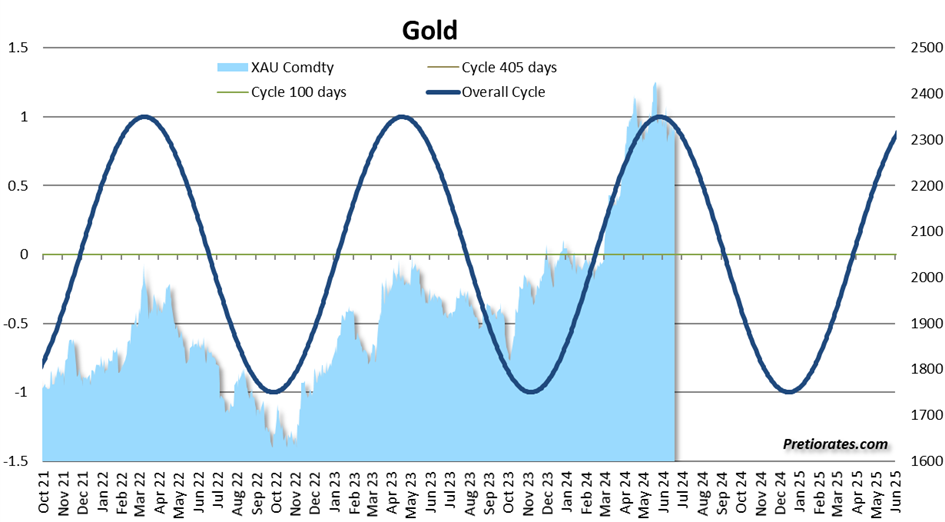

Gold And Silver Are Likely To Feel Another Hooray Before The Summer Vacations

The chart with the 405-day cycle should not really please the Gold bugs. But a downward cycle in the second half of the year does not necessarily mean that all the gains from the first half have to be lost again... just remember Summer 2023… And the most important question will only be answered at the end of the next cycle: Will the high hit rate even remain???

(Click on image to enlarge)

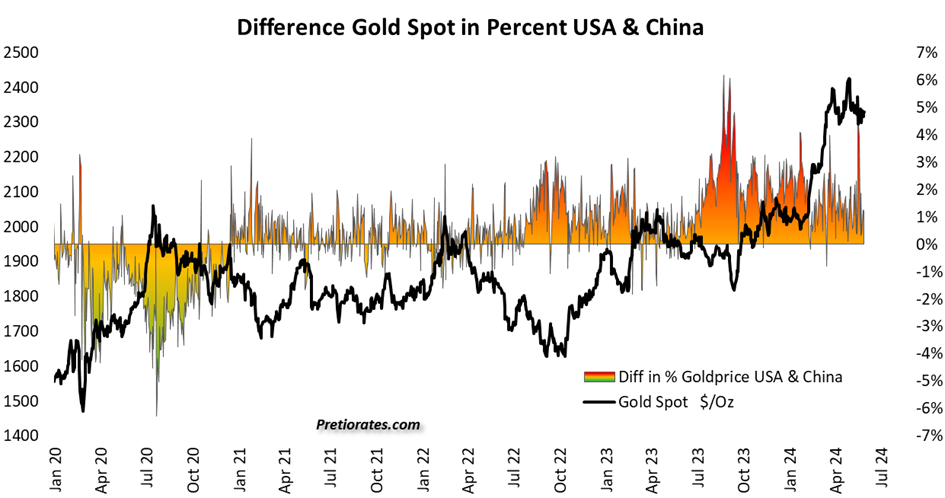

The premium in the Gold price between Shanghai and the Western markets has recently narrowed to 1%...

