Base Metals Could Soon Take Off From The Base Again

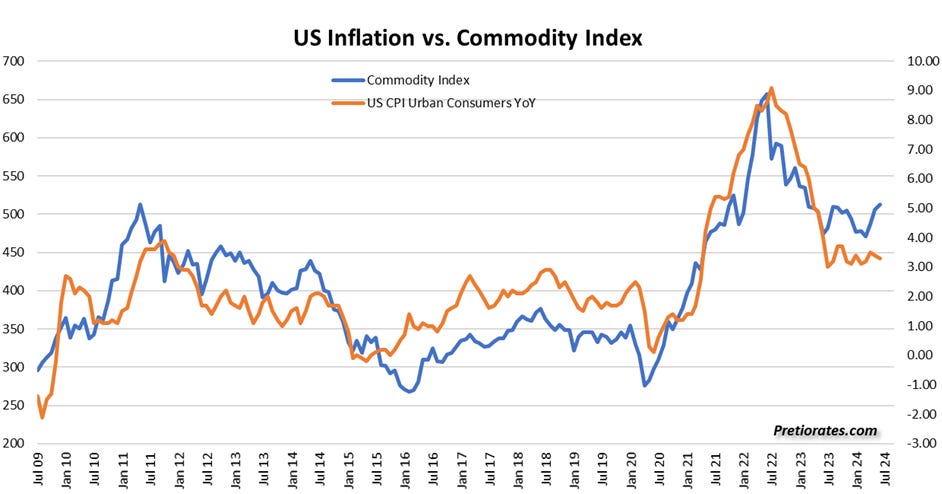

The inflation figures have been published. If we want to get an idea of where inflation is heading before the release, we analyze the commodities...

(Click on image to enlarge)

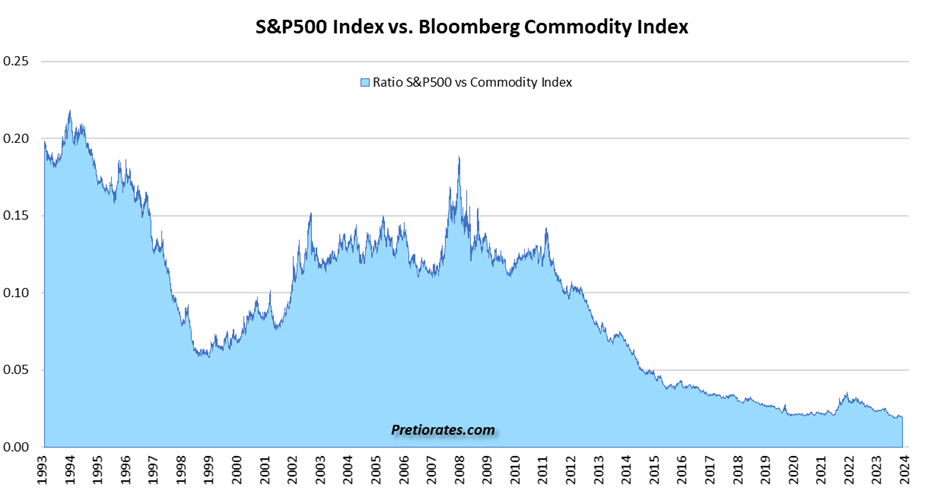

By the way, commodities are extremely cheap compared to the S&P500 index...

(Click on image to enlarge)

