Betting On A Countertrend Move In The Dollar And Related Intermarket Moves

(Click on image to enlarge)

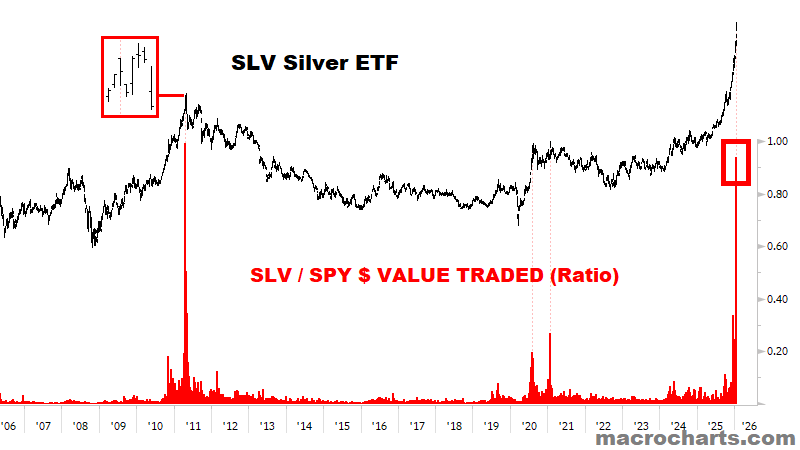

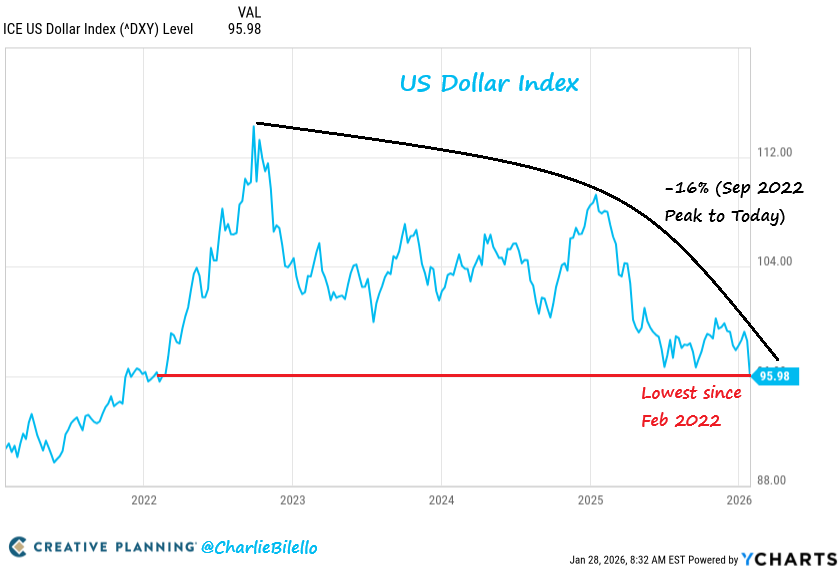

The precious metals – especially silver – have gotten overly extended to the upside while the dollar seems due for a countertrend rally. SLV closed 144% above its 200 day moving average on Wednesday as massive amounts of funds flow into the ETF. The dollar – on the other hand – is the most oversold since 2007 by one measure and at its lowest level since February 2022. To be clear, I am bullish on silver and bearish on the dollar longer term. But in the short term, I’m betting on a countertrend move.

The key to my thesis is a countertrend rally in the dollar. While the dollar rallied Wednesday, it sold off in the wake off the Fed Statement and Powell’s presser. I didn’t think Powell was dovish and I wouldn’t be surprised if the market reassesses that action today and the dollar sees further strength. I’m long the dollar via UUP. (My average price from Wednesday is $26.67 while UUP closed Wednesday at $26.63).

If the dollar does in fact rally, I’d expect that to be a catalyst for some profit taking in silver. While I continue to be extremely bullish the precious metals over the longer term, the move has become parabolic and is due for a breather.