(Click on image to enlarge)

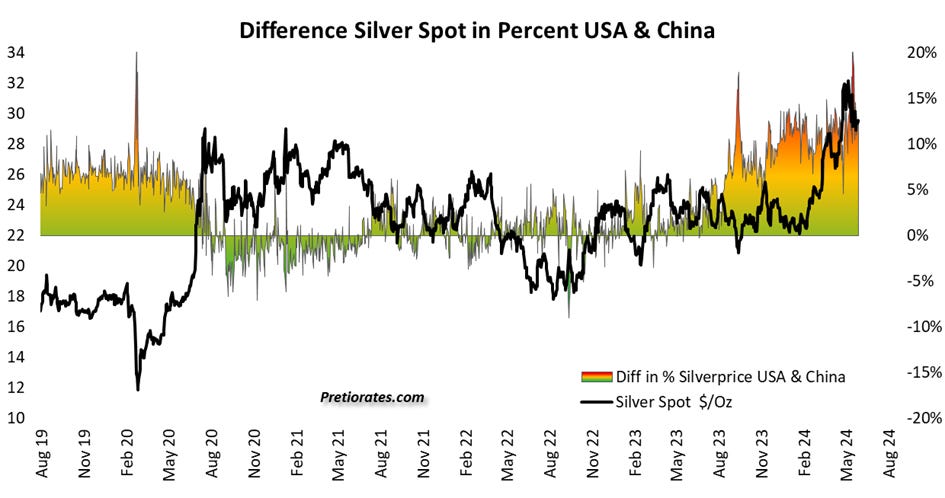

However, Silver still pays around 11% more in Shanghai than in London or Chicago...

(Click on image to enlarge)

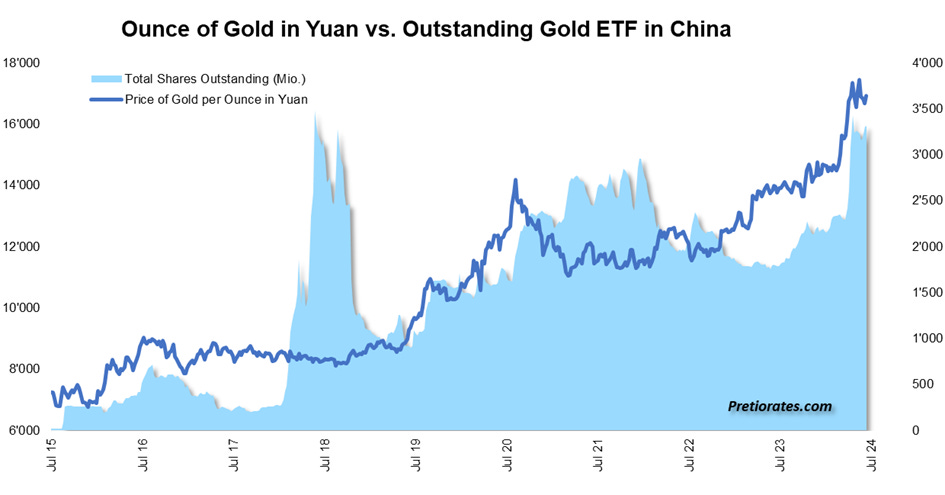

The number of outstanding Gold ETFs in China remains at a very high level. Chinese investors remain loyal to their Gold investments...

(Click on image to enlarge)

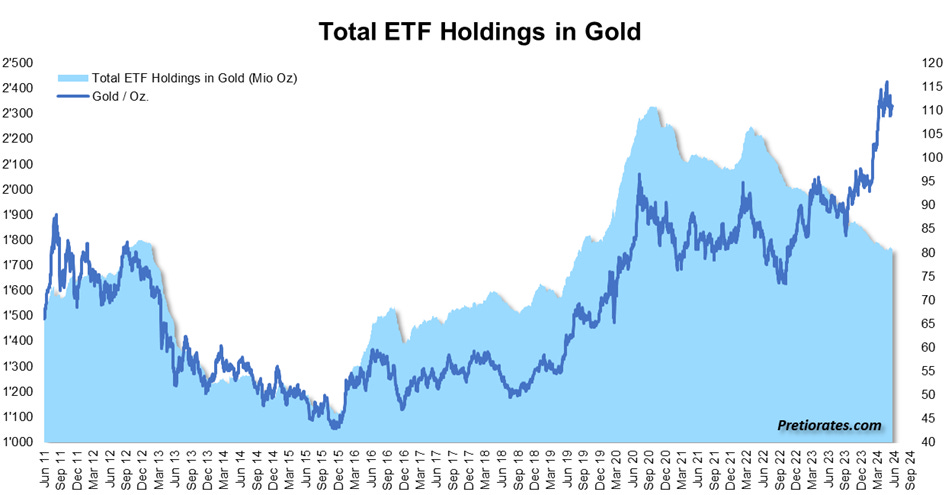

Investors in the West continue to sell their investments in Gold ETFs. The number of outstanding ETFs is still decreasing...

