Grain Prices Suggest Inflation Far From Peaking

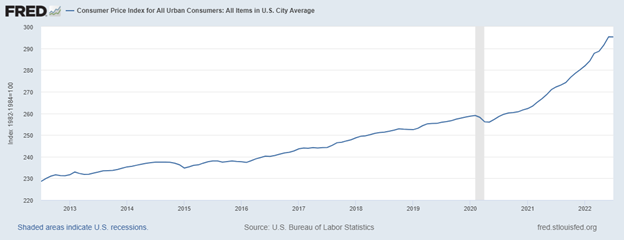

Consumer Price Index for All Urban Consumers: All Items in U.S. City Average (CPIAUCSL) Jul 2022: 295.271, Aug 10, 2022

-

Written by Mish Schneider and Wade Dawson Portfolio Manager

The chart above is the Consumer Price Index for All Urban Consumers and reflects that inflation is historically high.

The Fed has been trying to get a handle on the inflation problem, but the graph seems to illustrate that inflation may not be contained.

The Fed has had to act. In increasing interest rates, the economy though has slowed down.

Also, commodity prices have been increasing since 2019 due to global demand and changing supply dynamics. Historically, commodity markets experience price volatility.

Since July 12 Teucrium Corn Fund are up 7% and Teucrium Soybean Funds 8% and Teucrium Wheat fund is down -3%.

These same factors have increased agricultural commodity prices in recent weeks. The grains appear to be slowly starting to recover in price from a previous rebound earlier this year.

(Click on image to enlarge)

Grain prices are now rising due to strong global demand for these agricultural commodities and a lack of supply, due to adverse weather conditions, from droughts to floods, and the Ukraine conflict.

This new demand should lead to continued strength in agricultural commodity prices over the coming months.

It’s important to remember that commodity markets are incredibly volatile and can change rapidly so we advise actively managing commodities in your portfolio.

ETF Summary

S&P 500 (SPY) 410 pivotal support 397 major support 423 resistance

Russell 2000 (IWM) 190 pivotal support, 180 major support, 199 resistance

Dow (DIA) 339 resistance with 319 major support

Nasdaq (QQQ) 312.50 pivotal support, 301 major support and 325 resistance

KRE (Regional Banks) 65.00 support 68 resistance

SMH (Semiconductors) 222 the 50-DMA support and over 240 better

IYT (Transportation) Through 243 better and must hold 225

IBB (Biotechnology) 123 the 50-DMA support to hold

XRT (Retail) 67.20 must hold on a weekly close. If not, looking at 65.00 next

More By This Author:

Is the Market Pause A Buying Opportunity In Small Caps?

Stay Ahead of Volatility With The Risk Gauge

The Bulls Are In Charge

Disclaimer: The information provided by us is for educational and informational purposes. This information is based on our trading experience and beliefs. The information on this website is not ...

more