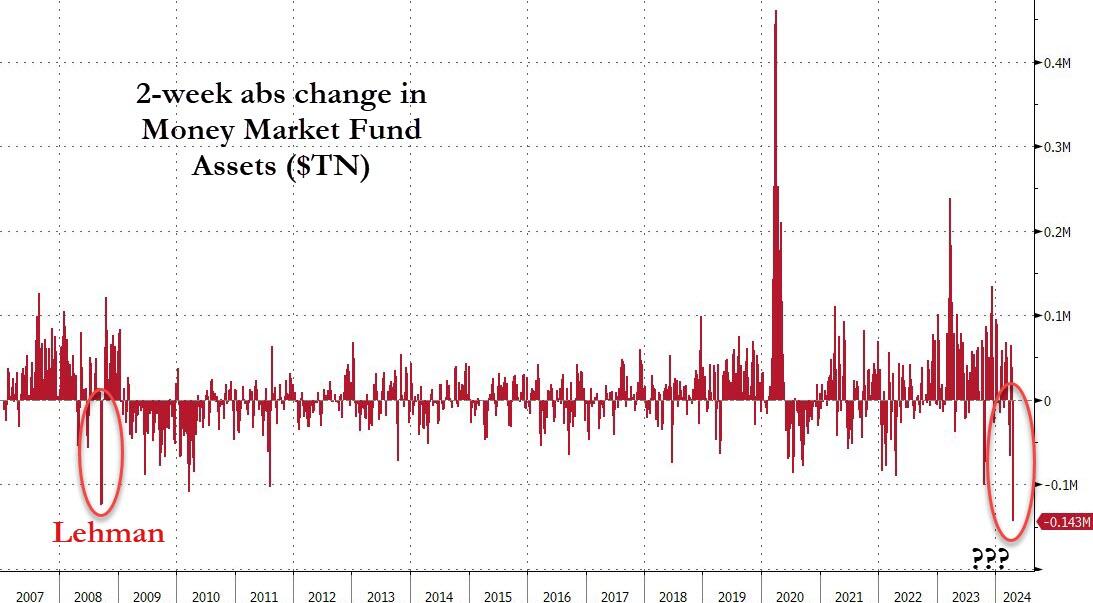

Money-Market Fund Assets See Largest Outflows Since 'Lehman'

Image Source: Pexels

Total money-market fund assets plunged by $112BN in the last week as Tax-Day demands took the total assets below $6 Trillion for the first time since January (to $5.97 Trillion).

Source: Bloomberg

Corporate taxes collected from April 11 through April 17 totaled $100.7 billion, Treasury data show.

While Tax-Day's impact matters obviously, we note that this is the largest weekly drop in money-market fund assets since Lehman (Sept 2008) and the biggest two-week drop (-$143BN) on record.

Source: Bloomberg

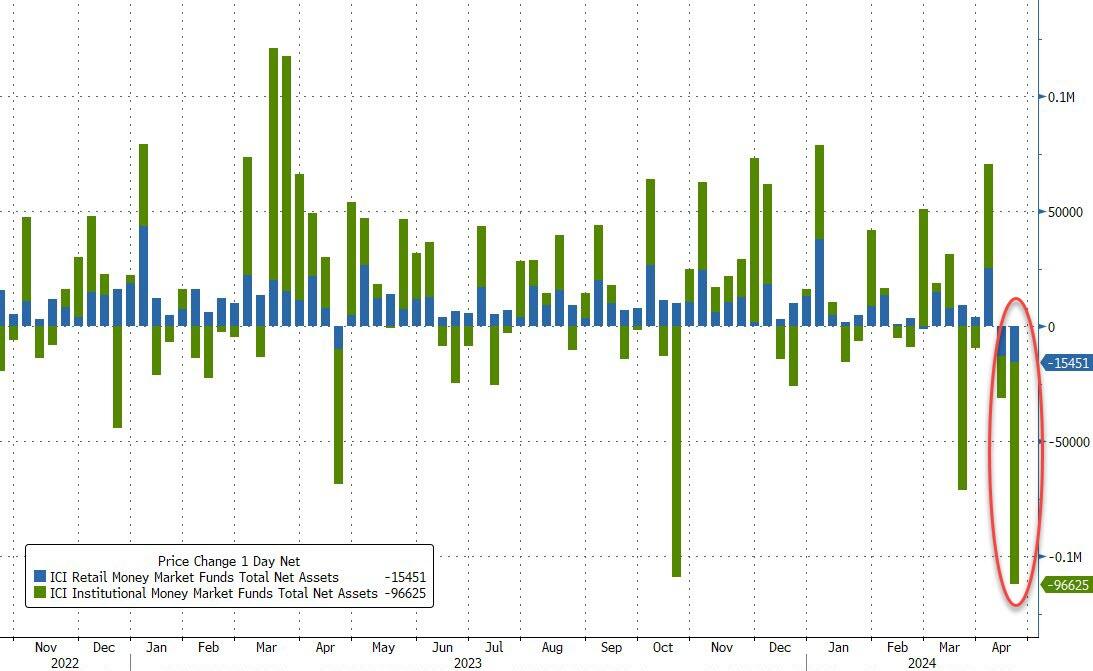

Much of the decline in money-market fund assets was led by institutional outflows that totaled $96.6BN in the week ended April 17 - the largest drawdown since an extended tax-filing deadline in mid-October. Retail investors pulled about $15.5 billion out of money-market funds.

Source: Bloomberg

In a breakdown for the week to April 17, government funds - which invest primarily in securities like Treasury bills, repurchase agreements, and agency debt - saw assets fall to $4.8 trillion, a $99 billion decline.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets fall to $1.01 trillion, a $12 billion decline.

Still, cash is expected to continue piling into money funds as long as the Federal Reserve keeps rates on hold - and this week has seen rate-cut expectations tumble further.

Source: Bloomberg

The Fed's balance sheet shrank to its smallest since February 2021.

Source: Bloomberg

As The Fed starts discussing tapering QT and usage of The Fed's bank bailout facility (now expired but these are 12-month term loans) fell by $4.1BN more to basically erase all the late-period arb-driven inflows, leaving a huge $126BN hole in bank balance sheets still being filled by this...

Source: Bloomberg

Finally, we note that bank reserve at The Fed slipped last week as it appears the reality for the US equity market cap is starting to dawn...

Source: Bloomberg

While there may be no rate cuts anytime soon... will The Fed taper QT in a big enough manner to avoid that recoupling?

More By This Author:

Netflix Reports Blowout Q1 Results And Subscriber Adds But Warns Gains Will Slow, Stock SlidesJobless Claims Remains Deader Than Joe Biden's 'Uncle Bosey'

Crude-Crash Saves Stocks From CTA-Slaughter; Bonds Bid But Bitcoin Battered

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more