AgMaster Report - Wednesday, Nov. 6

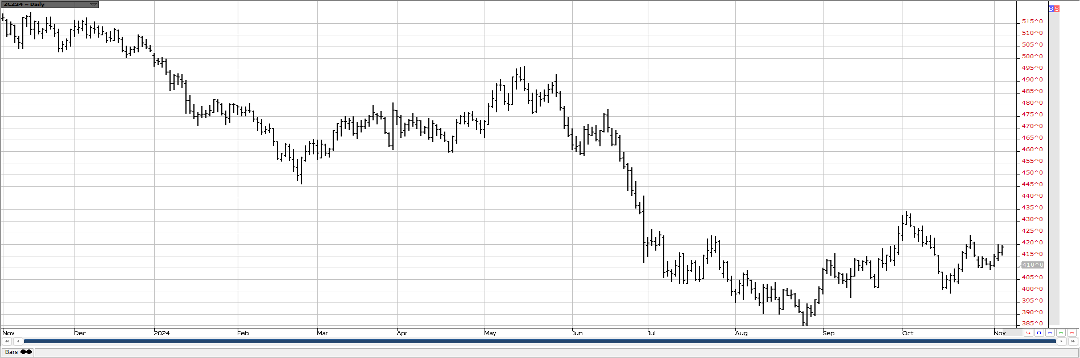

DEC CORN

(Click on image to enlarge)

Dec Corn continues to be range bound – as it was for the entirety of October (400-435)! Headwinds are the benign weather for the S/A crop which potentially is a record & tailwinds are the robust export sales in the past 2 weeks – including over 20 flash sales & weekly export #’s routinely running 1-2 mmt! However, this week 3 mkt events are looming – the US Election today, the Fed Meeting Wed & the Nov WASDE on Fri! Should Trump win, his tariffs would hurt our exports – The Fed might lower IR’s one more time in 2024 – given weak job #’s last Fri – & finally the USDA Report is expected to lower yields due to the extreme dryness in Sept! Harvest pressure is quickly waning as both corn & beans are over 90% in! When all the smoke clears, exports will lead corn higher from its 4-yr low!

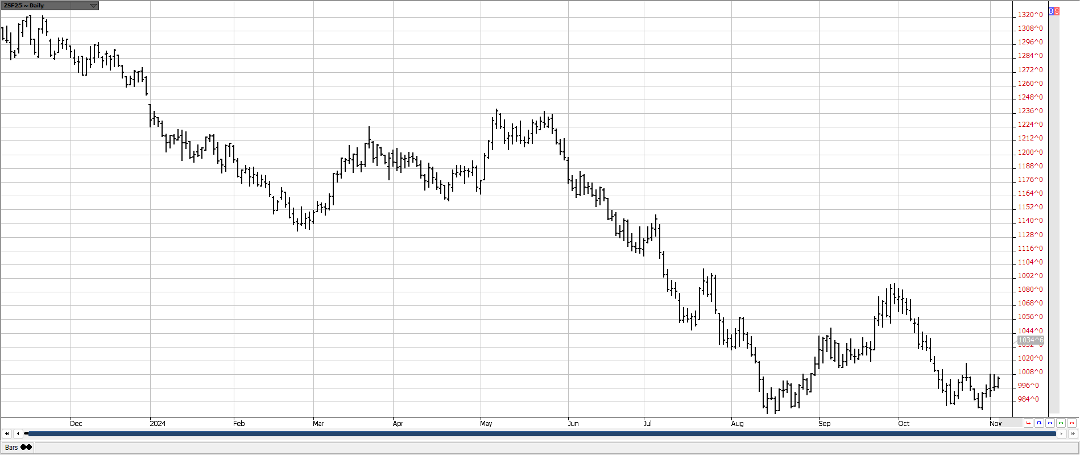

JAN BEANS

(Click on image to enlarge)

The above the chart indicates the roller coaster ride Jan Beans have been on since late Aug – as the contract rallied $1.00 (980-1080) off the S/A drought – then the mkt quickly – retracted all that Weather Premium – plummeting that same $1.00 down (1080-980)! But now with harvest pressure off, exports increasing & trader expectations down for bean yield this Friday in the USDA’s Supply & Demand Report, we expect another rally – once the mkt totally absorbs the election results! The current 4-yr low prices make US Beans the cheapest around – & this encourages a pronounced increase in our exports! As well, domestic biodiesel demand is also quite strong!

