Netflix Reports Blowout Q1 Results And Subscriber Adds But Warns Gains Will Slow, Stock Slides

Image Source: Pixabay

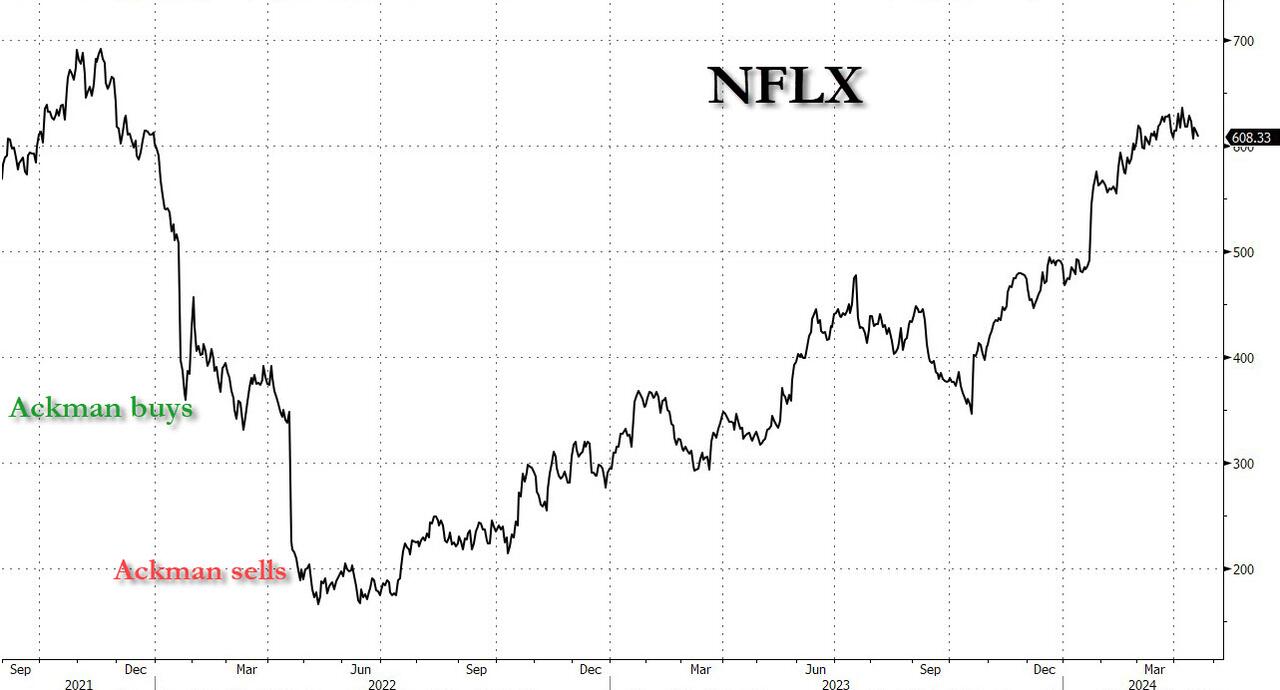

After suffering a historic collapse at the end of 2021, when in the span of five months Netflix lost 75% of its value, and when Ackman first bought then immediately dump the stock just around the generational bottom, the company has enjoyed a stellar recovery over the past two year when it rose by nearly 300%, from a low of $166 to a recent high of price of $636, just shy of the record hit in late 2021.

(Click on image to enlarge)

It is therefore not surprising that after this tremendous ascent and nearly 3x return, that both Goldman and UBS agree that Netflix remains a very crowded long with investors very bullish. According to UBS, "the bull thesis continues to revolve around the residual impact of password sharing and they are just scratching the surface on the scale of the ads business" while "the rationalization of content spend and direct-to-consumer efforts from competitors will also be a tailwind for Netflix." Goldman chimes in that positioning and sentiment skew more long - as NFLX’s multiple is approaching multi-year highs - with stock up ~28% YTD and short interest back at 10 year lows.

