Copper - Will Be In Great Demand

Image Source: Pixabay

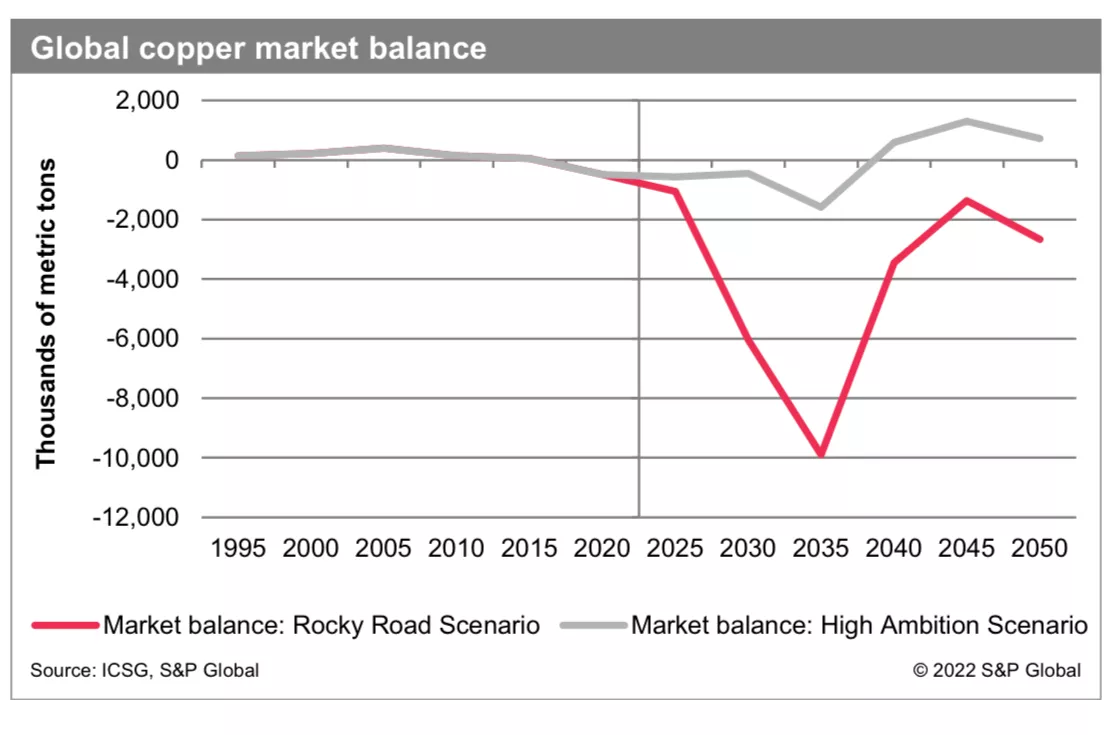

The S&P’s report “The Future of Copper, Will the Looming Supply Gap Short Circuit the Energy Transition” concludes the world has never produced anywhere close to the copper needed in such a short time frame.

Midway through the 2030s is when copper demand from the energy shift is predicted to peak.

(Click on image to enlarge)

In the 2040s, and witness a slight rise by 2050. But because of the expanding global economy and population, the demand for copper as a whole is expected to more than double from its current level.

Without a substantial increase in copper production in the short to medium term, which will be very difficult, the 2050 climate goals cannot be met. The following factors will boost demand for energy during the energy transition:

+ Global EV deployment » Modernization and expansion of the power grid to enable electrification Increasing the capability of renewable energy sources like wind, solar, and energy storage.

The world's fleet of vehicles must be electric, and electricity generation must swiftly shift to renewable sources of energy.

Cables are needed for deeper electrification, and copper is the material of choice for cables.

Furthermore, it is common for copper ore deposits to also contain other important minerals, and mining of these minerals results in substantial byproduct production of other metals like cobalt, molybdenum, and nickel.

The market for this energy transition will be especially strong in the United States, China, and Europe. The demand for purified copper is expected to nearly double from just over 25 MMt in 2021 to nearly 49 MMt in 2035, putting the supply system in its most difficult phase.

In light of the results of this research, key areas demand further investigation and development.

There is a need for an enabling investment and policy environment to support innovation and greater production of the vital minerals these new technologies depend on.

Innovation that allows cleaner copper extraction and refining will help address a number of the crucial issues that are currently fueling the supply-demand gap, including the copper industry's own carbon footprints and the capacity to obtain permits for new production. Innovation that promotes increased copper utilization efficiency, recycling, and/or the use of substitute materials that can lower current demand forecasts would also be crucial in closing the gap.

The energy shift will call for more copper as well as a number of other essential minerals. Some of these are already incorporated into government projects in some places, especially in the United States and the European Union.

There are several dynamics that will have a particular bearing on copper access. China holds a preeminent position in copper smelting (47%), and refining (42%).

Net-Zero Emissions by 2050 will probably stay a pipe dream unless new sources of the metal used in electrification are brought online promptly, with obvious political support and strategic commitment.

To invest in copper here are two ETF Names:

- United States Copper Index Fund

- iPath Series B Bloomberg Copper Subindex Total Return ETN

More By This Author:

The Capture Ratio Of Absolute Return Strategies

An Effective Method To Compare Risk Aversion To Speculation

Wave-Trend Update: Equities

Disclaimer: These illustrations are not a solicitation to buy or sell any ETF. I am not an investment advisor/broker