Three Stocks For The Era Of Casino Capitalism

Photo by Naser Tamimi on Unsplash

As an introduction to this blog I’d like to introduce three important concepts for understanding contemporary capitalism: casino capitalism, the K-shaped economy and financialization.

Since I started in the business in 2006, the market has come more and more to resemble a casino. One way to define this is to make a distinction between investment and speculation. Investment focuses on the value and growth of the underlying asset over a period of years. Speculation is focused on short term changes in price without regard to the underlying fundamentals. The market has become far more speculative over the last twenty years to the point where it resembles a casino in many ways.

The K-shaped economy refers to the division between those who own financial assets and those who do not. The latter depend on their income from work to support themselves. The top 10% own ~90% of the stock market while the bottom 50% own only ~1%.

Those who own financial assets have thrived in recent years as the stock market, real estate, etc.. have increased in value at an astounding rate. On the other hand, stable, well paying jobs have been disappearing as a result of globalization, technology and other forces. The result is the K-shaped economy of “haves” – those who own the financial assets – and “have nots” – those who don’t.

Financialization refers to the growing role of financial markets and institutions as opposed to businesses that produce good and services in the real economy. The result is a distortion of economic activity away from production towards financial engineering. The result is an unhealthy imbalance in the economy away from the activities that produce economic growth towards financial engineering which redistributes a fixed pie.

The three concepts overlap but the ultimate result is an economy that is increasingly speculative, unequal and unstable. One way to protect yourself from these corrosive forces is to invest in the companies that profit from them. Since you can’t beat them, join them by investing in a few of the leading players in financial markets. Welcome to the era of Casino Capitalism.

(Click on image to enlarge)

Goldman Sachs (GS) is the leading investment banker providing companies with access to the financial markets. They underwrite equity and debt, offer advice on mergers and acquisitions and also have a wealth management division. GS reported EPS of $51.32 for 2025 this morning – compared to $40.54 in 2024 and $22.87 in 2023.

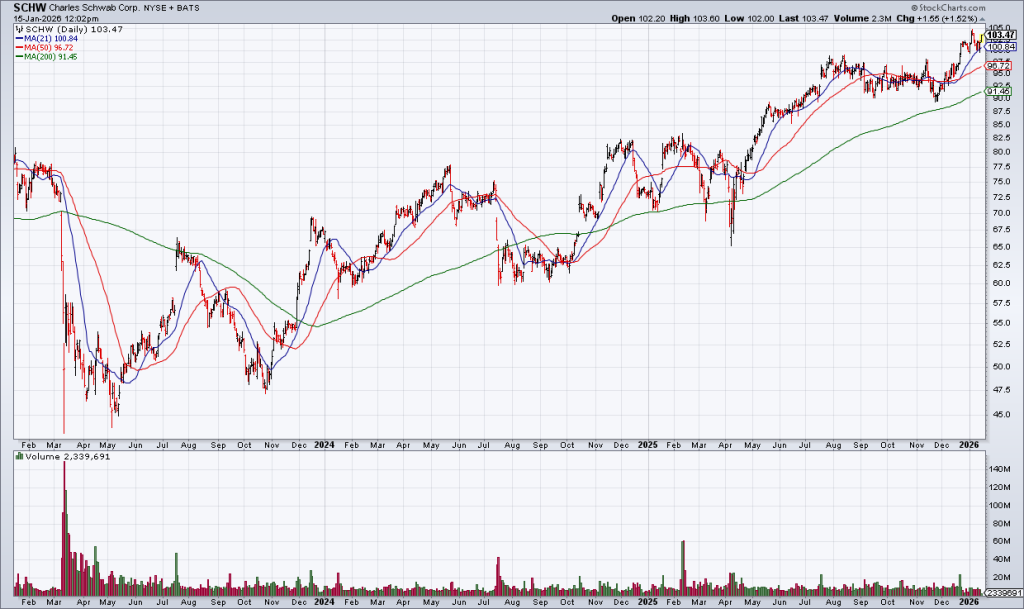

(Click on image to enlarge)

Schwab (SCHW) is the leading retail brokerage through which wealthy investors access the financial markets. They had 38 million active brokerage accounts and executed an average of 7.4 million trades per day as of the end of 3Q25. Revenue is +23% in the first three quarters of 2025.

(Click on image to enlarge)

Blackrock (BLK) is the leading provider of investment vehicles in the financial markets, including the fast growing category of Exchange Traded Funds (ETFs). BLK has $14 trillion Assets Under Management (AUM) – including $5.5 trillion in ETFs. Many of the wealthy investors who use Schwab and other brokers invest in Blackrock’s ETFs and other products. BLK reported this morning that revenue grew 19% to $24.2 billion in 2025 from $20.4 billion last year.

A glance at the stock charts of these three leading players in the financial markets shows that their businesses are profiting heavily from the underlying forces of Casino Capitalism. Since the trends I outlined at the beginning of this blog show no signs of abating, these companies will continue to have the wind at their sails.

More By This Author:

The Case For The Single Family Rental REITsThe Vision Of The Anointed And The Betrayal Of Value Investing

Investment Philosophies: Value Vs. Momentum