Crude Oil. Midterm Outlook

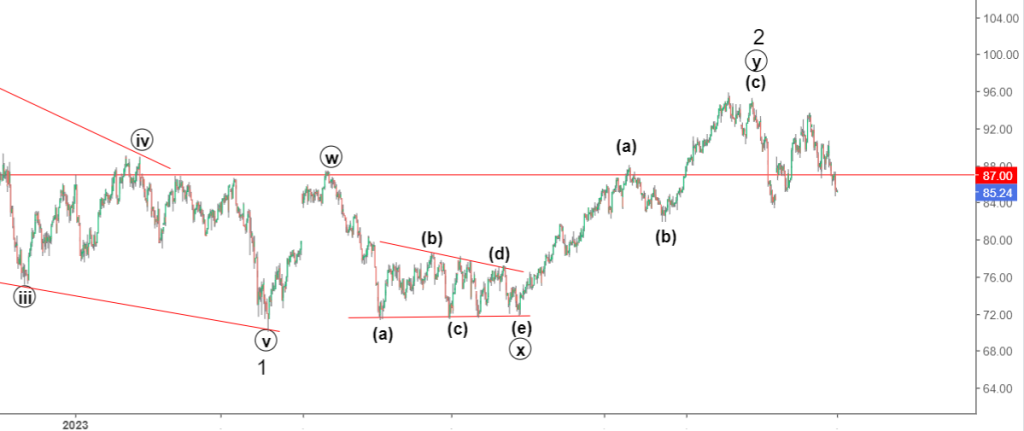

The last update at the end of August mentioned the importance of the level of 87 (brent). If it is broken, the growth was expected to continue to 91.15 and 97.57 . After passing 87, we quickly made 91.15 , there was a small consolidation , then almost perfectly executed 97.57 ( it was 97.69) and turned around.

First of all, we need to note the return to the 87 mark , and we are trying to test it again. The weekly chart is shown below . Nothing changed in the long run , only correction 2 was more prolonged.

(Click on image to enlarge)

Daily chart

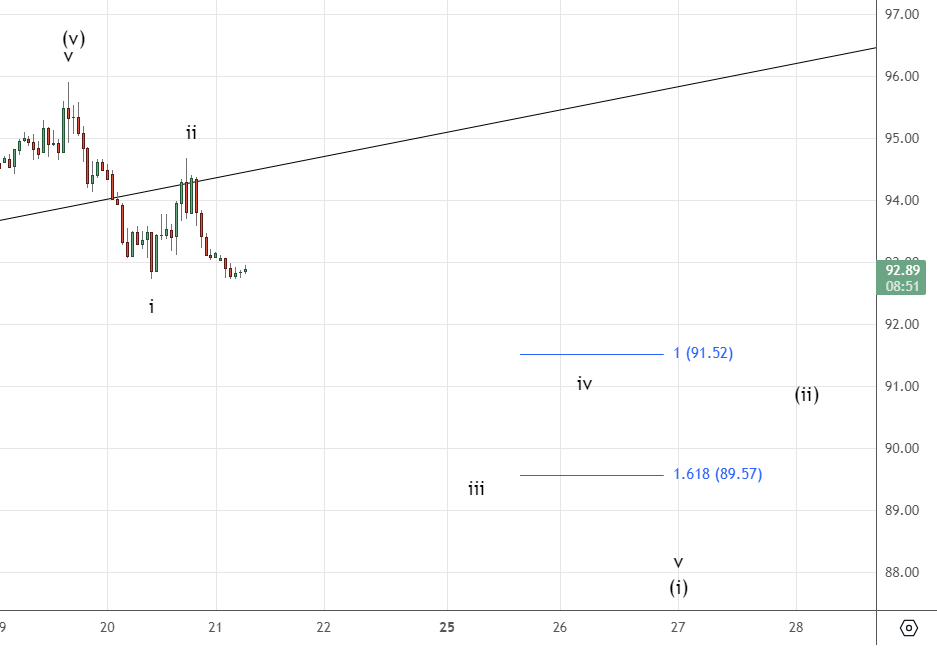

In more detail, maybe 2 isn't over yet .

(Click on image to enlarge)

Averages (weekly chart).

MA200 (blue) MA100 (red) MA50 (black). We are testing MA50 , a break and consolidation below will open the way to the important support level of MA200 (there were many attempts to pass) in the area of 73.6.

(Click on image to enlarge)

Detailed monitoring of the situation was conducted in the closed section.

16.09 (link).

The trend line was broken and tested from below, which confirms further growth in the range of 97.67-99.26. We also expect a clear downward momentum.

(Click on image to enlarge)

21.09. We waited for a downward impulse. the following schedule has been published. (link).

(Click on image to enlarge)

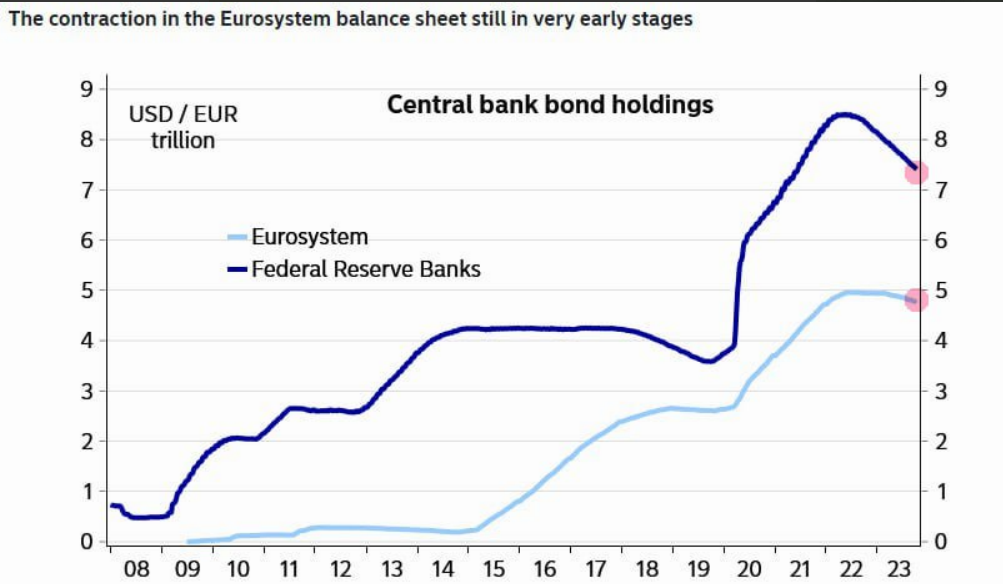

The fundamental factors are the same as in the stock market . This is a tightening of the fin.conditions, the reduction in the balance of the Fed and ECB, the approaching crisis.

(Click on image to enlarge)

Conclusion: Again, as last time, the important level is 87. When breaking through and consolidating, we will test 73.6. At the same time , we need to make a clear downward impulse, while this is not the case — the reversal is not confirmed. Nevertheless, the movement since May 4 is considered as a correction, so sooner or later we will break through these lows.

More By This Author:

The US Stock Market; Correction Before A Serious Fall

Gold And Silver. Will The Fall Continue ?

Elliott Wave Technical Analysis: Bitcoin Update

Disclaimer: My opinion is provided as general market information and do not constitute investment advice