That said, UBS cautions that stretched positioning and the stock near $620 cause some to pause, but given they are the first one out of the gate, the stock could benefit from investors using it as a safety play.

On the earnings print, investors will be focused on:

- magnitude of upside to sub net adds

- pricing updates as estimates are underpinned by price increases eventually hitting;

- tailwinds from paid sharing and if there are legs left versus already in run rate;

- updates on scaling in ad business progress into 2H/2025, and consistent message on revenue re-acceleration;

- updates to margin expectations (~2-3pts y/y annual OM expansion) and spending plans given pullback at peers; and

- updates on live content/sports strategy.

And here are the main bogeys:

- Q1 Subscriber Adds: 8MM (heard a wide range of estimate - some higher, up to 10MM, some lower, 7-8MM, Goldman expects +7MM)

- Q1 Revenue Growth adjusted for FX: +16-17%

- Q1 Reported Revenue Growth: +14%

- Q1 EBIT: $2.4B, +40% y/y

- Q2 Subscriber Adds: 4M

- Q2 Revenue Growth adjusted for FX: +17%

- Q2 Reported Revenue Growth: +16%

- Q2 EBIT: $2.4BN

- FY24 Operating Margin: reiterate guide at 24%

- FY24 FCF Guide: $6BN

With that in mind, and considering that options are pricing in a roughly 7% swing after hours today, here is what NFLX reported for its first quarter:

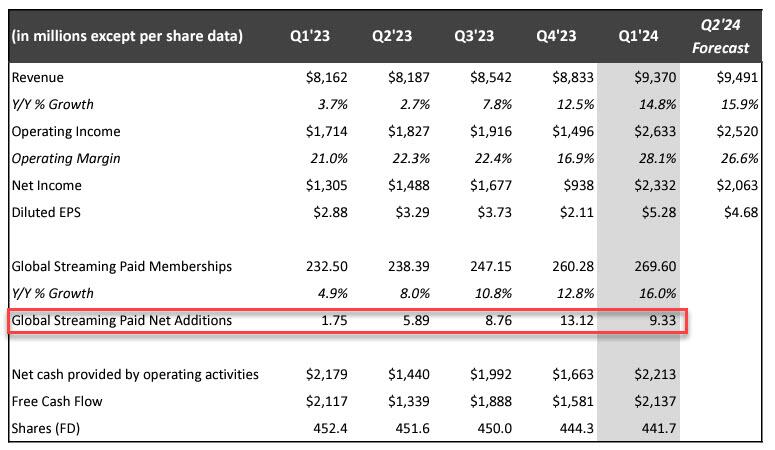

- EPS $5.28, beating the estimate $4.52, and more than double the $2.88

- Revenue $9.37 billion, up a whopping 15% y/y, and beating the estimate $9.26 billion

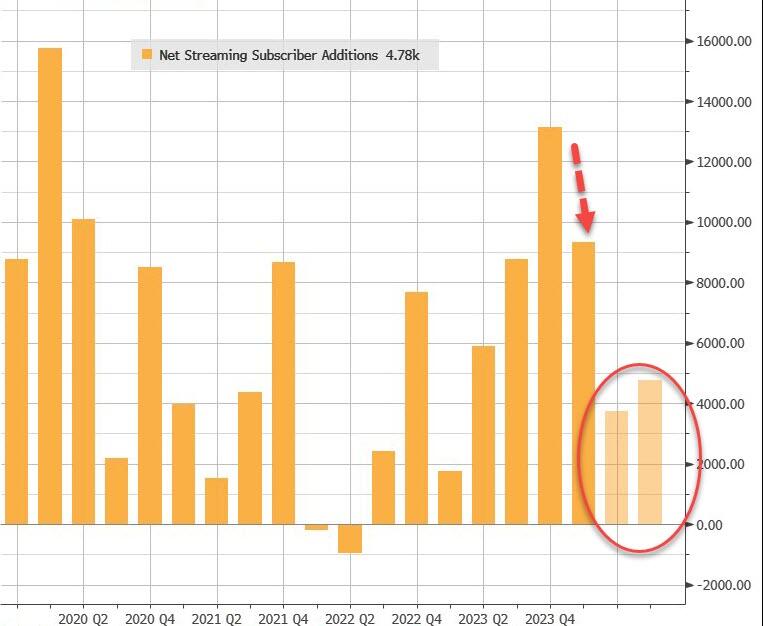

- Revenue was above the company's guidance as paid net additions (9.3M vs. 1.8M in Q1’23) were higher than we forecast.