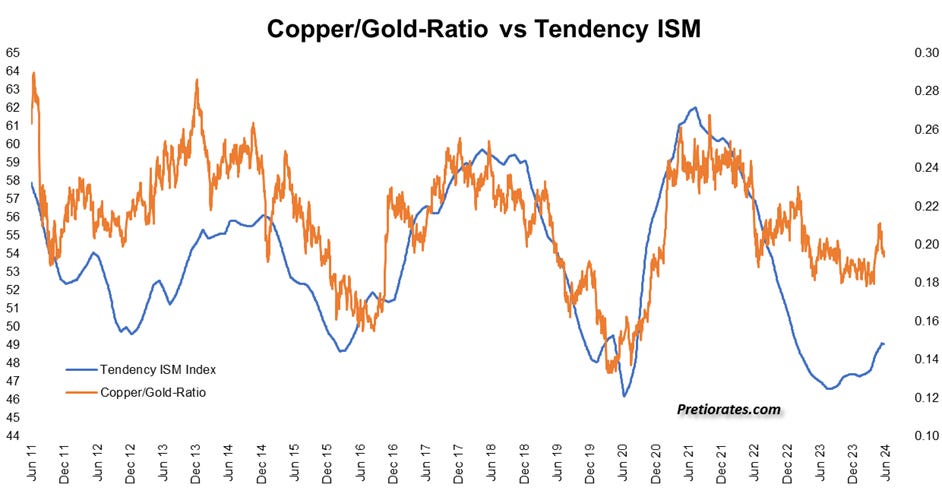

The ISM figures were also published this week. The copper/gold ratio used to have a very high correlation with the economic number. Copper tended to perform better in positive economic cycles, gold during the rest of the time. In the meantime, however, times are changing due to the high demand for copper (electrification) and gold (financial system and geopolitical developments)...

(Click on image to enlarge)

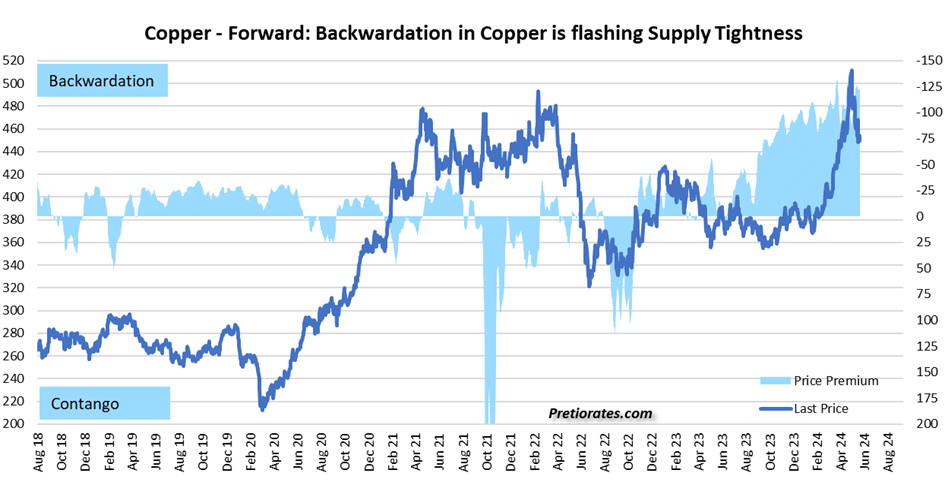

The massive backwardation in copper futures shows how scarce the availability of copper currently is...

(Click on image to enlarge)

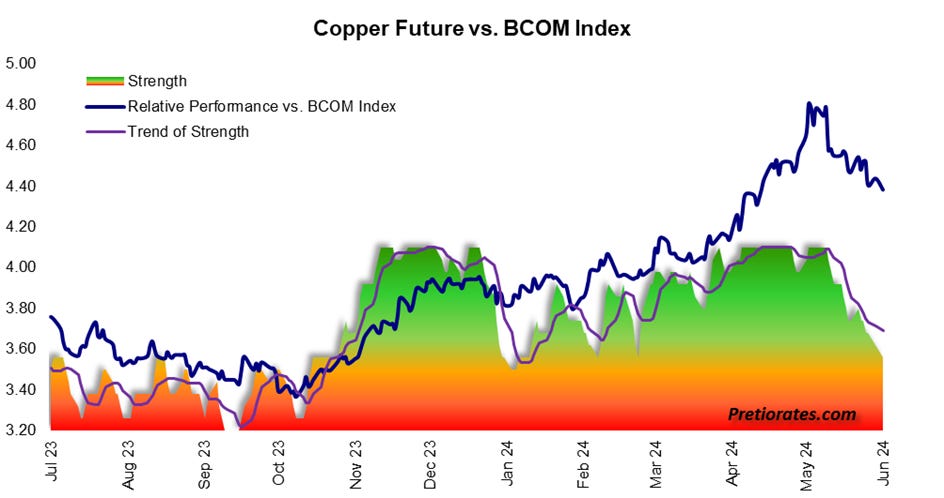

The trend strength of the copper price has, however, declined somewhat in recent days...

