A Very Ugly Week For The Nasdaq, A Terrible Week For Semiconductors

Image Source: Unsplash

It's been a very ugly week for momentum names, but since these days that really means AI and/or mega tech, we can just see this has been a very ugly week for the Nasdaq. And sure enough, with the QQQs down 0.4%, the Nasdaq is now pacing for its worst week in over a year - and is down 6 of the past 7 weeks...

(Click on image to enlarge)

... on what Goldman trader Peter Callahan calls a complicated technical backdrop (CTAs, lower retail participation, Nasdaq now testing 100-dma, seasonality), sideways earnings revisions thus far (ASML, TSM, and even Sheridan’s NFLX EPS revisions were only 1-2% last night), a tense geopolitical backdrop (overnight headlines) and elevated positioning are testing conviction into a busy week of earnings. The Goldman trader notes that this back and forth has spawned debate "if this all ‘helps’ the set-up into FAAMG prints or if the market is just read to ‘take a breather’ and sell any good news."

Some more observations from the Goldman tech sector specialist:

Top client inbounds yesterday (and this week):

- Why is MSFT leaking lower? Bogeys?

- Are Semis breaking or just a healthy rest?

- Feedback on drawdown stocks (eg LYV or ADSK)

- Bogeys (META, NOW)

Bad = Bad (or not good enough = not good enough) across pockets of cyclicals to start: handful of charts that jump out to me on earnings - KNX & JBHT in Industrials … INFY & EFX in Services .. LVS in leisure / casinos .. TSM & ASML in Semis (admittedly, a secular angle here) .. something to keep in mind ahead of upcoming earnings (esp for areas like Analog Semis)

NFLX -7%: headline numbers were ‘solid’ for Netflix – 1Q subs ~9.3mn (vs expects +HSDs q/q), beat on revs/EPS, raised FY OM guidance .. but, stock sharply lower this morning against the backdrop of elevated positioning & expectations (SI at lows, multiple at local highs). Sheridan/GIR remains NEUTRAL rated

- BULLS: solid UCAN/EMEA sub growth (2.5-3mn q/q) .. narrative hand-off from Subs -> Ad supported (& Live with WWE) is next story .. no more subs = no more volatility (?!) .. ‘easy’ to own in this (geo)-political climate .. can look at GAAP EPS approaching a 3-handle in ’26 (GIR went to ~$28.30 – stock 20x that number in the pre’) … potential capital returns on a sustained double-digit revenue growth compounder .. catalyst = Media Upfronts in mid-May ..

- BEARS: no more subs disclosure = slower subs growth? (I suppose Apple is a case study?) … choppy revenues despite px’ing efforts (2Q / FY24 Revs guide below GSe) .. continued modest growth of ARM .. lack of visibility into Ad story … tough(er) comps from here (e.g. lapping >20mn subs added in 2H’23) .. long-term debate on ‘competition’ (short form video / A.I.) ..

TSMC: a number of inbounds yesterday.. feedback/action yesterday felt more like tactical de-risking (momentum breaking / profit taking on back or softer 'core' revs outlook and choppy GM cadence re: N3 ramp & costs)... whereas I did not really sense a m shift in long-term Bull views as Bulls remain focused on: 1) cyclical (eventual recovery in job AI workloads + secular (TSMC extended its 50% AI revs CAGR guide to ‘28 - from 2027 prior) growth, 2) multiple expansion on back of geographic manufacturing diversification, 3) upcoming node ramps – TSM noted AI adoption for N2 likely much faster vs that seen in N3/N5 and 4) pricing power (rather than a 'hike', GIR believes TSMC could provide lesser annual price reduction to its customers in 2025 vs typically a 5-10% of annual price reduction).

Finally, some charts from the Goldman trader:

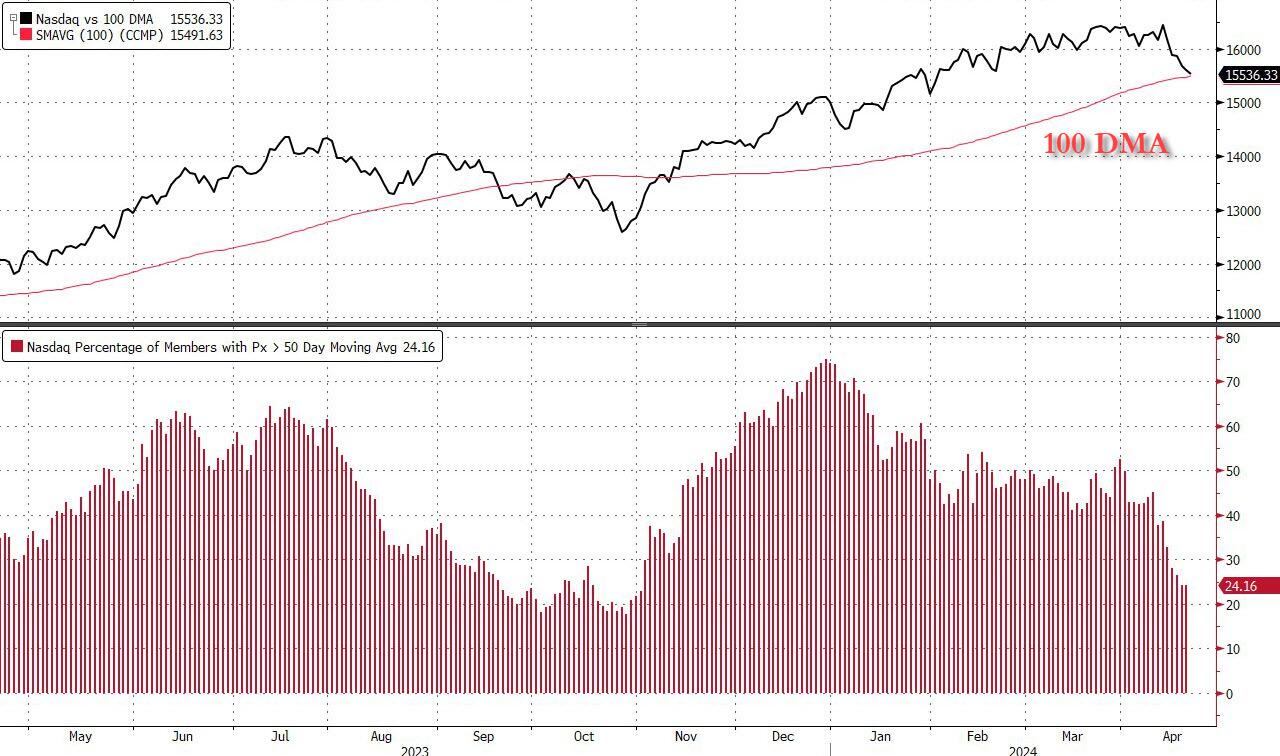

NDX back-testing its 100-dma: on this point, it has been a pretty swift drawdown with just ~1 in 5 names in the NDX still sitting above their 50-dma.

(Click on image to enlarge)

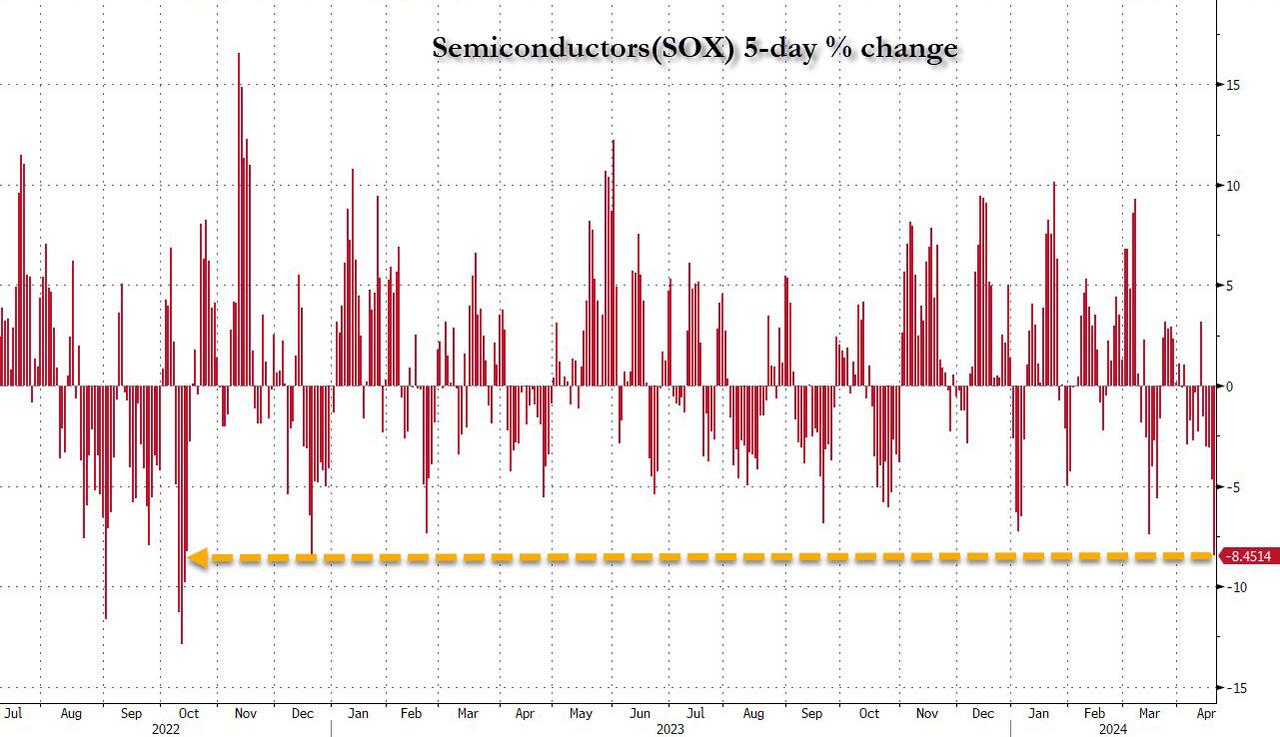

And the punchline: after ugly earnings from ASML and TSMC, the semis (SOX) are down ~8.5% in the last 5 sessions, the worst stretch since 2022.

(Click on image to enlarge)

More By This Author:

Money-Market Fund Assets See Largest Outflows Since 'Lehman'

Netflix Reports Blowout Q1 Results And Subscriber Adds But Warns Gains Will Slow, Stock Slides

Jobless Claims Remains Deader Than Joe Biden's 'Uncle Bosey'

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more