- Streaming paid net change +9.33 million smashed estimates of 4.84 million and were far above the +1.75 million a year ago, and one of the best ever Q1s in company history

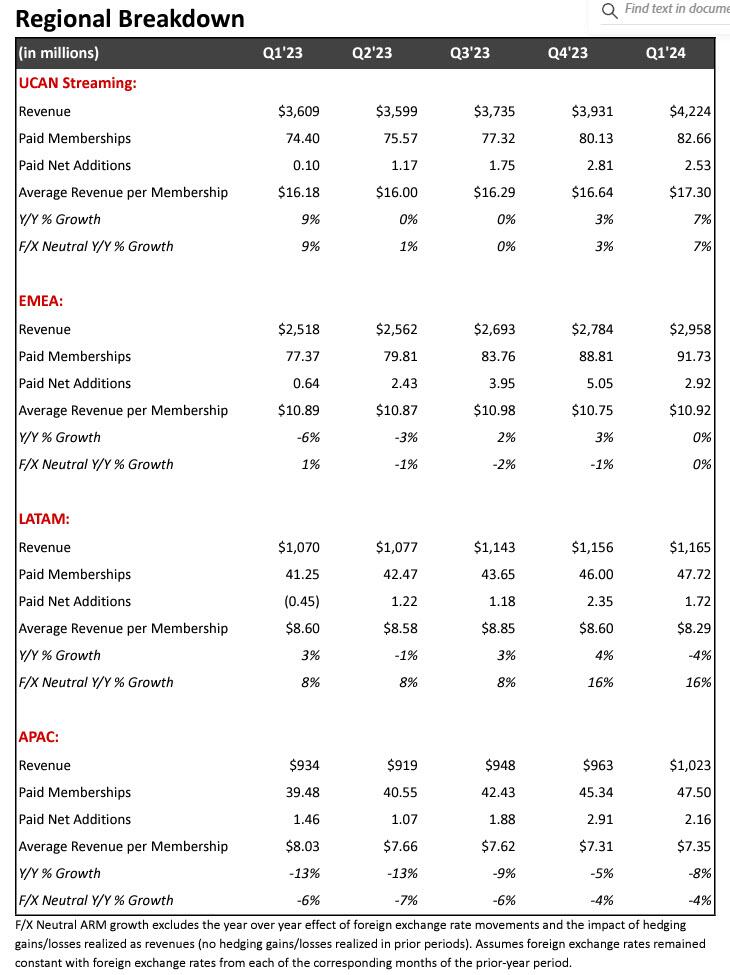

- UCAN streaming paid net change +2.53 million vs. +100,000 y/y, beating estimates of +988,580

- EMEA streaming paid net change +2.92 million vs. +640,000 y/y, beating estimates of +1.58 million

- LATAM streaming paid net change +1.72 million vs. -450,000 y/y, beating estimates of +837,467

- APAC streaming paid net change +2.16 million, +48% y/y, beating estimates of +1.48 million

- Operating margin 28.1% vs. 21% y/y, estimate 25.7%

- Operating income $2.63 billion, a whopping +54% increase y/y, and beat estimates of $2.43 billion