(Click on image to enlarge)

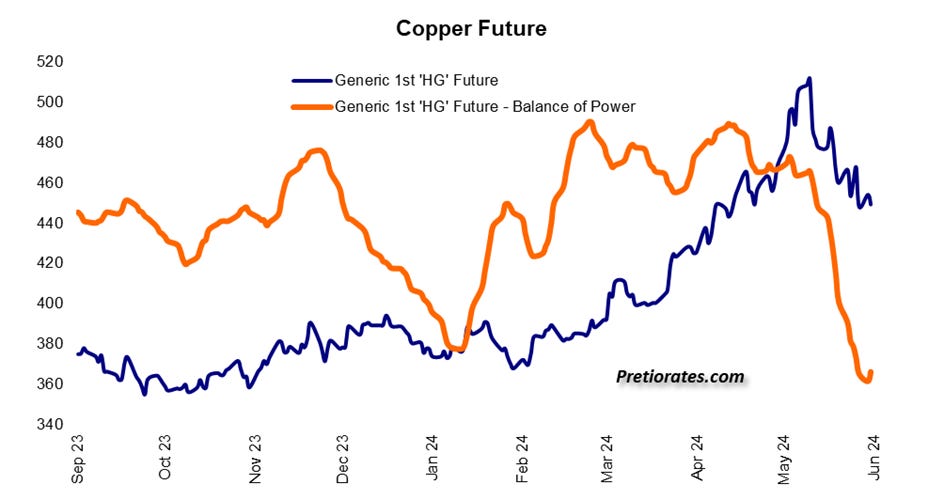

However, the short-term indicators are already massively oversold... Ready to speculate???

(Click on image to enlarge)

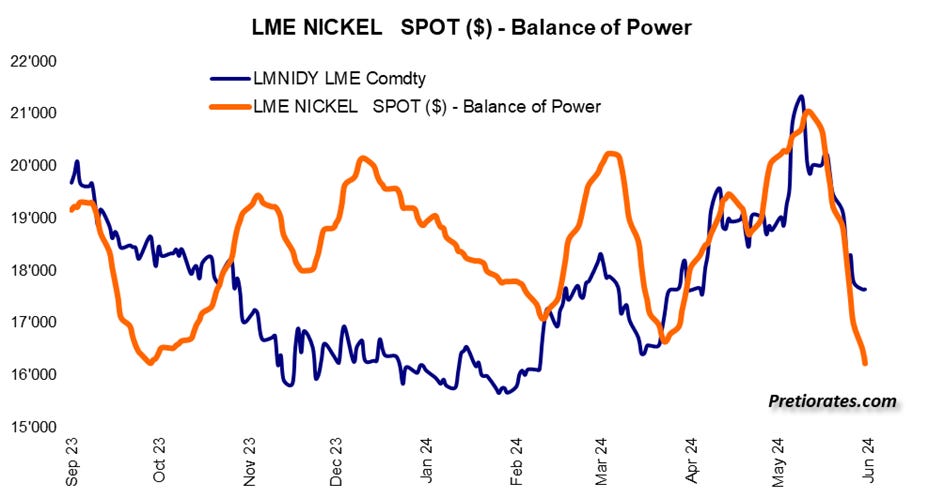

The same indicator shows a similar situation for nickel: massively oversold...

