Gold & Silver Surge As Dollar Index Drops Sharply

Both gold and silver prices are sharply higher today, as the dollar index is down over a full point, which has provided a bid for the precious metals.

(Click on image to enlarge)

As you can see in the chart above, the dollar index surged into and throughout the Trump election, going from under par (the $100 level) just before the Fed started cutting rates, until it eventually reached over 110. Then as you can see it has declined since then, and is currently down over 1% today.

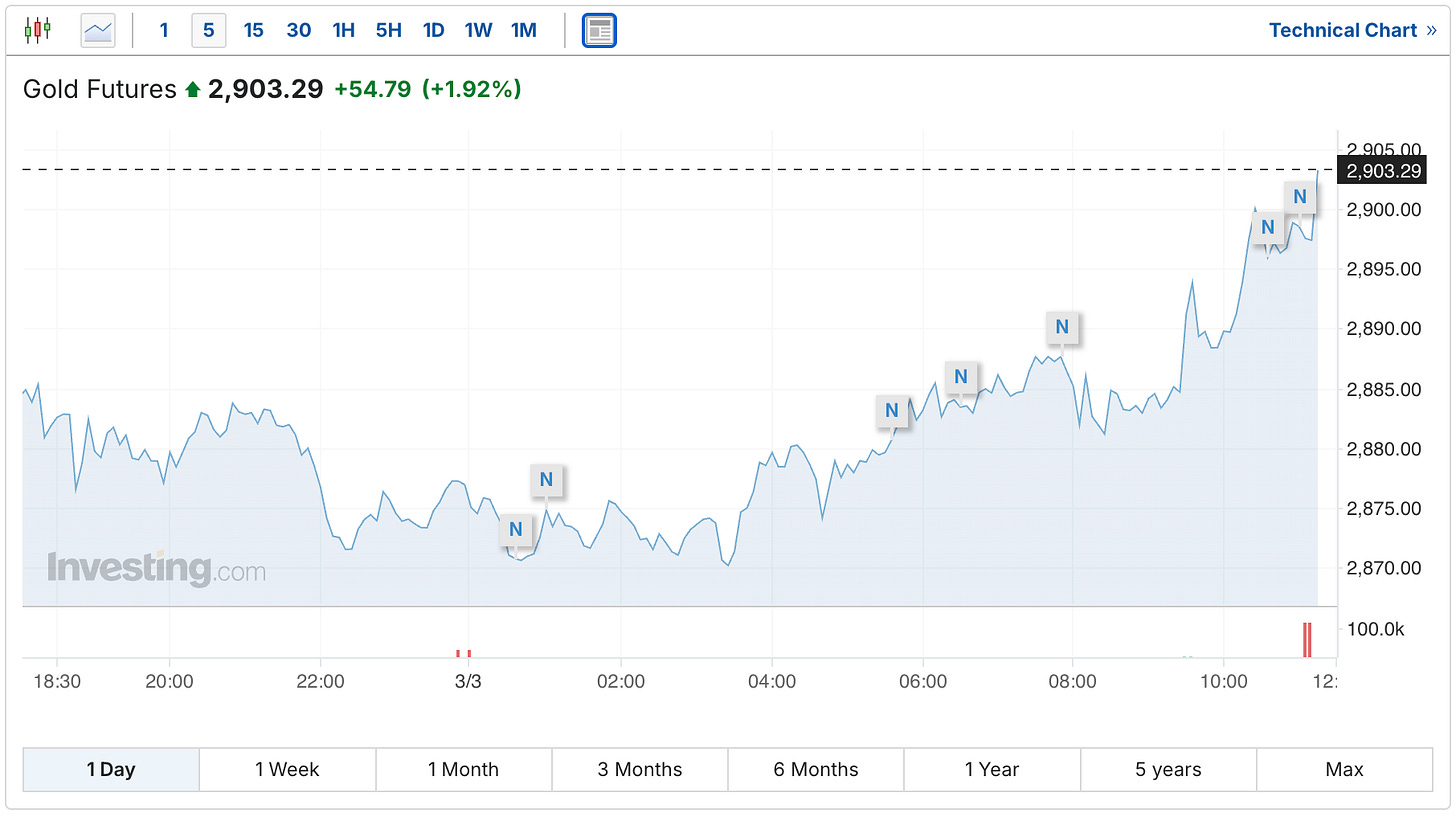

In response, the gold futures are up $54.

