The Capture Ratio Of Absolute Return Strategies

Image Source: Pexels

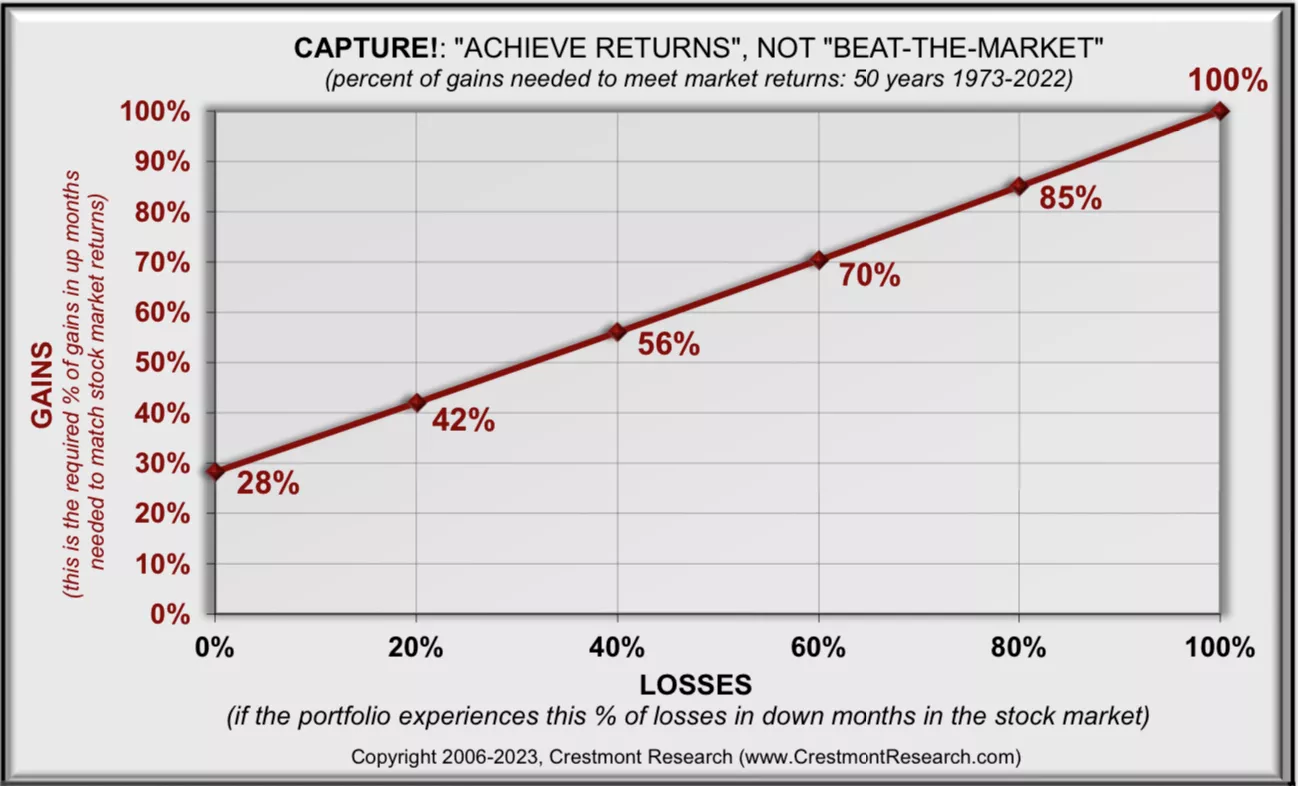

Most investors are unaware of how much more volatile the equity market is. The friction loss from returns' dispersion and the disproportionate effect of losses are two volatility gremlins that significantly lessen returns' compounding. An absolute return-oriented investment strategy that acknowledges this dynamic and seeks to improve investors' compounded returns by offering a more risk-managed and constant return profile is called "capture" in this context. The "absolute return" investor only requires a fraction of the upside when downside losses are kept to a minimum, unlike the "relative return" investor (tracking stock market indices), who typically experiences 100% of the downside and 100% of the upside to accomplish market returns.

(Click on image to enlarge)

The graph above illustrates just how little of the upside is needed to match stock market returns over time and it demonstrates the way that many absolute return strategies exceed stock market returns without having to "beat-the-market" each year...

More By This Author:

An Effective Method To Compare Risk Aversion To Speculation

Wave-Trend Update: Equities

Investing In Desalination

Disclaimer: These illustrations are not a solicitation to buy or sell any ETF. I am not an investment advisor/broker