AgMaster Report - Wednesday, Aug. 30

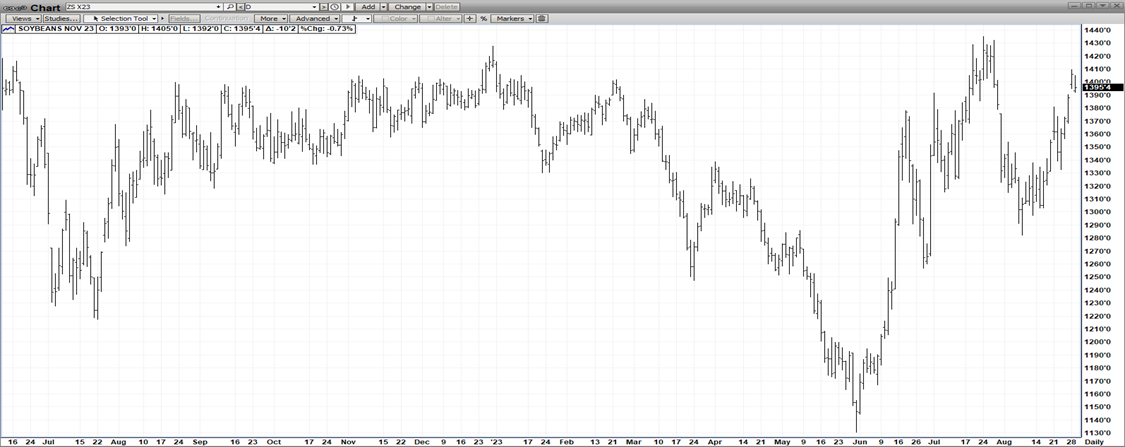

NOV BEANS

(Click on image to enlarge)

The widely anticipated, highly respected Pro Farmer Crop Tour concluded last Thursday with some surprising results – that revealed a “shrinking crop” despite the cooler, wetter weather pattern of mid-July! Total bean production was 4.110 BB (USDA – 4.205) & yield at 49.7 (USDA – 50.9)! Apparently, the early & late hot-and-dry spells did more damage than was thought! Plus, exports have picked up appreciably with over twenty 8 am “flash sales” in the past 4 weeks! And we started the season with a 4 million acreage reduction & 6 year-low carry-out! Which explains why Nov Beans are hovering around $14.00 – only .30 cents off contract highs in late August! No margin for error!

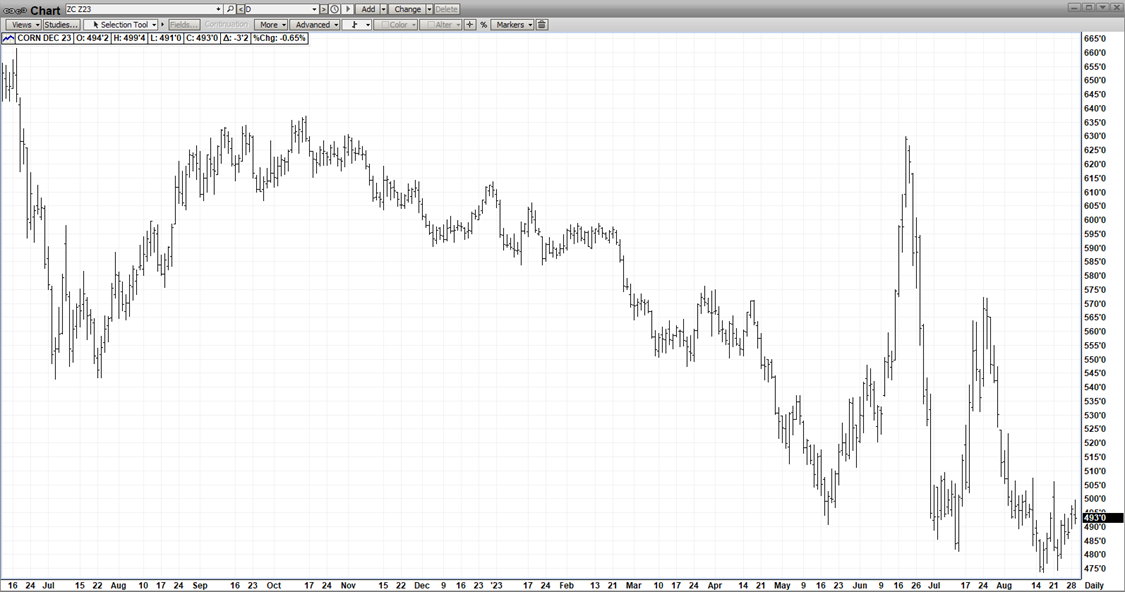

DEC CORN

(Click on image to enlarge)

Dec Corn was also the unexpected beneficiary of the lower #’s from the Pro Farmer Tour – with production at 14.960 (USDA – 15.111) & yields at 172.0 (USDA – 175.1) as well, export activity as picked up markedly in the past month as the $1.00 break in corn induced by the cool/wet weather has been scooped up by exporters! The US is competitive with Brazil & should soon be increasing their mkt share of the record buying China is doing with them! It’s amazing that Dec Corn is right around $5.00 with the lackluster export scenario we’ve had most of 2023! It speaks to the tight ending stocks! And now with exports ramping up again, the Corn Mkt is a lot tighter than people think! Especially if production & yield continues to slip into harvest! Finally, corn will derive spill-over support from the Bean Complex – with its 4 million fewer acres in 2023!

