Banks Increase Silver COMEX Short Position

Image Source: Pixabay

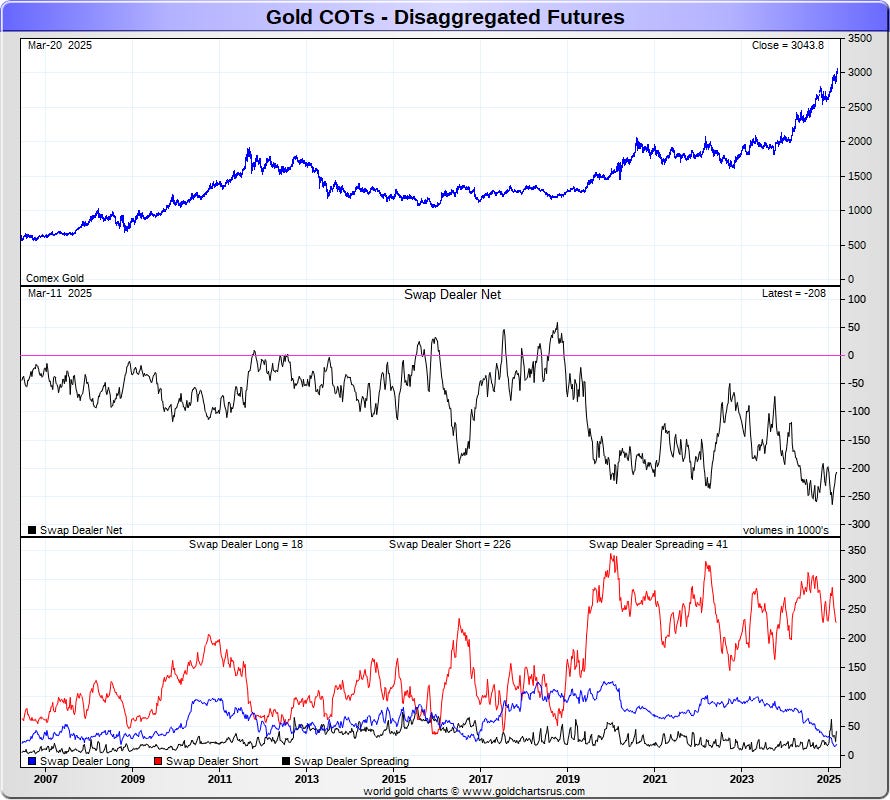

The sell-off in the precious metals continued again on Friday, particularly in the silver market, where the silver price was down another 45 cents to $33.53.

(Click on image to enlarge)

