Cocoa Hyperinflation Accelerates As Grindings Show No Demand Destruction

Image Source: Unsplash

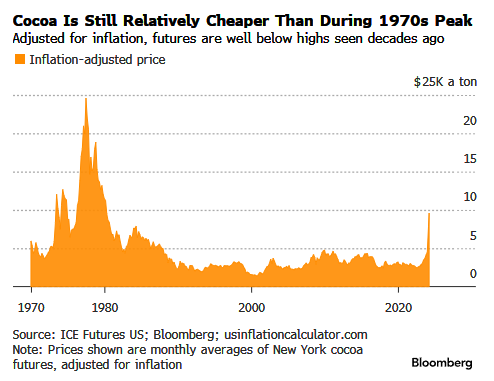

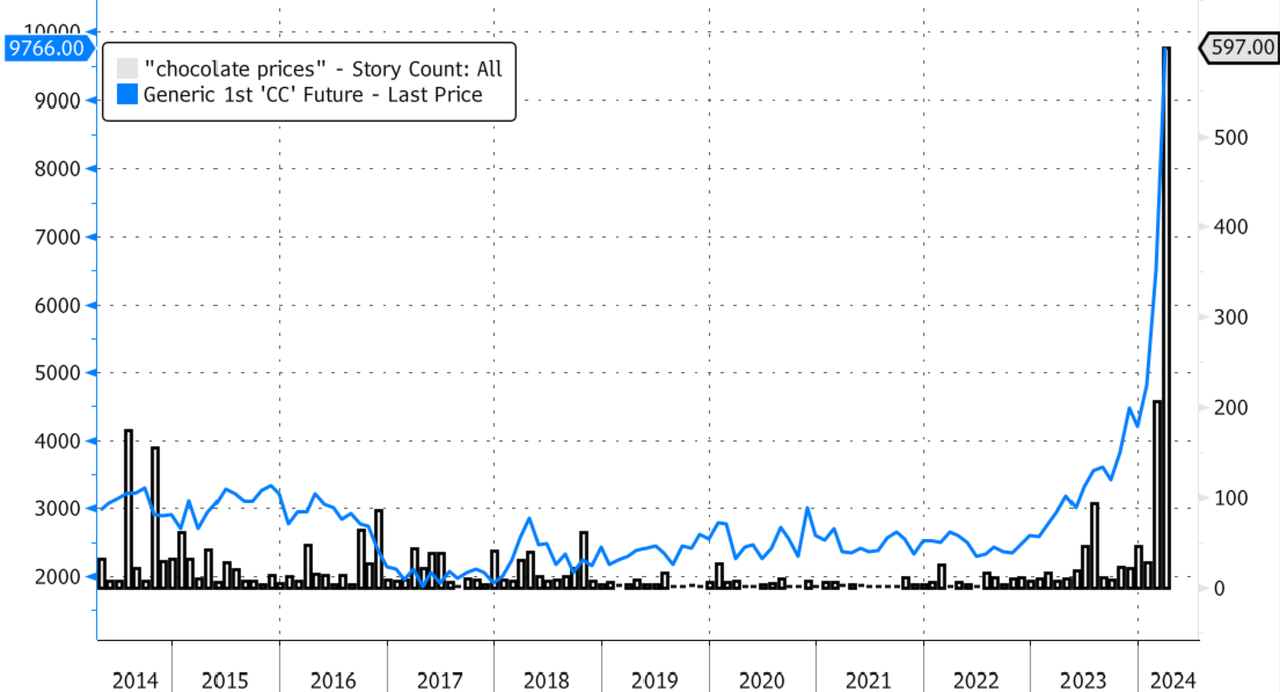

Cocoa hyperinflation is insane. The latest data from the futures market shows that cocoa prices in New York surged above the $12,000 per ton level today as the pace of processing in factories remains robust. This indicates that demand destruction has yet to emerge despite the massive multi-month parabolic price surge.

Cocoa futures surged 18% in the last two days to a record high of $12,125. Prices are up more than 190% year-to-date and are in breakout territory.

