Elliott Wave Technical Forecast: Block, Inc. - Monday, April 28

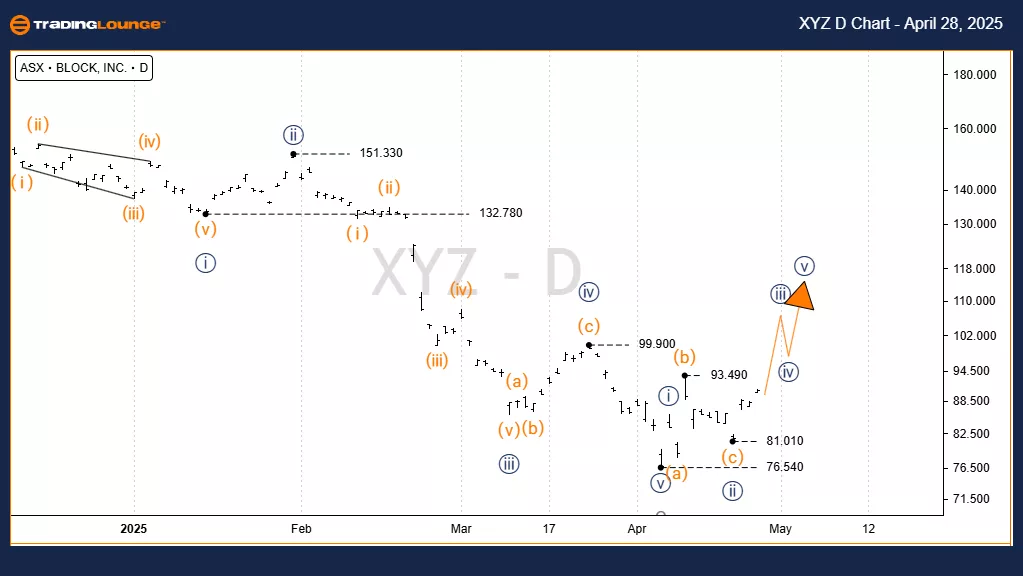

ASX: BLOCK, INC – XYZ (SQ2) Elliott Wave Technical Analysis (TradingLounge 1D Chart)

Greetings,

Today’s Elliott Wave analysis updates the Australian Stock Exchange (ASX) with insights on BLOCK, INC – XYZ (SQ2).

We observe that ASX:XYZ has the potential to rise within a (3) – orange wave. However, for this bullish scenario to strengthen, the price must remain above the invalidation point for approximately 5–7 days.

ASX: BLOCK, INC – XYZ (SQ2) 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ii)) – Navy of Wave (3) – Orange

Details:

Wave (2) – Orange appears to have completed, and wave (3) – Orange is developing upward.

A breakout above $93.49 would confirm the long-term bullish setup, targeting highs near $110.

Invalidation Point: 76.54

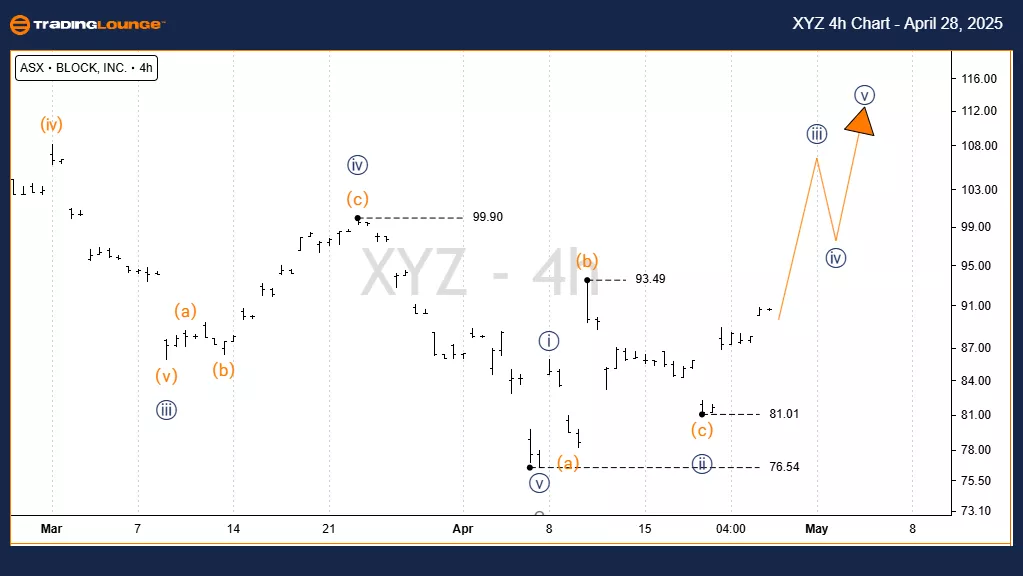

ASX: BLOCK, INC – XYZ (SQ2) 4-Hour Chart Analysis

Function: Major Trend (Minute Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ((I)) – Navy of Wave (3) – Orange

Details:

Zooming in from the low at 76.54, wave (3) – Orange is progressing upward.

Within this, a complete navy sequence from ((i)) to ((v)) is forming.

Price movement should stay above 76.54 to uphold this bullish view.

Invalidation Point: 76.54

Conclusion

Our Elliott Wave analysis and short-term forecast for ASX: BLOCK, INC – XYZ (SQ2) aim to provide readers with practical market insights.

We outline specific validation and invalidation levels to strengthen confidence in the wave structure.

By integrating analysis and market trends, we deliver an objective and professional viewpoint to assist in effective trading decisions.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

More By This Author:

SP500, Big Tech Stocks — Wave Counts, Trade Setups, Key Earnings Drivers

Elliott Wave Technical Forecast: Newmont Corporation - Friday, April 25

Elliott Wave Technical Analysis: Spotify Technology S.A.

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more