(Click on image to enlarge)

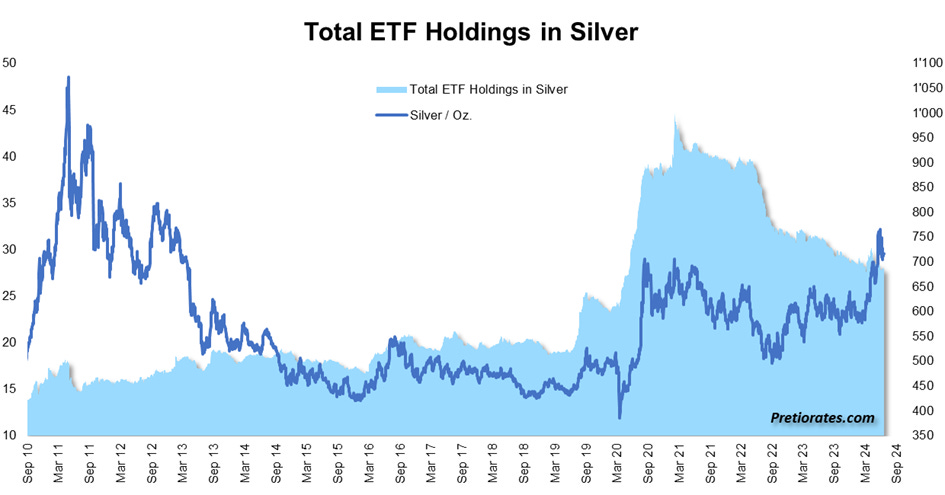

There is still no interest in Silver ETFs in the West either...

(Click on image to enlarge)

But the supply of Silver on the Shanghai Futures Exchange has recently fallen dramatically...

(Click on image to enlarge)

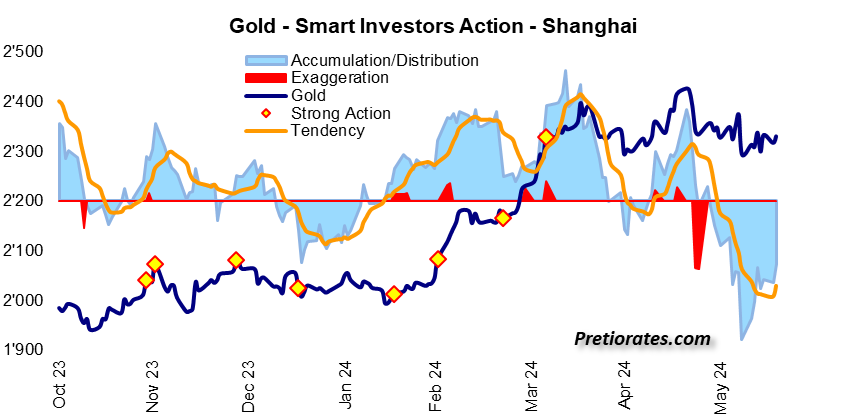

According to Smart Investors Action, the consolidation of investors in Shanghai should soon be over. There are clear signs that there is less distribution...