(Click on image to enlarge)

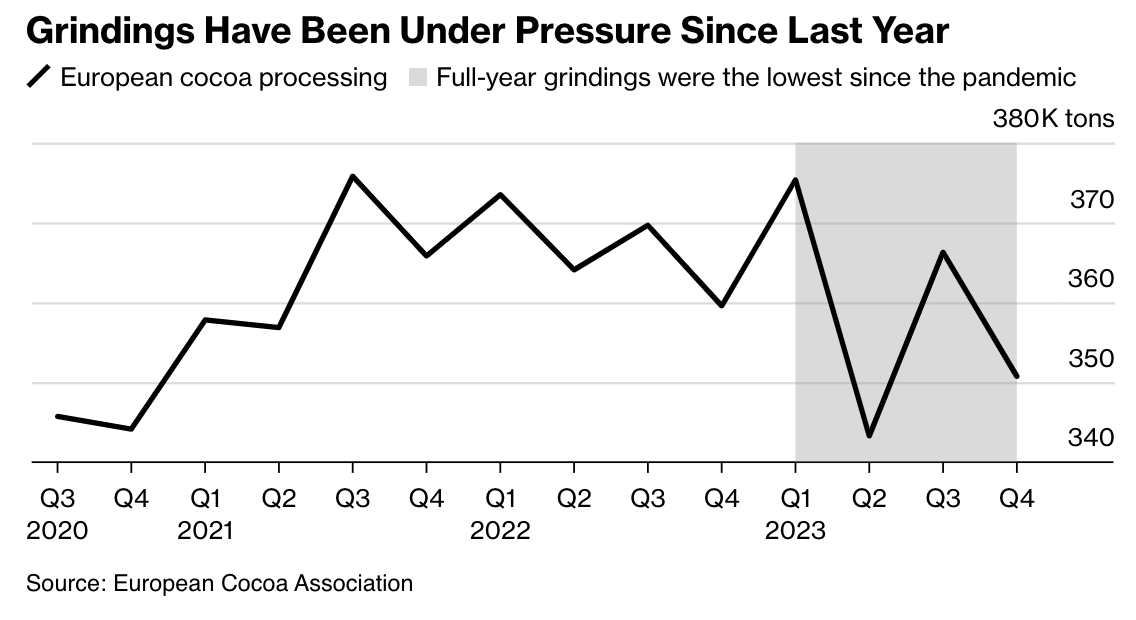

Bloomberg says the news today about grindings—where cocoa transforms into butter and powder used in candy—only dropped 2% in Europe and marginally lower in Asia for the first quarter compared with the same quarter one year ago.

(Click on image to enlarge)

John Goodwin, a senior commodity analyst at ArrowStream, said the grindings numbers are "nowhere near the deterioration we needed to end this rally," adding, "It's crazy how resilient those numbers were."

In other words, despite cocoa prices skyrocketing to the moon, there has yet to be noticeable demand destruction among consumers that would derail this rally.

"The market is watching processing data to get an idea of whether the rally is starting to hurt demand and how hard it's becoming for chocolatiers to obtain beans, though the data risks becoming a less reliable gauge of demand as shortfalls make it more difficult to source cocoa," Bloomberg pointed out.

Paul Joules, an analyst at Rabobank, wrote in a note that grindings figures are "an indication that for now demand is holding up despite current pricing," adding that "demand destruction will come, but clearly it's taking longer to filter into grind data than the market was anticipating."

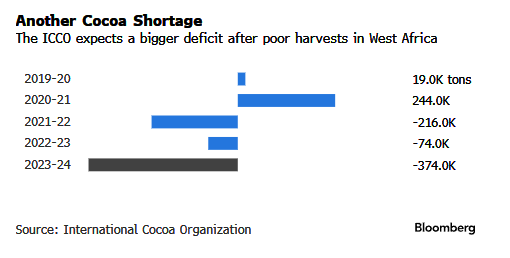

Earlier this month, Bloomberg reported that famed commodity trader Pierre Andurand opened a "small, long position" in cocoa futures in early March. Since then, prices have erupted. In an email, he told the media outlet that his price target is "$20,000 later this year" amid worsening continued drought and disease across West Africa, denting production at cocoa farms.

If cocoa prices rise, chocolate makers like the US Hershey Company will see demand destruction. However, this has yet to happen, and consumers are not complaining about higher prices (yet).

On Google Search, we looked at various key phrases a consumer would ask online about why prices were rising. Still, there is no search trend explosion.

However, as cocoa prices soar, the number of headlines about "chocolate prices" has hit a record high.

(Click on image to enlarge)

Perhaps Andurand's $20,000 price target is correct. Still, we have no idea where the price must go before demand destruction strikes.

More By This Author:

A Very Ugly Week For The Nasdaq, A Terrible Week For Semiconductors

Money-Market Fund Assets See Largest Outflows Since 'Lehman'

Netflix Reports Blowout Q1 Results And Subscriber Adds But Warns Gains Will Slow, Stock Slides

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more