather forecasters have suggested. If so, this will have an overall longer-term bullish impact on many commodities.

Finally, just for fun, If you want to hear Eliot read the entire 25-minute poem, just “google” it. However, I prefer the April philosophy in Simon and Garfunkel’s “April Come She Will”. This is less than 2 minutes long and is hypnotic. Listen here

We invite you to learn how to trade commodity ETFs, futures, and options with one of our two newsletters at Best Weather. Take a look as the ...

more