Elliott Wave Technical Analysis: Ethereum Crypto Price News For Friday, April 25

Image Source: Pixabay

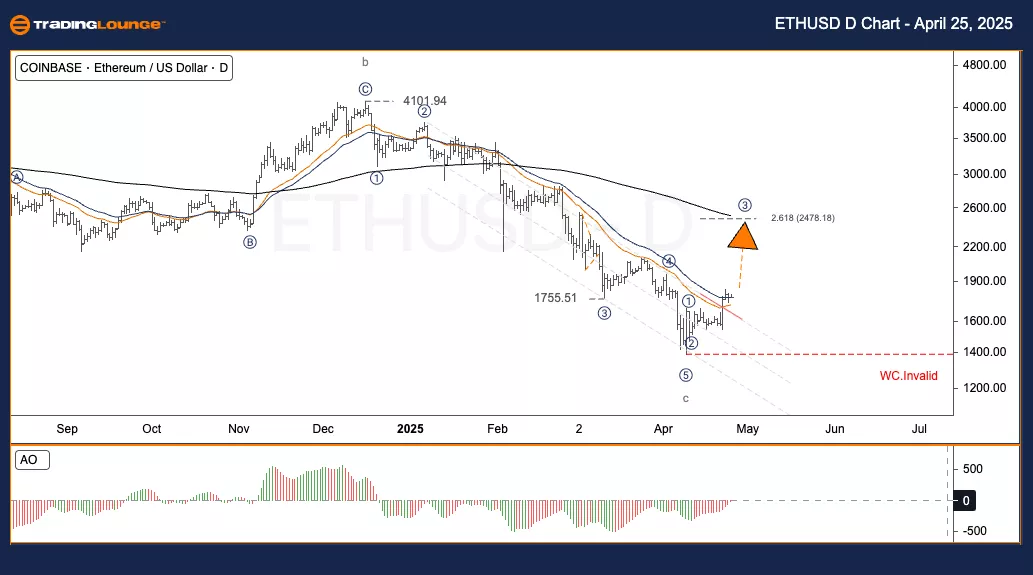

Elliott Wave Analysis – TradingLounge Daily Chart

Ethereum/U.S. Dollar (ETHUSD)

ETHUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Next Higher Degree Direction: Upward

Wave Cancel Invalid Level: $1,380

Ethereum (ETH) Trading Strategy – Daily Chart

Ethereum has exited its recent corrective phase since March and has begun forming a new uptrend. The Elliott Wave outlook shows a developing three-wave bullish structure. The previous downtrend in the W–X–Y corrective formation concluded at $1,380. With waves (1) and (2) complete, ETH appears to be entering wave (3), which could extend to the Fibonacci level of 261.8%, targeting around $2,478.18.

Trading Strategies:

For Swing Traders (Short-term):

Look for a small dip and reversal signal to consider entry.

Risk Management: Watch the invalidation level at $1,380.

Elliott Wave Analysis – TradingLounge H4 Chart

Ethereum/U.S. Dollar (ETHUSD)

ETHUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Next Higher Degree Direction: Upward

Wave Cancel Invalid Level: $1,380

Ethereum (ETH) Trading Strategy – H4 Chart

Ethereum's market behavior continues to align with the new bullish cycle. The correction ending in March at $1,380 marks the low point. The impulse wave structure indicates we are moving into wave (3), with the potential to reach $2,478.18 if the Fibonacci extension holds.

Trading Strategies:

For Swing Traders (Short-term):

Monitor for brief price retracements followed by confirmation signals.

Risk Management: Use $1,380 as the invalidation reference.

Analyst: Kittiampon Somboonsod, CEWA

Source: TradingLounge.com

More By This Author:

Elliott Wave Technical Forecast : Amcor Plc

Elliott Wave Technical Analysis: The Boeing Company - Thursday, April 24

Elliott Wave Technical Analysis: U.S. Dollar/Canadian Dollar - Thursday, April 24

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more