(Click on image to enlarge)

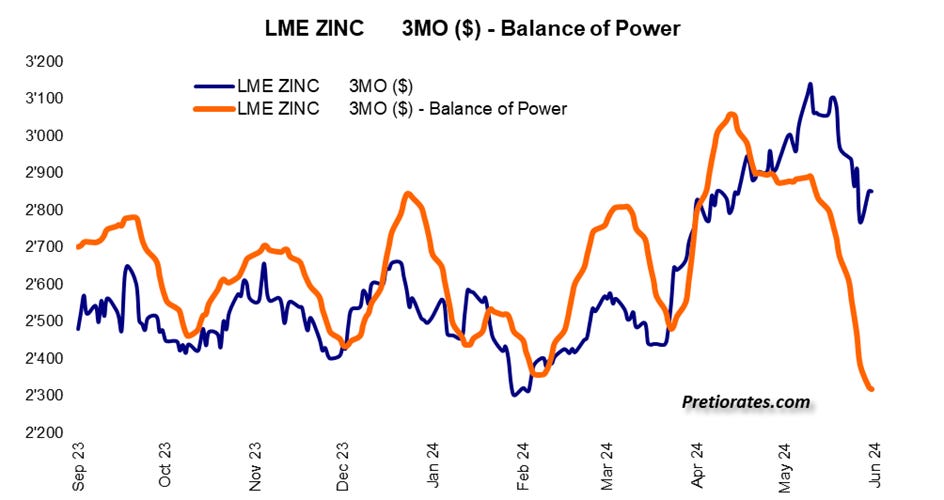

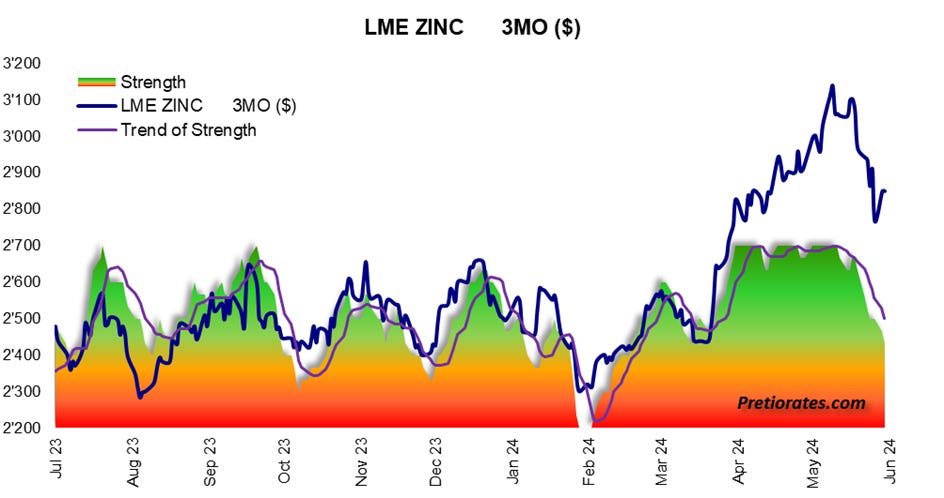

And also zinc: The earlier movements cannot be compared with the last ones...

(Click on image to enlarge)

In the medium term, however, the trend strength continues to weaken...

(Click on image to enlarge)

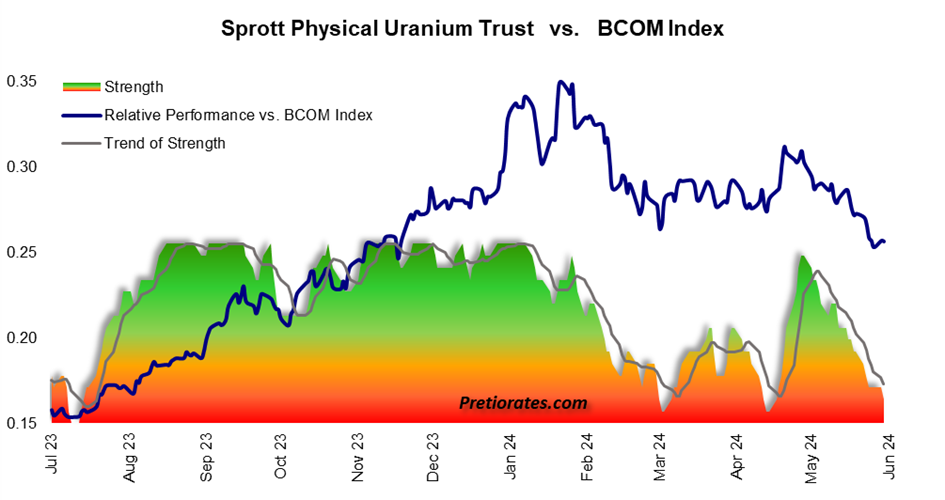

This has been the case with uranium for some time now. The Physical Uranium Trust from Sprott was a winner in 2023. Since the beginning of the year, however, only for a very short time...