DEC WHT

(Click on image to enlarge)

An ugly chart to be sure! But it’s time to trot out one of the oldest “Commodity Cliches” – LOW PRICES CURE LOW PRICES! Indeed, wht is dirt cheap but so much so that now it finds itself competitive with Russia & may even finagle its way into some Egyptian tenders! Renewed corridor talks between Russia & Turkey has presented bearish pressure but is partially offset by friendly Canada Stats #’s! Generally, the extreme cheapness of wht will attract solid exports & post-harvest corn & bean rallies will also lend support to potential wht rallies!

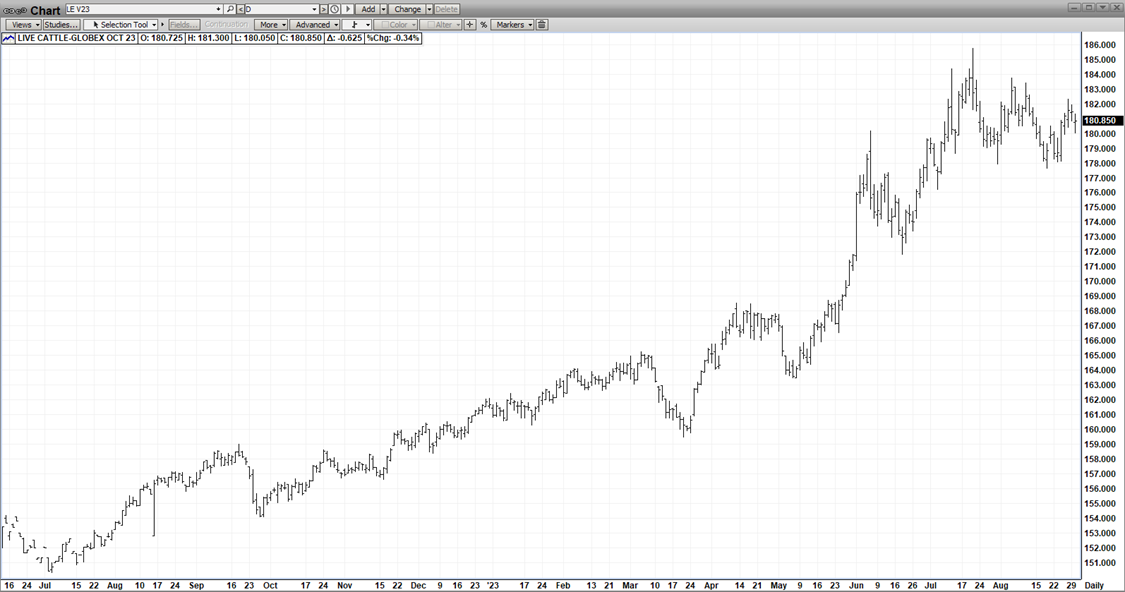

OCT CAT

(Click on image to enlarge)

After spiking to near $186 on July 20, Offsetting positive & negative forces have kept the mkt in a tight $6.00 range (178-184) since then! On one hand, supplies are still very tight but on the other, record high prices have discouraged demand – which seasonally falls off anyway – seasonally after Labor Day! The recent hot wave has been supportive – increasing death loss & reducing average slaughter weights! We’ll see how well the consumer supports the lofty beef prices – post LD W/E!

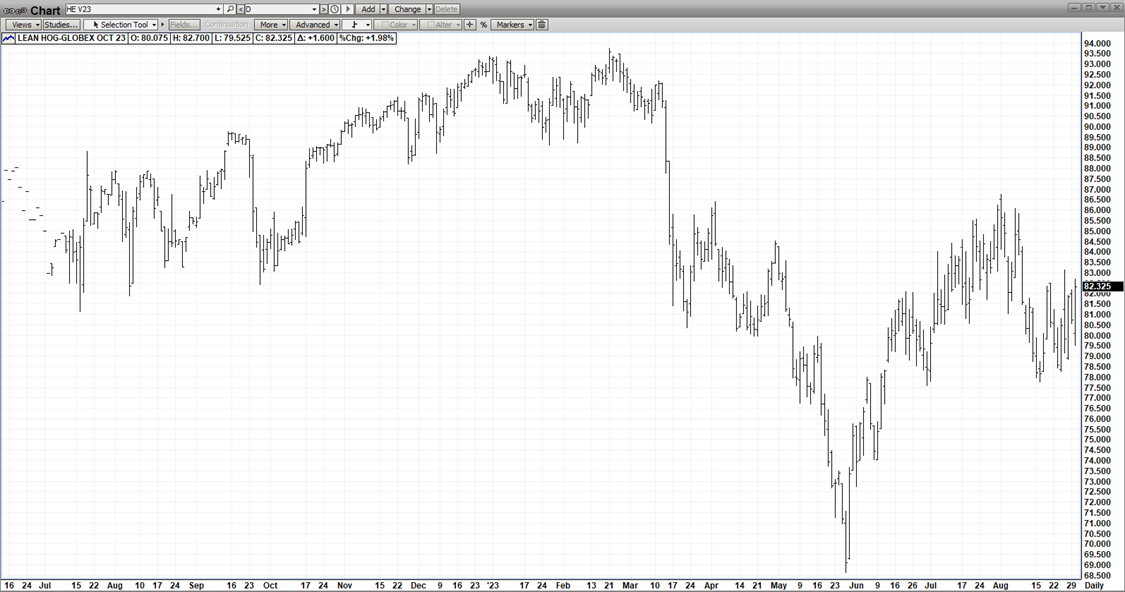

OCT HOGS

(Click on image to enlarge)

After peaking at just over $86 on 8-1-23, Seasonal weak pork prices & waning demand could pull Oct futures lower after Labor Day! The saving grace could well be the still relative cheapness of pork compared to beef in the supermarket – which could hold pork demand at least steady after the LD W/E!

More By This Author:

AgMaster Report - Wednesday, Aug. 23

AgMaster Report - Friday, Aug. 18

AgMaster Report - Thursday Aug. 10