- Free cash flow $2.14 billion, +0.9% y/y, and also beat estimate $1.87 billion

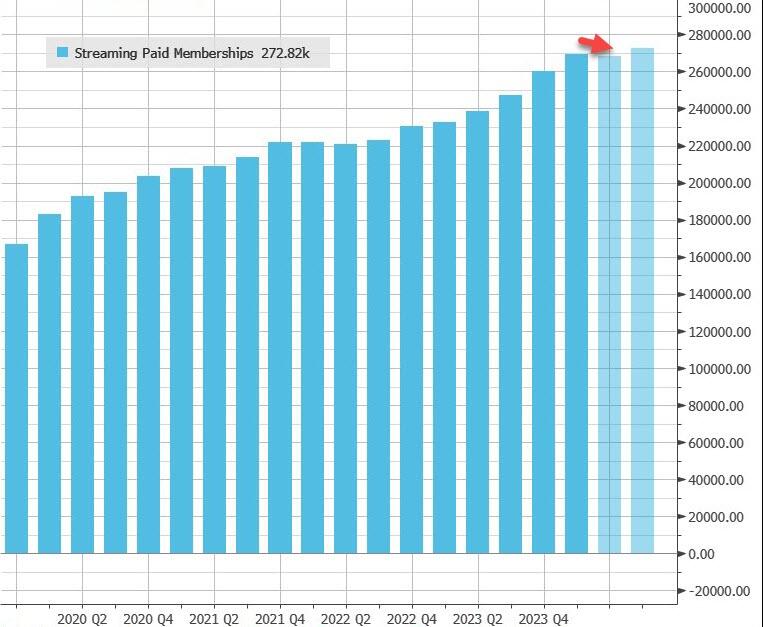

Netflix ended Q1 with total streaming paid memberships of 269.6 million, up 16% y/y, and well above the estimate of 264.52 million. The subs are in line with what it guided last quarter when it said that "paid net additions to be down sequentially but to be up versus Q1’23 paid net adds of 1.8M."

Looking ahead, for Q2 Netflix sees the following:

- Revenue $9.49 billion, missing the estimate $9.51 billion

- EPS $4.68, beating the estimate $4.54

- Operating margin 26.6%, beating estimate 25.4%

Drilling down the forecast, for Q2 NFLX forecasts...

- revenue growth of 16% which equates to 21% growth on a F/X neutral basis due primarily to price changes in Argentina and the devaluation of the local currency relative to the US dollar.

- paid net additions should be lower in Q2’24 vs. Q1’24 due to typical seasonality

- the company also forecasts global ARM to be up year-over-year on a F/X neutral basis in Q2. This is what the quarterly subs look like historically and vs WS estimates:

For the full year, NFLX sees revenue growth between 13% and 15%, boosted its operating margin outlook to 25%, beating the estimate of 24.1%, and above the 24% expected previously; the company still sees free cash flow about $6 billion, estimate $6.49 billion

And here are the results and projections summarized:

(Click on image to enlarge)

And here is the regional detail: for the third consecutive quarter, EMEA (Europe, the Middle East and Africa) accounted for the largest share of Netflix’s growth in the quarter. The company added almost 3 million customers in that region, following the 5 million added last quarter. The average amount Netflix makes per customer has increased only modestly in the past year, at $16.64, and rising 3%.

Yet despite the blowout numbers this quarter, something bad may be on deck because NFLX reported that starting next year with 1Q 2025 earnings, the company will stop reporting quarterly membership numbers and ARM; to counter that, the company will also start providing annual revenue outlook.

Netflix finished the quarter with gross debt of $14B and cash and cash equivalents of $7B; curiously, it boosted the revolving credit facility to $3 billion from $1 billion. NFLX expects to refinance its upcoming debt maturities and we don’t currently have plans to lever up to buy back stock as we value balance sheet flexibility

While the result were solid, and the historical beat was across the board, the stock initially spiked then dumped perhaps over the company's somewhat soggy guidance and the end of its quarterly membership reporting next year. At last check, NFLX was down about $20 from its closing price of $610.

(Click on image to enlarge)

More By This Author:

Jobless Claims Remains Deader Than Joe Biden's 'Uncle Bosey'

Crude-Crash Saves Stocks From CTA-Slaughter; Bonds Bid But Bitcoin Battered

Stellar 20Y Auction Sends Yields Sliding To Session Lows

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more