(Click on image to enlarge)

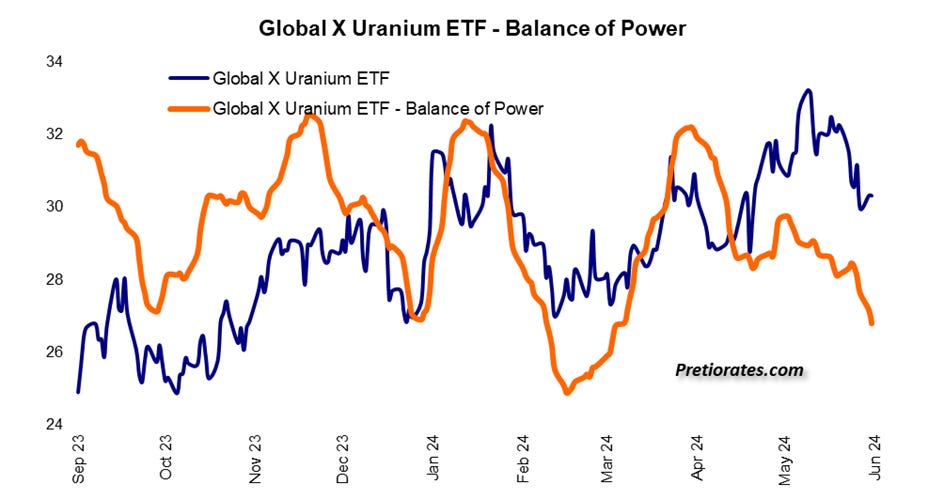

The balance of power, the strength between the bears and bulls, lets us know that the bulls could soon take control again...

(Click on image to enlarge)

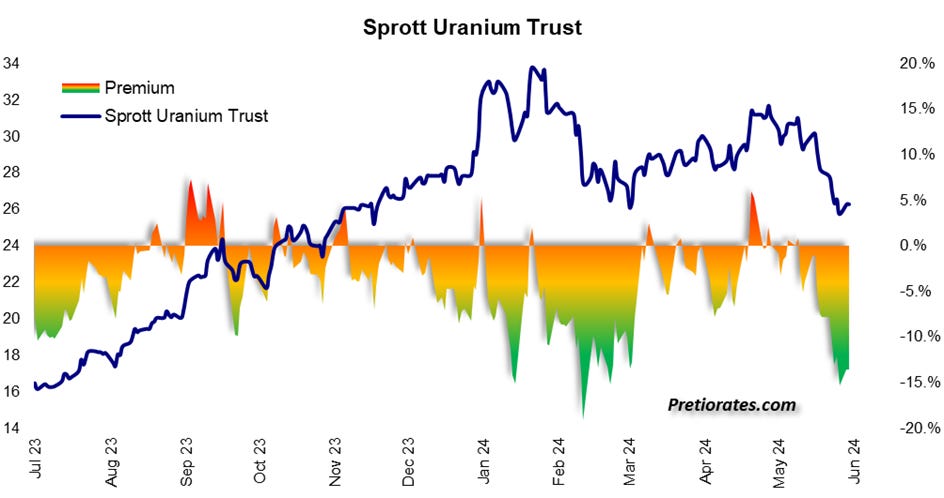

And again on the Sprott Uranium Trust: it is currently trading at a discount of almost 15%... Who wants a dollar for 85 cents?

(Click on image to enlarge)

More By This Author:

A Surprising Development In The Gold Market

World Equity Indices: Are The Bears Coming Back?

Gold And Silver Rally, Made In China

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more