As you can see in the chart at the top of this blog, the dollar value traded in SLV has only approached the dollar value traded in SPY on two days: April 25, 2011 and January 26, 2026 (Monday). In 2011, silver topped a within a few days.

(Click on image to enlarge)

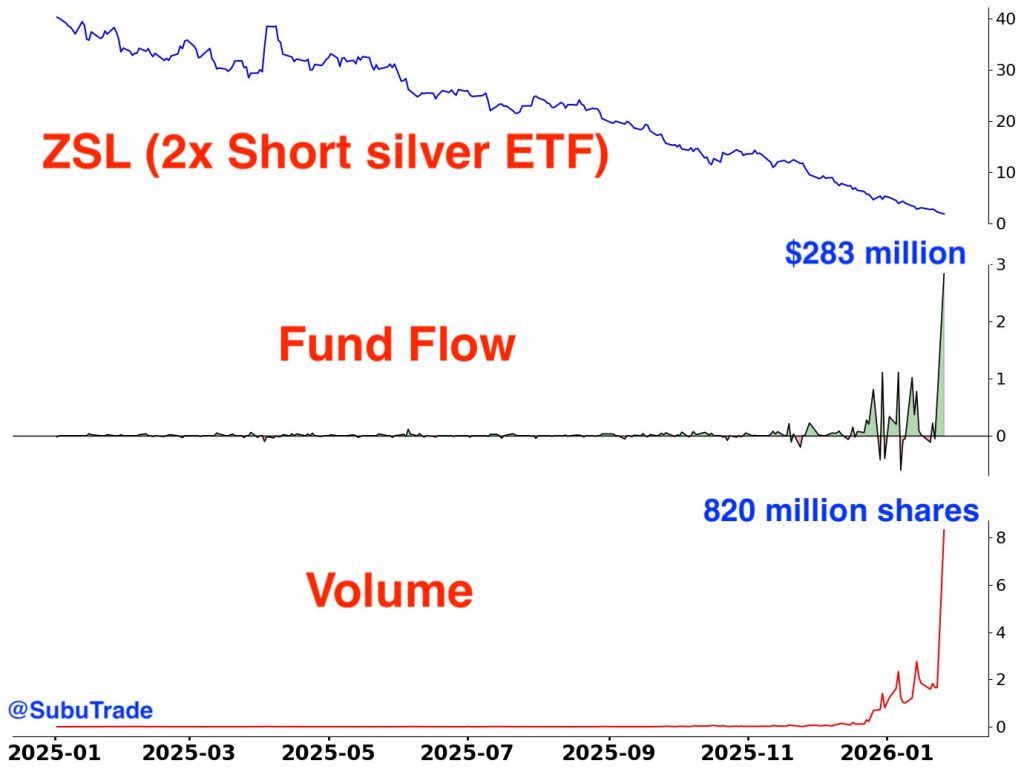

While I don’t expect this to be THE top in silver for this cycle, I am playing for a short term top. The vehicle I’m using is the ProShares 2x Short Silver ETF (ZSL). (My average price from Wednesday is $1.65 while ZSL closed Wednesday at $1.57). Investors have been piling into this ETF in recent days and I don’t think it’s all dumb money.

(Click on image to enlarge)

If the dollar rallies, I would also expect to see some selling in stocks. The S&P kissed 7,000 for the first time at the open Wednesday but then sold off for the remainder of the day. I am playing this via the ProShares 2x Short S&P ETF (SDS). (My average price from Wednesday is $66.21 while SDS closed Wednesday at $66.15).

Again: This is a short term countertrend trade. I am extremely bullish the precious metals and own plenty of stock that I intend to hold for the long term. In addition, my total position size on the trade is small, equal to ~0.75% of long/short accounts, evenly divided among the three ETFs mentioned (UUP, ZSL, SDS). Should this trade fail to start working in short order, I will almost certainly be out by the end of the week.

More By This Author:

Three Stocks For The Era Of Casino Capitalism

The Case For The Single Family Rental REITs

The Vision Of The Anointed And The Betrayal Of Value Investing