AgMaster Report - Wednesday, Sep. 6

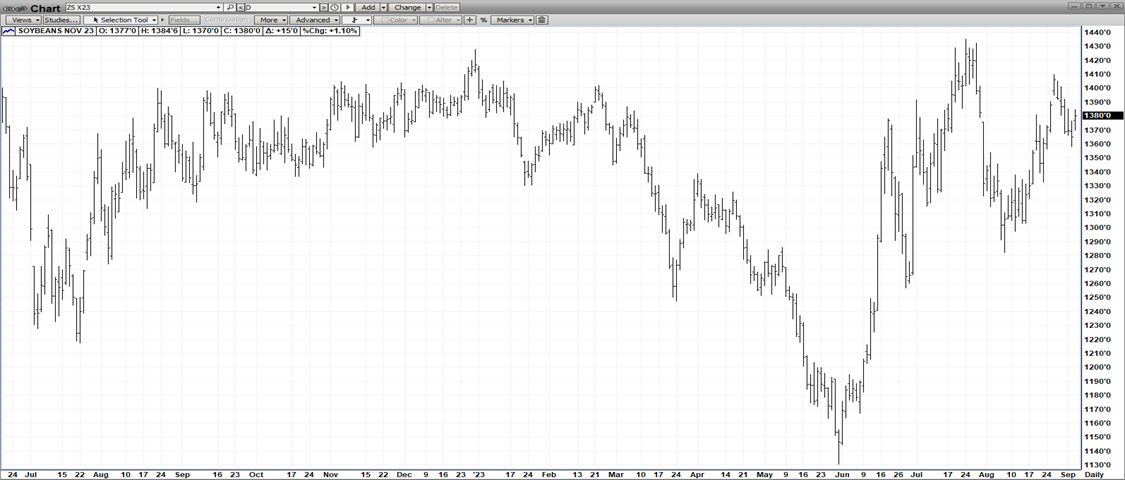

NOV BEANS

(Click on image to enlarge)

The bizarre weather patterns since June 1 have forced high volatility in Nov Beans this Summer – first a $3.00 rally off early hot & dry – then a $1.50 break off cool & wet – and finally a $1.30 rally off late hot & dry! The net result is a mkt hovering just off its 2023 high of course underpinned by a June 30 acreage report – which reflected 4 million less acres than 2022! That’s a staggering amount & has established the beans as the clear upside leader at the BOT! The Pro Farmer Tour – as a result – estimated our bean crop at 4.110 BB (ly-4.276)! In addition, daily 8am “flash sales” have increased dramatically in the past 5 weeks – totally over 25 – mostly to China! Finally, domestic demand has skyrocketed – addingmore support!

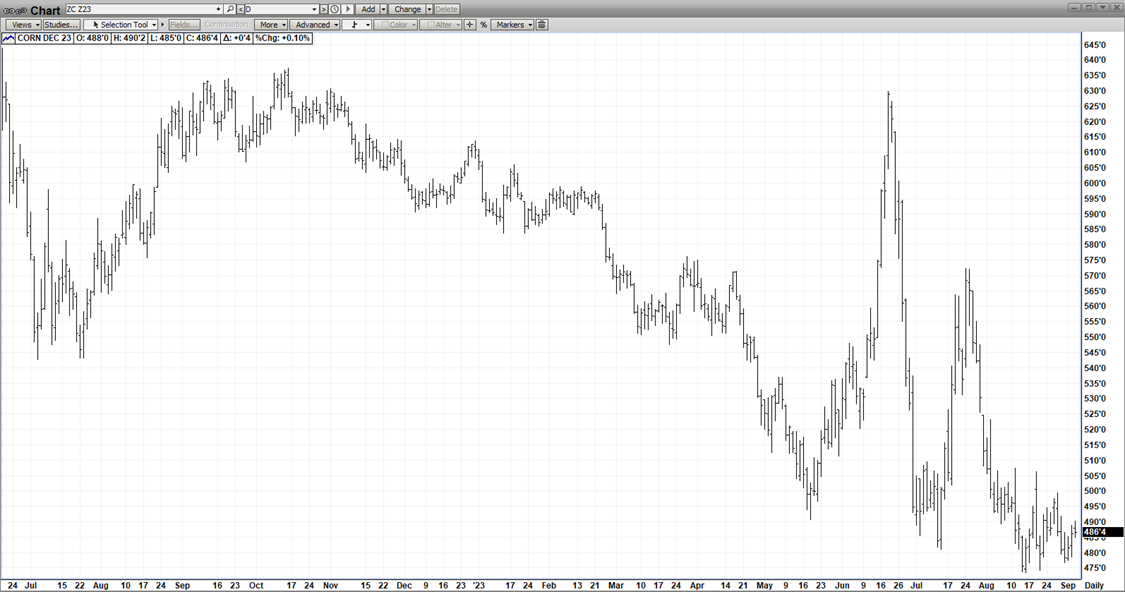

DEC CORN

(Click on image to enlarge)

