The Bulls Are In Charge

While investors are pleased by the recent tepid CPI inflation data, the S&P500 was at significant resistance until Wednesday morning.

At MarketGauge, we have many different proprietary market signals to alert us of potential trend changes so that you don't miss out on any opportunities when they arise.

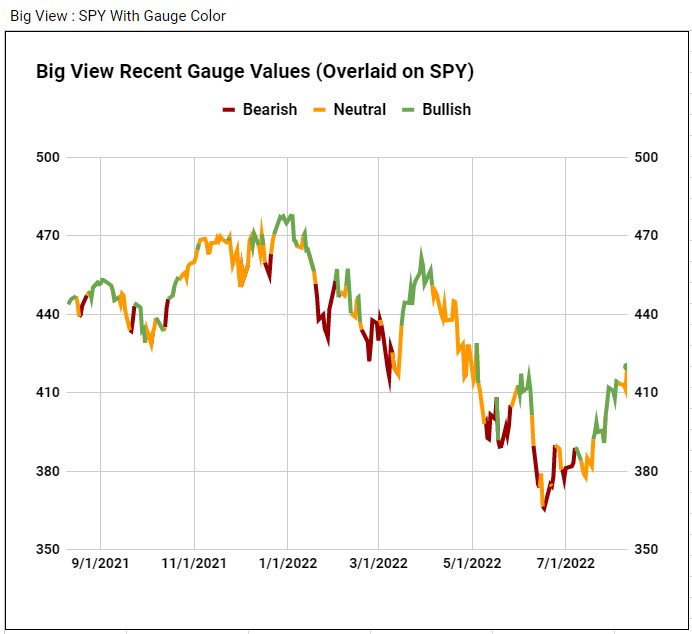

Our Big View Risk Gauge has been nuetral to bullish since early July.

This gauge is based on 5 inter-market relationships in our BigView Premium service and is intended to alert and/or confirm changes in trend strength.

After a brief shift into a neutral stance, today’s move higher in the SPY pushed it back into a bullish reading which suggest more strength over the short to intermediate term.

Today's price action can mean only one thing, the market is bullish on mild inflation numbers.

Additionally, we're overdue for higher trading volumes and are now looking for Thursday and Friday as follow-through days and for these spectacular daily gains to hold.

I will post our Big View Gauge again on Friday to see where it is pointing us into next week's trading and where it falls into place with a few other proprietary MarketGauge market signals.

Stocks rose Wednesday morning as a milder-than-expected CPI inflation Report drove the major indexes up with the QQQs leading the way.

The U.S. market has seen impressive consecutive weeks of gains and today the market soared even higher. The latest U.S. consumer inflation figures released Wednesday morning were crucial and the moderate inflation data is playing a key role in driving markets up.

Mild Inflation Expectations

As measured by the Consumer Price Index (CPI), Inflation in the United States was expected to decline to 8.7% yearly in July from 9.1% in June and inflation came in at 8.5%. The U.S. Federal Reserve remains committed to tightening its policy rate to battle inflation, and better-than-expected CPI figures are significantly impacting how markets price in the September rate decision.

It's worth noting that investors will also pay close attention to the Core CPI figure, which excludes volatile food and energy prices. Nevertheless, a modest decline in the annual CPI today is also causing investors to scale down their hawkish foercases on Fed tightening.

The overall tone of the market remains buoyant despite some concerns that have been percolating.

Technical Outlook

As the market has rebounded strongly from earlier lows in mid-June, the SPY was at MAJOR resistance today, but it looks like stocks will push higher and the SPY is decidely above resitance closing at 419.99 today.

(Click on image to enlarge)

Markets had slowed to a crawl till Wednesday morning and exploded higher today.

QQQ vs. SPY

The tech stock market is in a significant uptrend. The overall sentiment for technology and growth is positive, but with some uncertainty, especially due to short-term treasury yields and valuations.

The QQQs are technically in better shape than the SPY and above significant resistance compared to the S&P 500 even before the opening Wednesday morning.

Please see below the resistance that will now act potentially act as crucial support for the QQQs going forward. The QQQs were up 2.76% today to 325.93.

(Click on image to enlarge)

ETF Summary

S&P 500 (SPY) 421.08 now resistance with support at 417.90

Russell 2000 (IWM) 195.55 the resistance with support at 193.52.

Dow (DIA) 333.84 resistance and support at 329.76.

Nasdaq (QQQ) 326.47 1st level of resistance and support at 322.54.

KRE (Regional Banks) 65.99 resistance, support level at 64.98.

SMH (Semiconductors) 241.30 resistance and support at 236.20.

IYT (Transportation) 246.83 resistance and support at 240.71.

IBB (Biotechnology) 133.40 resistance point and 131.65 is support.

XRT (Retail) 68.83 resistance point and with support is at 65.91.

More By This Author:

Are The Nasdaq And S&P 500 Diverging?

Ways To Profit In A Stagflationary World

Can Gold And Silver Hold Recent Gains?

Disclaimer: The information provided by us is for educational and informational purposes. This information is based on our trading experience and beliefs. The information on this website is not ...

more