Cocoa Commodity Elliott Wave Technical Forecast

Cocoa Elliott Wave Analysis

After reaching a record high in December 2024, cocoa prices have been correcting lower against the October 2024 low. The pullback finished a 5-wave lower from the 12931 record high and is now correcting the decline higher with higher prices. Thus, another 5-wave lower will happen after the current bounce unless prices reach for the record high.

Cocoa Elliott Wave Analysis - Daily Chart

Cocoa is on a long-term bullish trend from the lows of December 2000. From the December 2000 low of $707, the commodity completed a 5-wave impulse structure to $3775 in February 2011. A corrective pullback followed for the 2nd wave and was completed in April 2017 at $1756. The 3rd wave started in April 2017 and is still ongoing, evolving as an impulse wave structure. Thus, we can count a 3-swing rally from the December 2000 bullish cycle so far. It could end up being a 3-wave cycle or a 5-wave cycle. However, since it’s coming from the all-time low, we should lean more toward an impulse wave cycle. Thus, price is in the 3rd wave, which is yet to be completed.

From further wave investigation, we could realize that the price is currently in the 3rd sub-wave of the 3rd wave. The daily chart shows that the record high marks the end of wave III of (III) of ((III)). In addition, the pullback that follows could extend much lower in a double correction. Thus, the low of April 2025 marks the end of an impulse structure for wave ((A)) of IV, and the current rebound marks the corresponding wave ((B)).

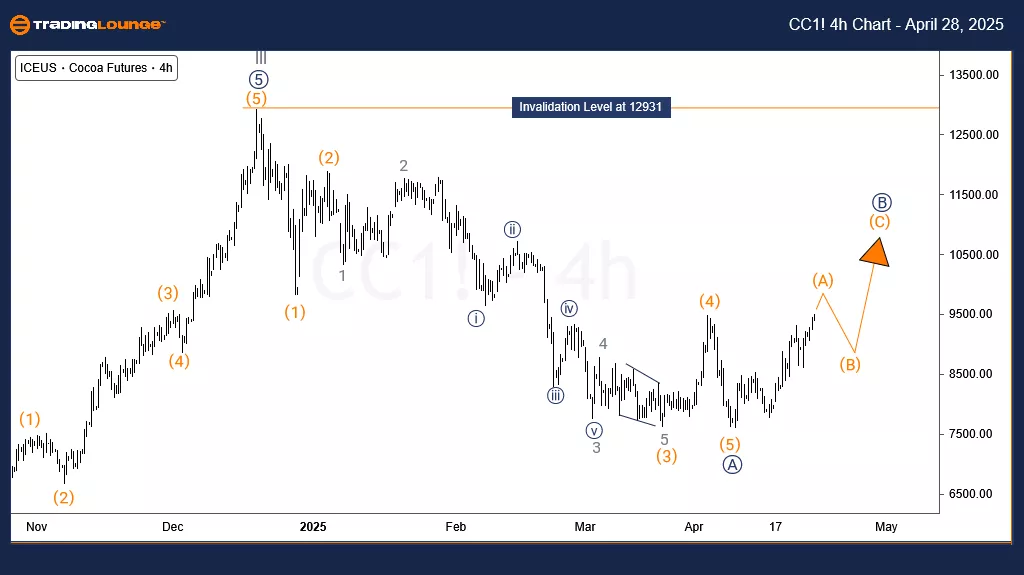

Cocoa Elliott Wave Analysis - H4 Chart

On the H4 chart, a bullish impulse structure is evolving from the low of April 2025 for wave (A) of ((B)). However, while ((B)) extends higher, we can expect it to end below the 12931 high before sellers push for ((C)) lower to complete the wave IV pullback before the long-term bullish trend continues. However, if 12931 is breached bu]y the current rally, then we can confirm the end of wave IV at the April low and expect further rallies.

Technical Analyst : Sanmi Adeagbo

More By This Author:

Elliott Wave Technical Forecast: Block, Inc. - Monday, April 28

Elliott Wave Technical Analysis: JPMorgan & Chase Co. - Monday, April 28

Elliott Wave Technical Analysis: British Pound/Australian Dollar - Monday, April 28

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more