(Click on image to enlarge)

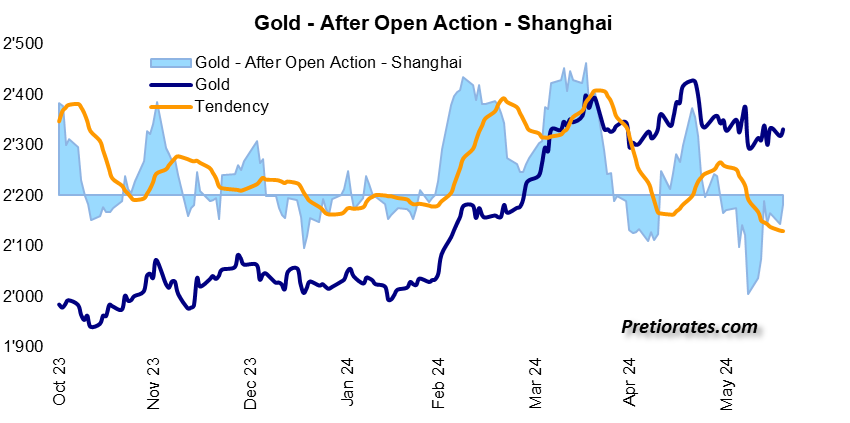

The After Open Action also indicates that the consolidation could soon be over...

(Click on image to enlarge)

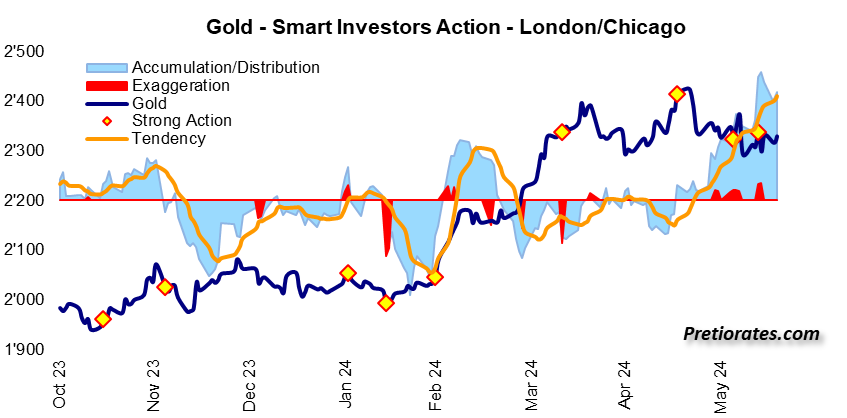

In London/Chicago, investors continue to accumulate massively in the background – but cautiously without pushing the price...

(Click on image to enlarge)

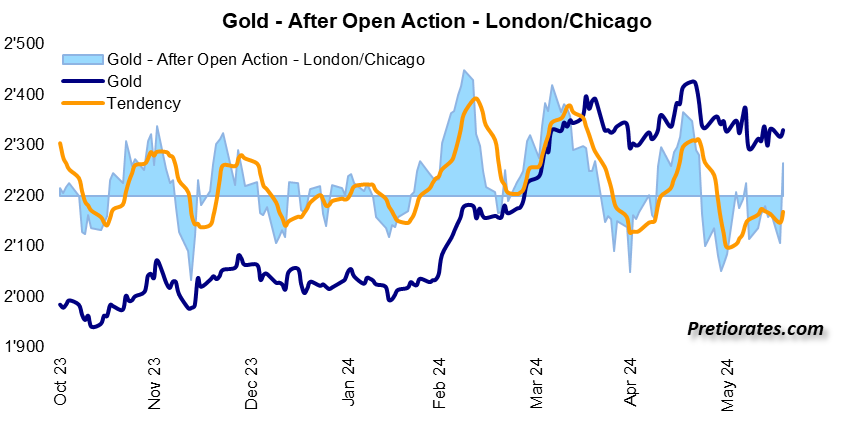

...and the After Open Action in the West is positive again...