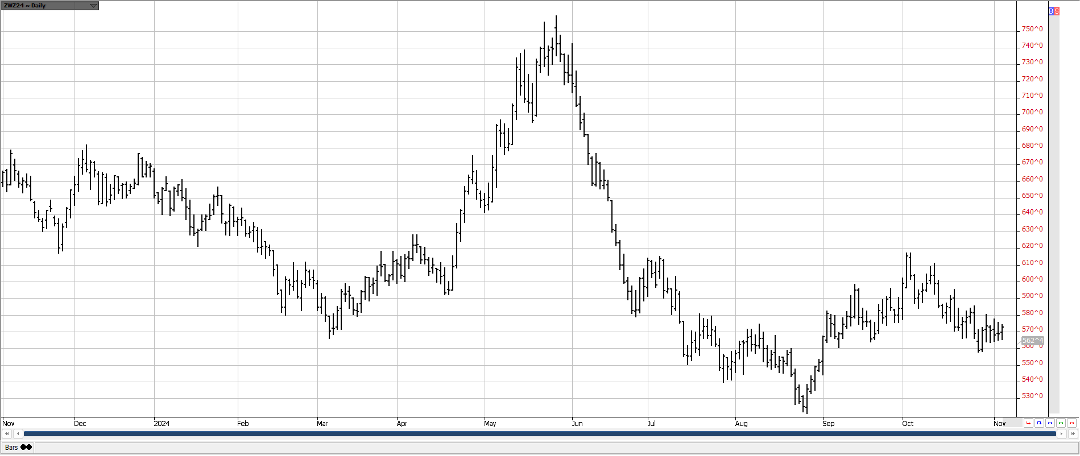

DEC WHT

(Click on image to enlarge)

Dec Wht has been in a 60 cent trading range (560-620) sent Labor Day but current fundamentals indicate that may give way to an upside move! Recent rains in the plains could not break the mkt, the gd-ex rating on Winter Wheat is only 41% -, the 2nd lowest ever, Egypt recently tendered for 290,000mt from Ukraine, Romania & Bulgaria & Russia’s current WW crop has been reduced to 130mmt (prev-150 )! As well, Dec Wht rallies will benefit from spill-over support from post-harvest rallies in corn & beans!

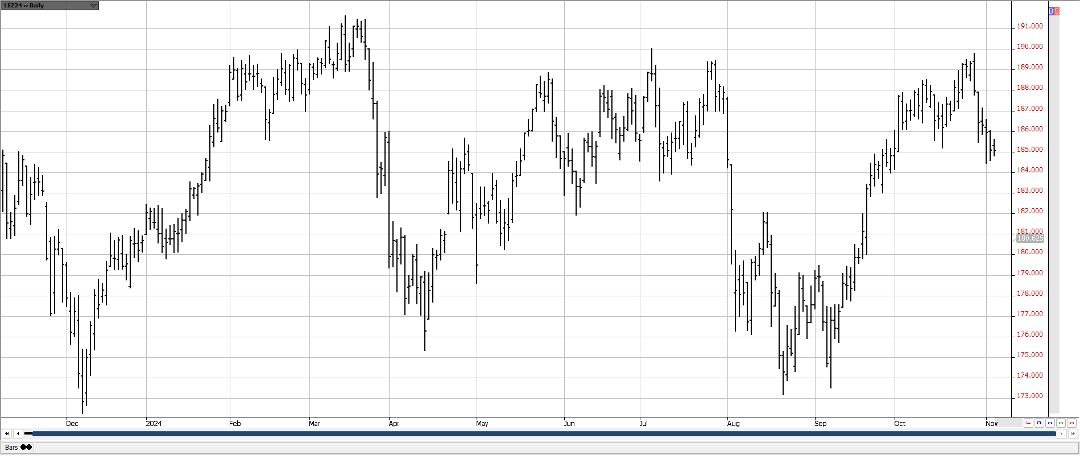

DEC CAT

(Click on image to enlarge)

Six mkt days ago, Dec Cat experienced a classic “key downside reversal” – making new highs for the up-move – then closing under the previous day’s low! Since then the reversal has been validated by continuing days of lower highs & lows! After a nearly vertical $16 rally since Labor Day, the Bull Move is experiencing – at the very least – a solid correction & maybe a top! The Bull Mkt has been victimized by record high weights & prices! Yet the correction has not yet violated the 200 day moving average! The mkt is pausing this week – while awaiting the outcome of the Presidential Election!

DEC HOGS

(Click on image to enlarge)

With a flurry of important mkt happenings this wk including the election today, the Fed meetings Wed-Thur & the Nov WASDE on Fri at 11am, the Raging Bull that is Dec Hogs decided to correct this week $4.00 (85-81)! Record high Fund Longs & Open Interest certainly “greased the slide”! During its $23 up (62-85) since early July, the mkt has been an absolute juggernaut but with everything occurring this week, the mkt decided to pause! It will re-evaluate after the election results are known later this week!

More By This Author:

AgMaster Report - Wednesday, Oct. 30

AgMaster Report - Wednesday, Oct. 16

AgMaster Report - Wednesday, Sep. 25