(Click on image to enlarge)

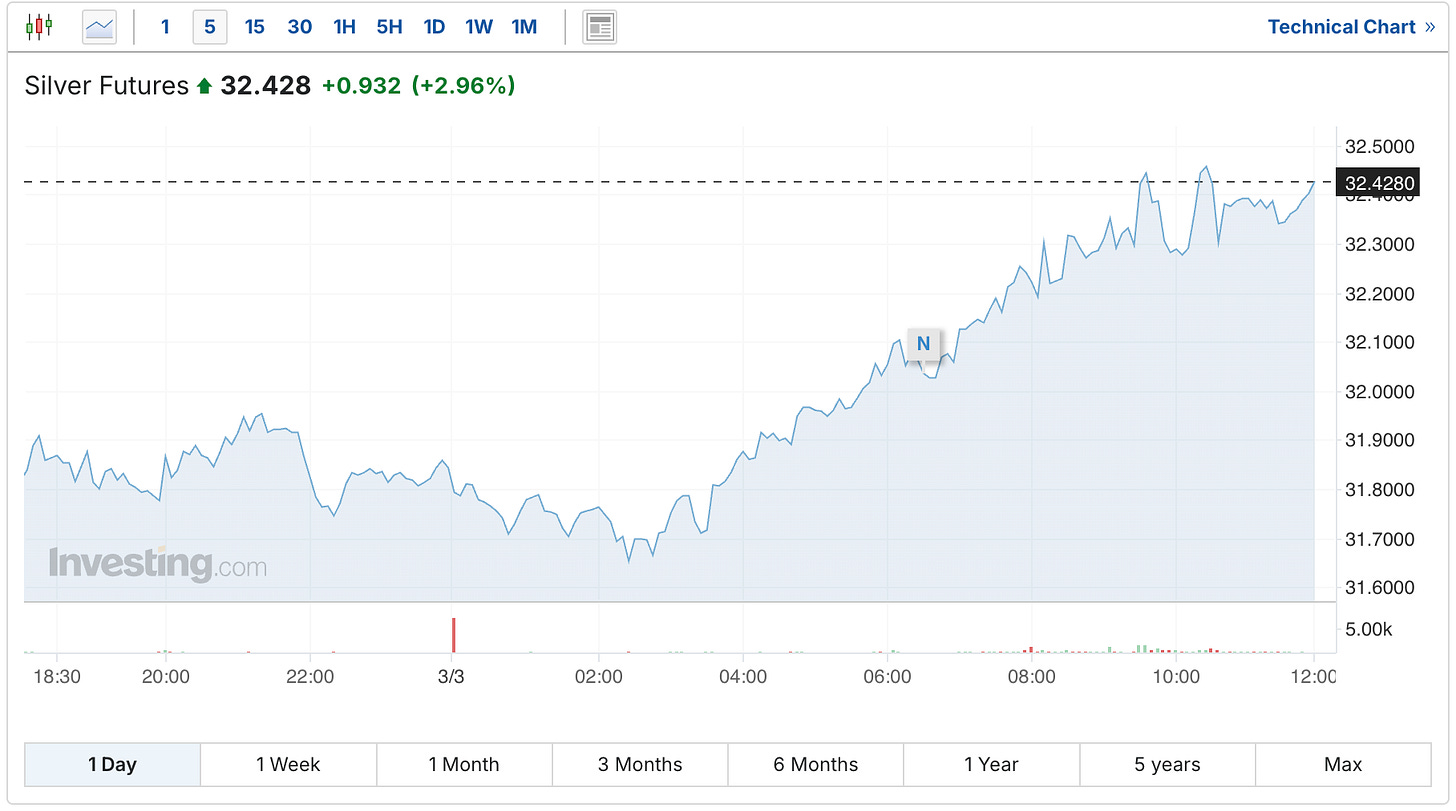

Meanwhile, silver is trading 93 cents higher.

(Click on image to enlarge)

CNBC is chalking it up to ‘a weaker dollar and safe-haven buying in response to concerns over U.S. President Donald Trump’s tariff policies.’

Which may well be partly true. Although I would also add to just think back to the end of last week, where there was not a substantial fundamental reason for that large sell-off. But as we talked about on Friday, when the markets are in this type of environment, there's a good chance you're going to see higher than normal volatility.

Last week that volatility was to the downside, and today it's to the upside.

In terms of monetary news, president Donald Trump did announce ’the creation of a strategic crypto reserve,’ which is worth keeping an eye on, especially given some of the vague comments out of the administration about potential monetization of assets on the US balance sheet.

For what it's worth, while Treasury Secretary Bessent’s comments did sound like he could be referencing gold, he has since come out and said that was not what he was referring to. Of course how much you choose to believe any government proclamation is up to you. Although at least that's the latest official commentary on the matter at this point.

Also, if you did not already catch this last week, there was a rather shocking (and highly uncomfortable) meeting between the Trump Administration and Volodymyr Zelensky. And given the impact that the ongoing conflict can potentially inflict upon the current monetary order, let's just say it wasn't the best moment for the cause of world peace. But if you’ve not seen it yet, it is worth watching.

Lastly, the PDAC mining conference is going on in Toronto this week, and I’ll be looking forward to checking in with some colleagues about the tone of the show. Especially as the mining sector eagerly awaits a new inflow of capital, which hopefully the latest miner earnings will help to attract.

So we’ll have an update on that later this week, but for now hopefully you’re just enjoying today’s gold and silver rally!

More By This Author:

February COMEX Silver Deliveries Surge To 10,119 Contracts (50.6 Million Ounces)Gold And Silver Stress Isn't Limited To Just New York And London

Wall Street Talk Of Gold Revaluation Is Drawing Attention

Disclosure: None.