(Click on image to enlarge)

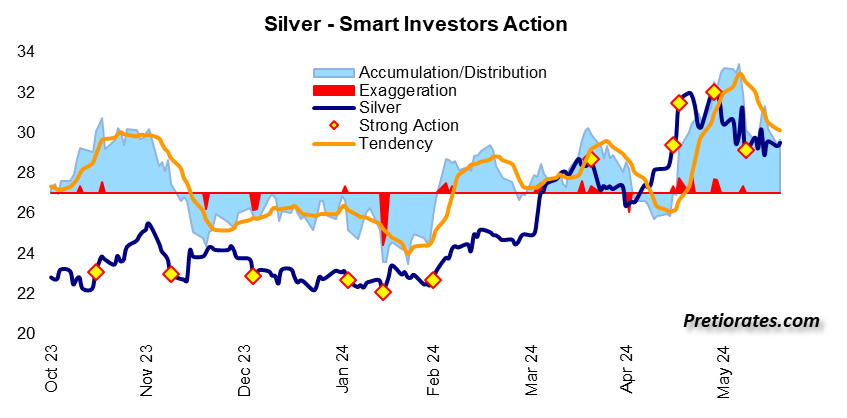

Even if the Silver price has consolidated recently, there has been further strong accumulation in the background...

(Click on image to enlarge)

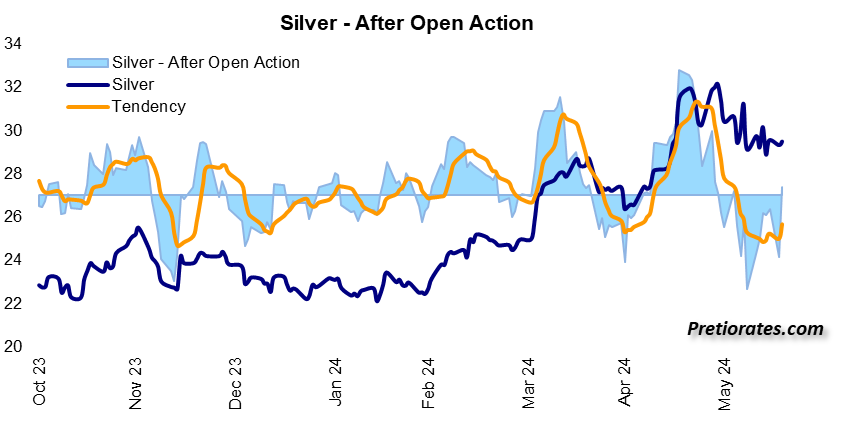

And the After Open Action suggests that buyers will soon be more aggressive again...

(Click on image to enlarge)

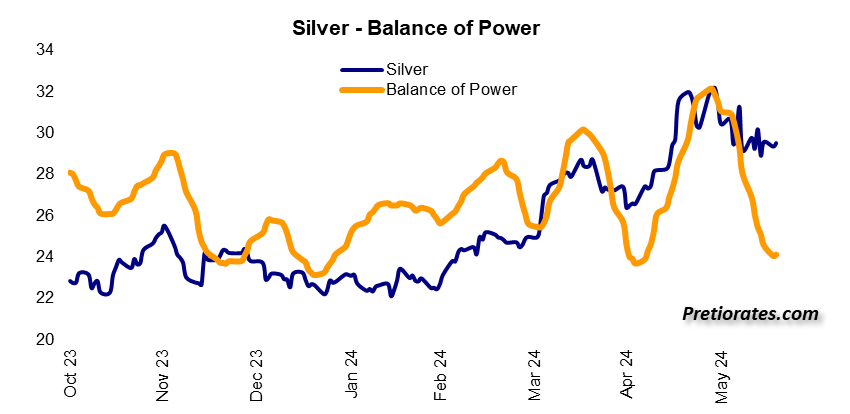

Even the Balance of Power, which measures the forces between the bulls and bears, suggests that the bulls could soon take over the control again...

(Click on image to enlarge)