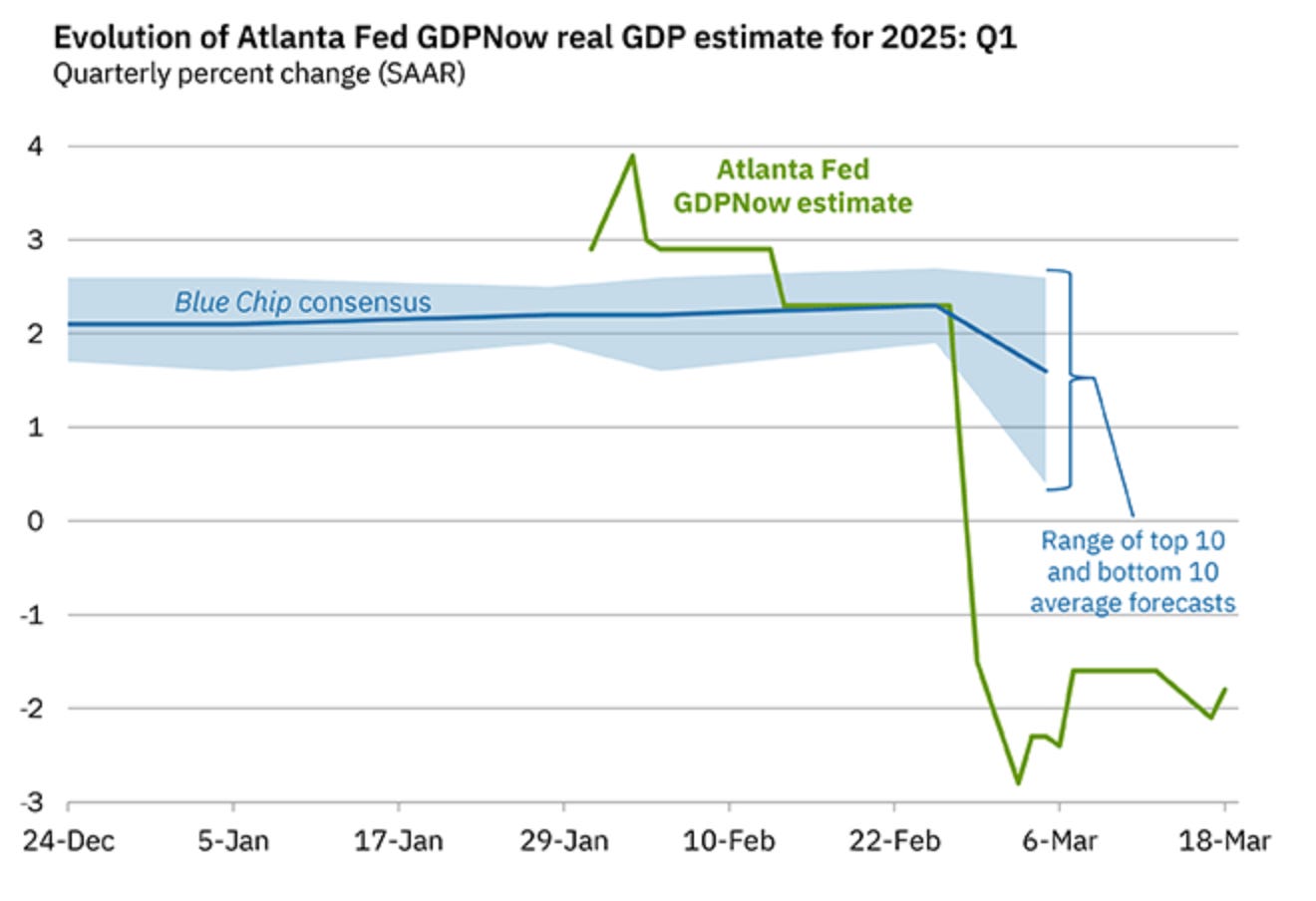

Meanwhile, in the gold market, the futures fell $15 down to $3,028.

(Click on image to enlarge)

Given the ferocity of the rally earlier this week, this feels like a rather mild sell-off.

Of course we don't yet know what next week holds, but it still seems encouraging to see a rally like we have, and for the price to stabilize without a sharper correction.

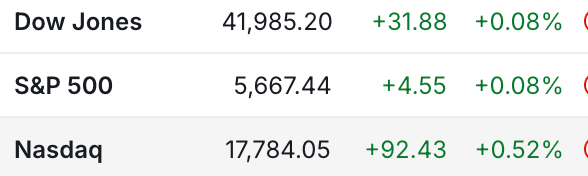

The stock markets also stabilized somewhat on Friday after their recent sell-off, although if the Atlanta Fed’s GDPNow forecast ends up being anywhere close to accurate, we may not have seen the end of the stock market declines just yet.

As you can see below, their model continues to forecast negative growth in 2025.

(Click on image to enlarge)

The Wall Street media keeps saying that it's a temporary impact caused by the tariffs. Although those tariffs still don't seem very temporary at the moment, with speculation rising that they may actually be getting increased.

Additionally, unless the DOGE board plans to back off at some point, their plans are also on track to take another chunk out of GDP. As government spending currently accounts for 23% of total GDP.

In terms of the bank positioning in the gold and silver markets, we've seen an interesting divergence in the last few weeks between the two metals.

(Click on image to enlarge)

The banks have reduced their COMEX short position on the gold side, but increased their COMEX short position in silver.

(Click on image to enlarge)

As always, remember that there is some degree to which the banks can have offsetting positions. So I would treat these charts as a guideline rather than an absolute figure.

Yet at the same time, as I’ve talked with people who are a bit closer to the banks than I am, I don't think most of the banks are completely hedged, and feel the swap dealer short positions can still be a good general indicator of their exposure.

