Elliott Wave Technical Forecast: Newmont Corporation - Friday, April 25

NEWMONT CORPORATION (ASX:NEM) – Daily Chart Analysis

Elliott Wave Technical Overview

Function: Major Trend

Degree: Intermediate (orange)

Mode: Motive

Structure: Impulse

Position: Wave 3 – grey of Wave (3) – orange

Market Insight:

Our latest Elliott Wave analysis for ASX:NEM highlights a rising trend under wave 3. The previous corrective wave 2 (orange) concluded near the $58.92 low. Currently, wave 3 (orange) is gaining strength and subdividing into wave 1 (grey), wave 2 (grey), and the active wave 3 (grey). This wave is now targeting highs around $100.00 and potentially up to $102.37.

Invalidation Level: $68.11

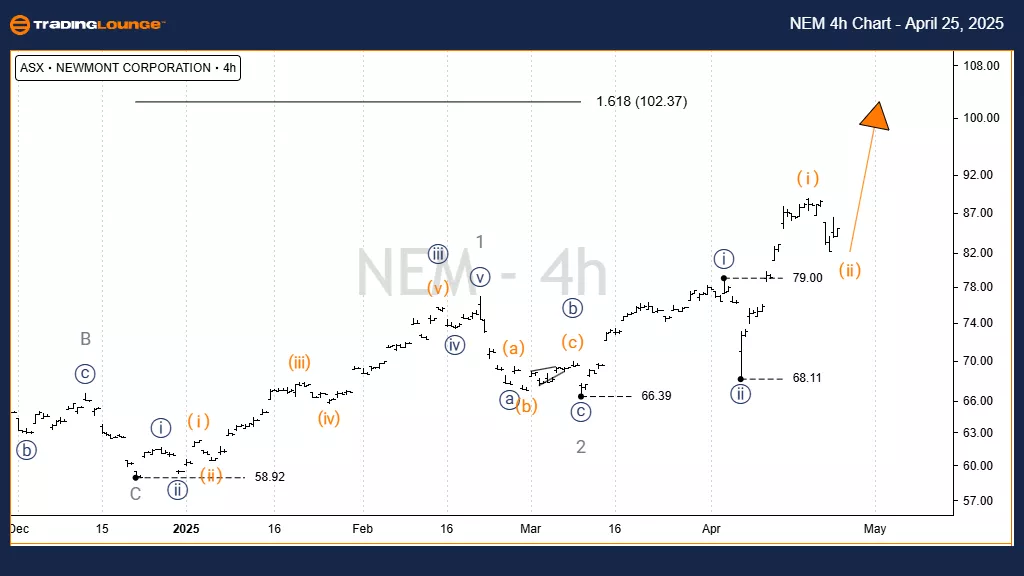

NEWMONT CORPORATION (ASX:NEM) – 4-Hour Chart Analysis

Elliott Wave Technical Overview

Function: Major Trend

Degree: Minor (grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii)) – navy of Wave 3 – grey

Technical Details:

From the $58.92 low, wave 3 (orange) continues to extend. The latest movement shows the development of wave ((iii)) (navy), eyeing the $102.37 target. For this bullish outlook to remain valid, the price should stay above $68.11. Another key level is $79.00, which must not be breached by any correction under wave ((iv)) navy, preserving the integrity of the ongoing uptrend.

Invalidation Levels: $68.11 and $79.00

Conclusion

This forecast provides a comprehensive look into ASX:NEM’s market momentum using the Elliott Wave model. By marking key levels for invalidation and tracking wave formations, traders can gauge trend continuity and optimize entry points. Our objective is to deliver an accurate, structured view of price movements to support informed trading decisions.

Technical Analyst: Hua (Shane) Cuong, CEWA-M

More By This Author:

Elliott Wave Technical Analysis: Ethereum Crypto Price News For Friday, April 25

Elliott Wave Technical Forecast : Amcor Plc

Elliott Wave Technical Analysis: The Boeing Company - Thursday, April 24

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more