With 4-5 million more acres & slack demand, Dec Corn has drifted to the $4.80 level – some $2.00 of its 2022 highs! So, the mkt has dialed in the big increase in acreage & sharp downdraft in exports but has NOT factored in the closing hot & dry weather pattern! We feel prospect of much better exports & a smaller-than-forecast crops mean early “harvest lows” have already been carved out! There has been much talk about renewing the “Corridor Deal” but it appears Russian’s pre-requirements for that are too stringent for a renewal! Domestic ethanol demand is very strong & the current price level makes the US suddenly competitive with Brazil! Pro Farmer pegged corn yields at 172 late last month but a weather-induced deterioration has evolved since then – possibly dropping the yield 2-3 bushels/acre! This coupled with heightened export potential from the sub-$5.00 price level – makes a strong case for “early harvest lows”!

DEC WHT

(Click on image to enlarge)

Sometimes, as the old commodity axiom goes, LOW PRICES CURE LOW PRICES! Dec Wht is a stunning $5.00 off its 2022 highs – mostly as a result of Russia’s massive exports of its “cheap wht” as a direct result of its recent record harvest! But even they are saying lately that “enough is enough” – that wht prices are inordinately cheap! And who would disagree?So, this cheapness will inevitably attract solid export demand & as well, wht prices will benefit from the spillover of its neighboring mkts – corn & beans – as the rally after carving out harvest lows! After all, wht is far & away the cheapest grain on the world mkt!

OCT CAT

(Click on image to enlarge)

Despite record high prices & the waning impact of the fading “grilling demand” season, tight cattle supplies continue to dominate the fundamental landscape! Both the 4th & 1st Qtr production is much lower than normal & despite lackluster demand, will keep prices, at the very least, in the tight consolidation pattern they’ve been in since late July –and only $3-4.00 off its late-July contract highs! This mkt action is particularly impressive given the relative cheapness of pork products in the supermarket!

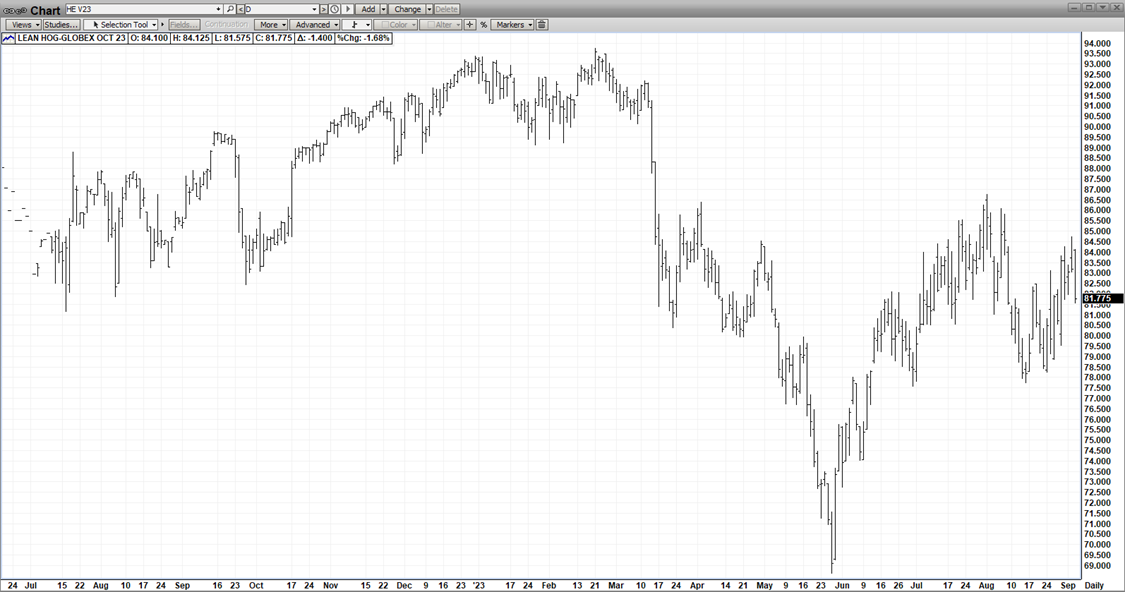

OCT HOGS

(Click on image to enlarge)

Despite National Pork Week coming soon, a higher USDA pork cutout & strong export sales, Oct hogs are down $1.50 – even as its Sister Mkt, Oct Cat surges for nearly a $3.00 inter-day gain! An enigma to be sure! Afterall, pork chops are a lot better deal in your grocery store than are steaks! But demand is lately favoring beef -albeit a much pricier alternative!

More By This Author:

AgMaster Report - Wednesday, Aug. 30

AgMaster Report - Wednesday, Aug. 23

AgMaster Report - Friday, Aug. 18