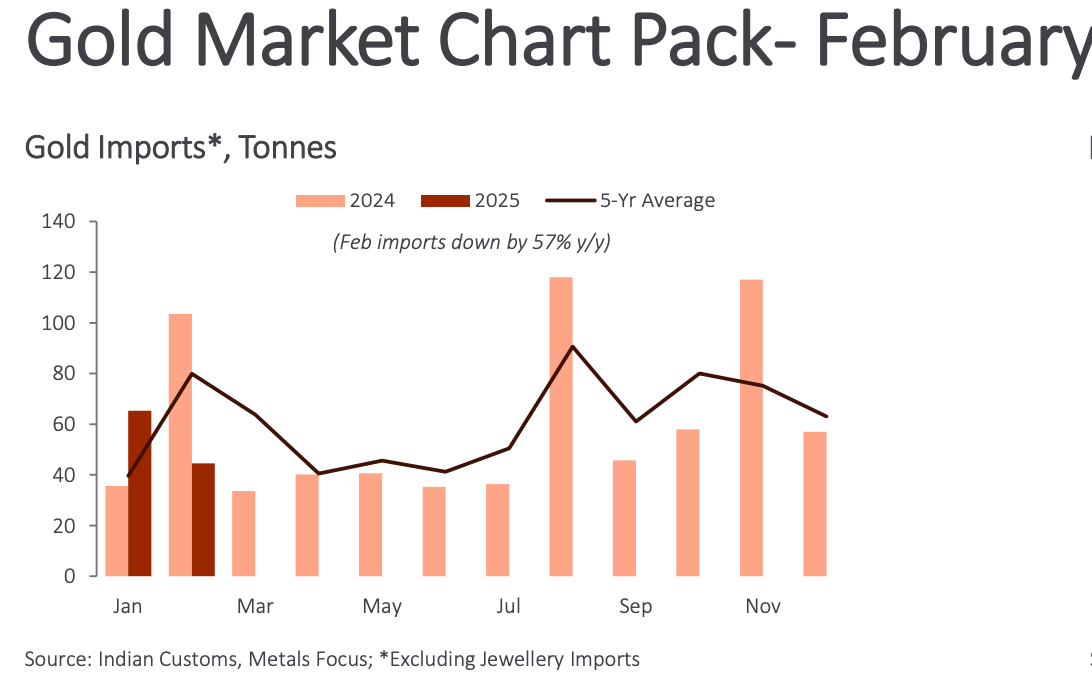

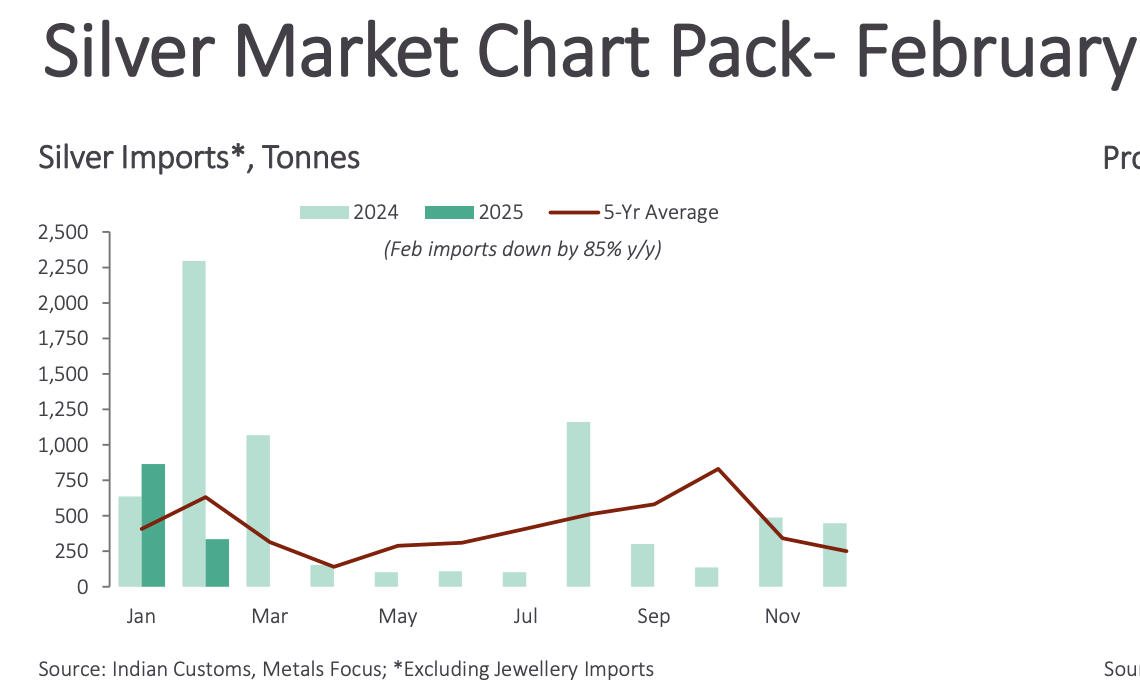

I mentioned earlier this week that the latest Indian gold and silver import data was out, and the charts for both are below.

(Click on image to enlarge)

As you can see, it wasn't a particularly busy month for either metal.

(Click on image to enlarge)

Although you can also see on those charts how there are somewhat regular spikes at various points in time, and my guess is that we will have a few more of those in both gold and silver before the year is done.

However, speculation aside, at least you can see how the data is stacking up so far this year.

Lastly, if you’d like something to watch over the weekend, my colleague and dear friend Vince Lanci did talk about how the conditions for an LBMA short-squeeze are currently brewing (which ANZ Bank also talked about in their precious metals report this week).

“ Furthermore, there are increasing risks of a short-squeeze, as [LBMA] swap-dealer positions are net short at the highest since 2020. We believe these developments will keep silver vulnerable to a price spike” —ANZ Bank Report

To be clear, this is different than saying that a short-squeeze is guaranteed.

Although you probably already know at this point that markets don’t usually work with guarantees, yet that there are sometimes clues before events occur. And Vince shares what he’s been seeing in this video here.

Video Length 00:17:33

More By This Author:

Gold Breaks The $3,000 Level And Keeps On Going

Gold And Silver Rally Again, While Silver Supply Issues Remain Unresolved

Trump's Plans With Ripple (XRP) And Precious Metals Backing

Disclosure: None.