Gold And Silver Rally Again, While Silver Supply Issues Remain Unresolved

It sure is amazing how things can change in a week, as towards the end of last week when gold and silver were selling off, there was a bit of concern in the precious metals community.

Although here we are a week later, and after another rally today following a cooler than expected CPI report this morning, the gold futures are up to $2,943.

(Click on image to enlarge)

The silver futures are now up to $33.68, and within shouting distance of the $35 top the price reached last year.

(Click on image to enlarge)

Of course while that’s been happening, it’s not exactly as if the conditions in the markets have been resolved.

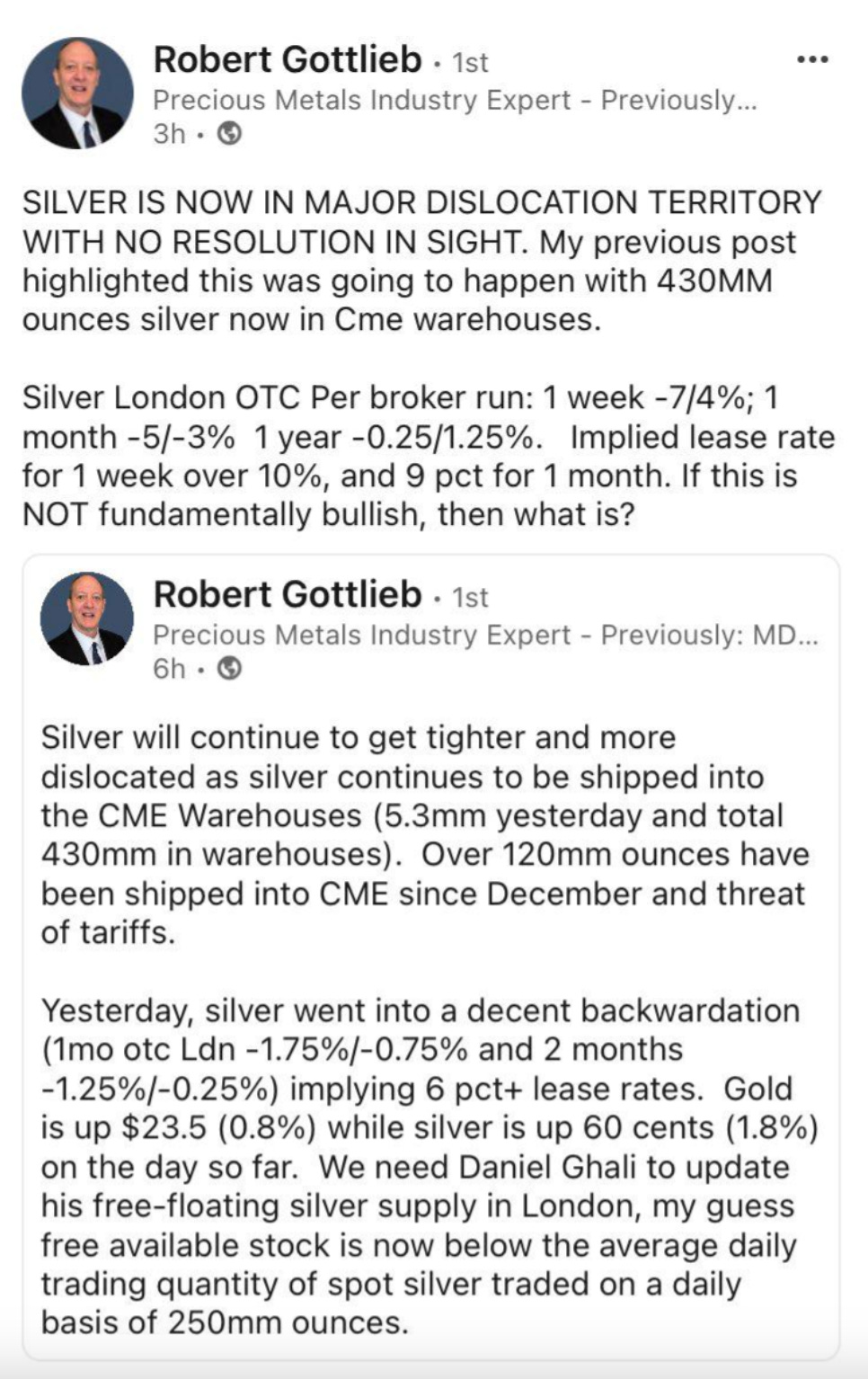

The EFP premiums have come back in since the latest surge about a month ago, although as former JP Morgan precious metals managing director Robert Gottlieb mentions in this note (shared by Occupy Silver), ‘silver is now in major dislocation territory with no resolution in sight.’

Again, this is from a former gold and silver managing director from JP Morgan. Which I know is not most precious metals investors’ favorite bank, although we are talking about someone who has close access to the market, so his comments do hold weight with me. And they also speak to the degree to which the problems that are popping up don’t have easy fixes.

Tomorrow brings the PPI report, and especially if we get another milder than expected number, we could well see this rally continue.

More By This Author:

Trump's Plans With Ripple (XRP) And Precious Metals Backing

Trump Tariffs To Cause Ripple Effects In Gold Market

Gold & Silver Surge As Dollar Index Drops Sharply

Disclosure: None.