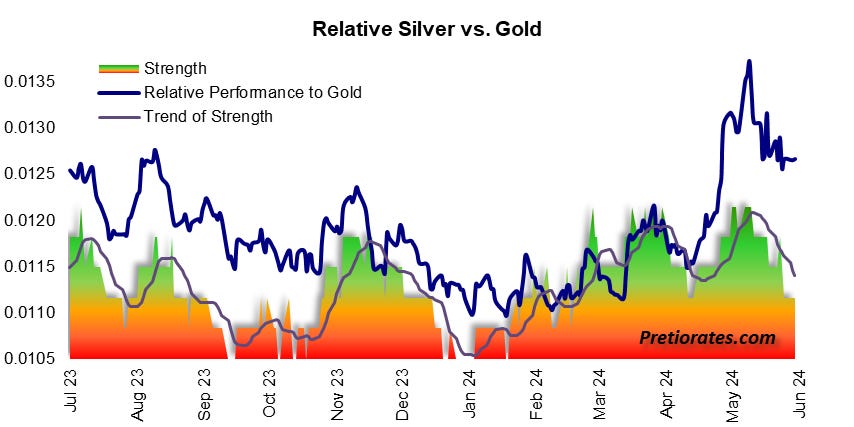

Silver has recently disappointed somewhat compared to Gold. Let's hope that this was only of a temporary nature...

(Click on image to enlarge)

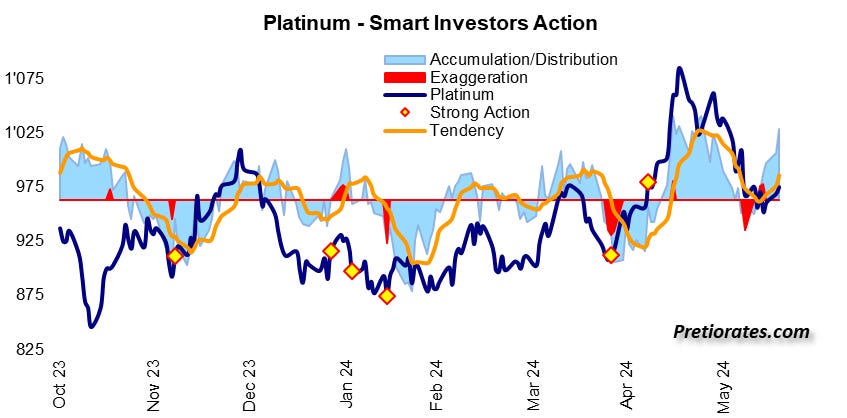

The Platinum price has also fallen back more sharply recently. But the accumulation of smart investors has never really stopped in the background and is picking up again...

(Click on image to enlarge)

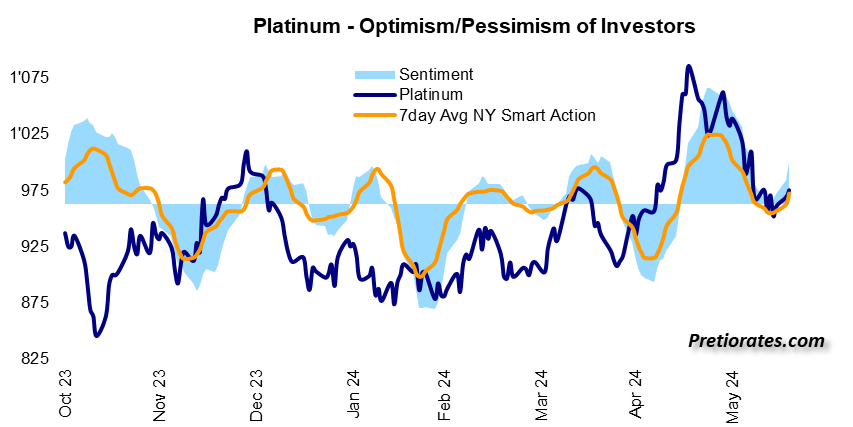

Moreover, investors never really became pessimistic...

(Click on image to enlarge)

