Gold - A Case Of Unrealistic Expectations

Gold - What Did You Expect?

Question No. 1. What's wrong with gold?

Question No. 2. Inflation is roaring and gold is dropping in price. Since gold is an inflation hedge, why isn't its price going up?

If you need to ask either or both of those questions, then you are likely suffering from a bad case of unrealistic expectations involving gold and its price behavior.

What's Wrong With Gold?

Nothing. Absolutely nothing.

First of all, only a few months ago, the gold price hit $2043 oz. and reflected a full ninety-nine percent loss in U.S. dollar purchasing power since the origin of the Federal Reserve more than a century ago.

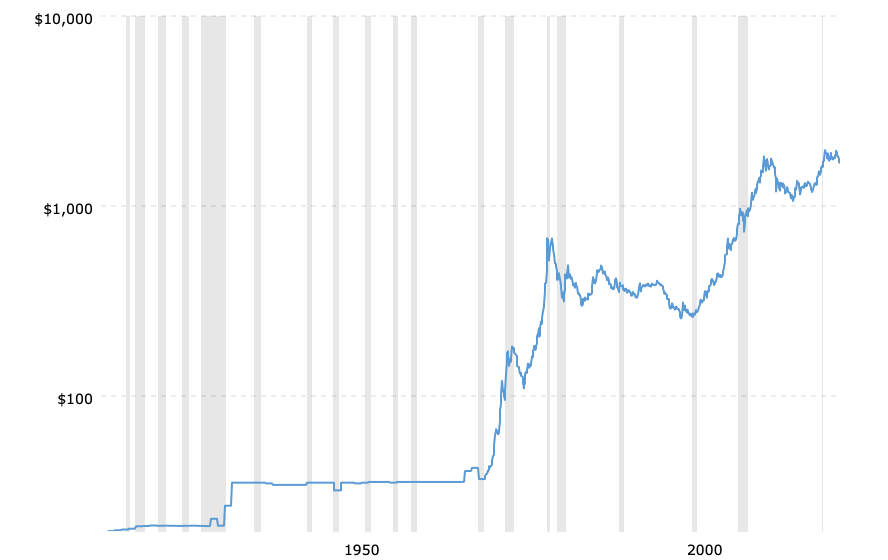

There is only one reason the price of gold increases over time - to reflect the loss in purchasing power of the U.S. dollar. See the chart below...

Gold Prices - 100 Year Historical Chart

The cumulative loss in purchasing power of the U.S. dollar shows up in a continually rising price for gold. As can be seen on the chart, too, there are long periods of time when the price of gold remains relatively stable or declines.

The U.S. dollar price of gold does not tell us anything about gold. It tells us what has happened, or is happening, with the U.S. dollar - nothing else. Lately the U.S. dollar has been quite strong.

The US dollar is in a constant state of deterioration, punctuated with periods of temporary strength and stability. This action is reflected in the U.S. dollar price of gold.

Inflation Is Worse; Why Isn't Gold Going Up?

Let's be blunt: Gold is not an inflation hedge.

Inflation is the debasement of money by governments and central banks. Inflation never stops. All governments inflate and destroy their own currencies.

The higher prices for goods and services that most people focus on are the effects of inflation and those higher prices result from the loss in purchasing power of the currency (i.e., U.S. dollar).

Here are two critical points to remember...

- The effects of inflation are unpredictable (see The Fed's 2% Inflation Target Is Pointless)

- Some of the higher prices we are currently seeing have nothing to do with inflation...

Higher prices resulting from supply chain disruptions have nothing to do with inflation; but they do provide a distraction which defers attention away from the real cause (see Simple Facts About Inflation).

Gold Is Not An Investment

Gold is not an investment. Gold is real money and a long term store of value. It is original money and the measure of value for everything else.

Gold's value is in its use as money. Period. It is immune and indifferent to wars, political and social unrest, natural calamities, etc.

Radical changes in the price of gold are a reflection of the currency in which it is priced. Again, those changes tell us nothing about gold.

Inflation, or expectations of inflation, do not impact the value of gold. The value of gold is constant and unchanging. (see Gold And Inflation Expectations)

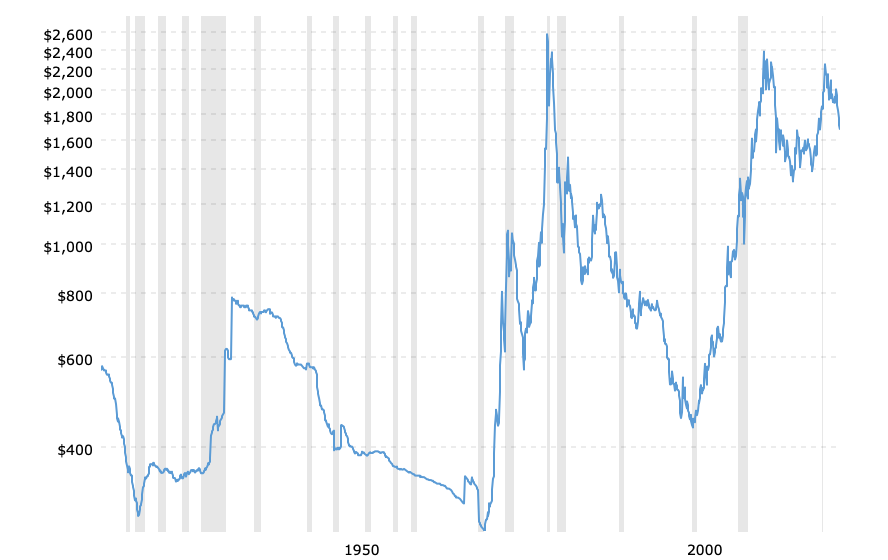

Below is a second chart which shows the same price action of gold as in our first chart, except that the prices in the chart below are adjusted for inflation.

Gold Prices (inflation-adjusted) - 100 Year Historical Chart

Each time the gold price peaked in the above chart, it represented fully the accumulated effects of inflation - the loss in U.S. dollar purchasing power - up to that point. Those peaks will never be exceeded no matter how high the gold price goes.

Summary And Conclusion

The gold price is not declining because the Fed is raising rates. The gold price is declining because the U.S. dollar is strong. As long as the U.S. dollar remains strong, or strengthens further, then don't expect higher gold prices.

False assumptions based on non-fundamentals lead to unrealistic expectations. For gold investors, the unrealistic expectations can lead to disappointment and financial loss.

More By This Author:

Gold Not Undervalued - Expect Lower Prices

Debt, Deflation, Depression

Latest Gold Charts Are Not Pretty

Kelsey Williams Is The Author Of Two Books: Inflation, What It Is, What It Isn't, And Who's Responsible For It And more

Good read.