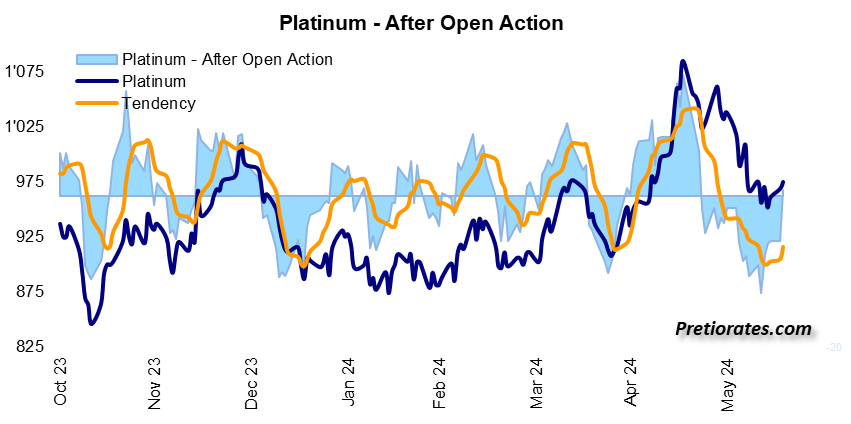

Here too, the After Open Action shows that the bulls are taking control again...

(Click on image to enlarge)

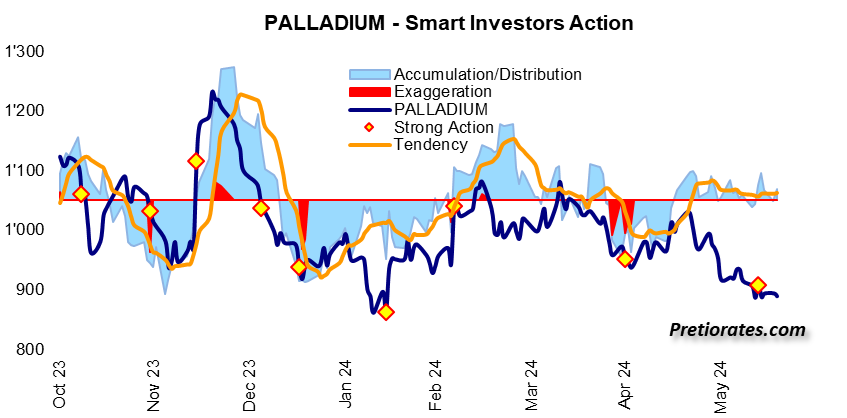

Palladium, on the other hand, is likely to continue to disappoint. Smart Investors indicates that investors are still not interested...

(Click on image to enlarge)

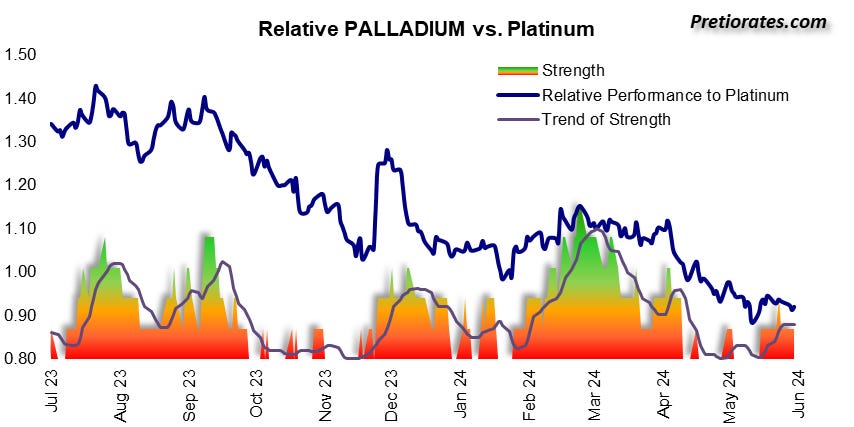

This is also reflected in the performance comparison with Platinum: Palladium is unable to build up any strength of its own...

(Click on image to enlarge)

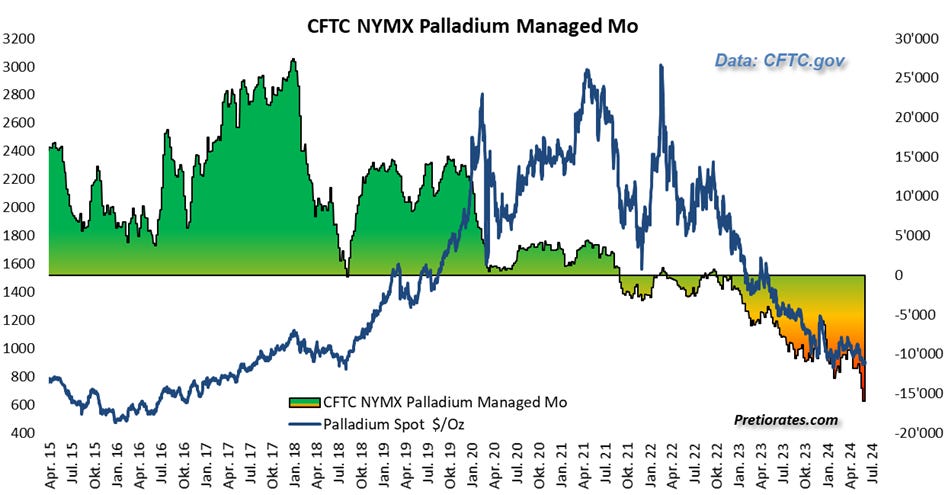

And on the COMEX, the short positions of investors (non-commercials) are being further expanded...

(Click on image to enlarge)

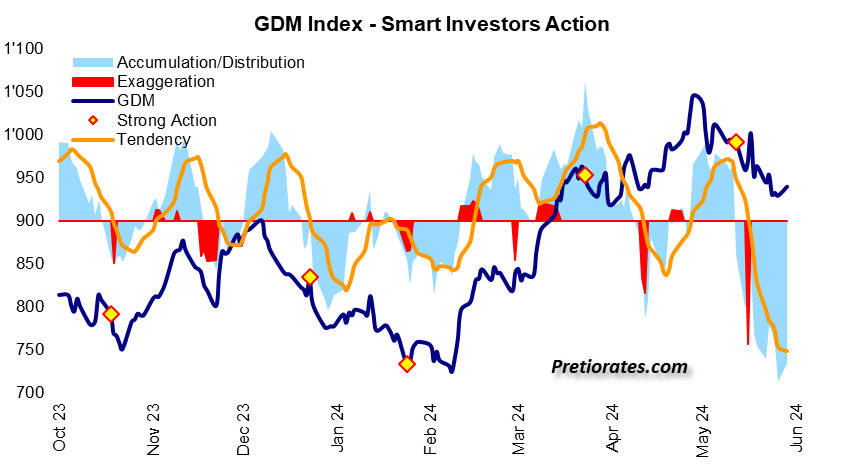

Still on mining stocks: According to Smart Investor Action, there has been massive distribution recently. The fact that the mining indices have not lost more ground can also be interpreted as a sign of strength... In any case, this distribution pressure should also decrease here from now on...

(Click on image to enlarge)

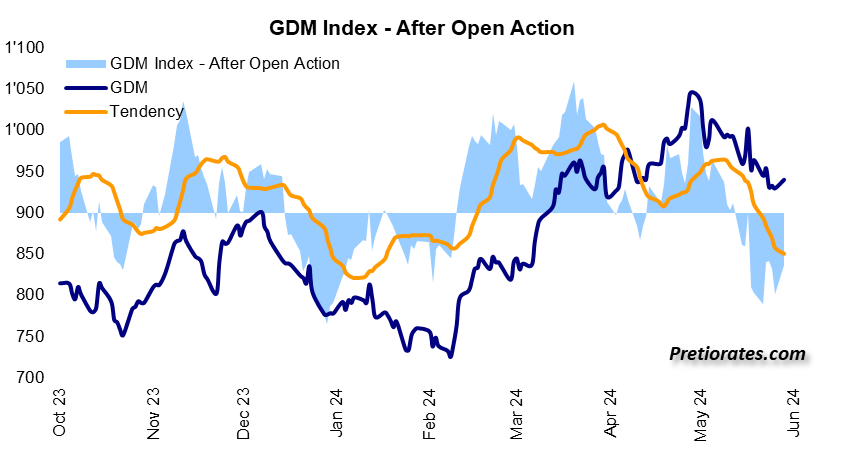

Confirmation also comes from the After Open Action...

(Click on image to enlarge)

More By This Author:

Base Metals Could Soon Take Off From The Base AgainA Surprising Development In The Gold Market

World Equity Indices: Are The Bears Coming Back?

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more