AgMaster Report - Wednesday, Sep. 25

NOV BEANS

(Click on image to enlarge)

It’s highly unusual for the grains to rally during harvest – let alone rally sharply! But that’s exactly what happened this week with Nov Beans surging 50 cents (1010-1060) the past 2 days! Macro factors have intervened to give the mkt a huge lift – China has taken major steps to rejuvenate its economy & of course last week, The US Fed lowered interest rates a whopping .5% with more cuts promised! This helps domestic demand for all commodities & also lowers the US Dollar – which paves the way for more exports! This coupled with dryness in N Brazil, SW Russia & the Central US have ignited this contra-seasonal rally! 4 year lows have finally attracted substantial demand globally & the record crops currently being harvested have been baked into the prices!

DEC CORN

(Click on image to enlarge)

After corn bottomed in late Aug at a 4-yr low, USDA issued its Sept WASDE raising the corn yield to 183.6 from 183.1! The mkt immediately traded 8 cents lower but recovered late to close higher! And then followed thru higher the next day! This mkt action displays solid bullish divergence & confirms that the record crop was already dialed in! Since then the mkt is trading sideways to higher – as it deals with the headwinds of an active harvest! Extreme dryness in N Brazil will be a major factor- should it continue into mid-Oct! Hot & dry in the Central US has taken out the top-end yields for corn! Increased tensions between Israel & Lebanon have added a “war premium” to prices! And shorts are bailing in front of the month/quarter end next Monday & the election just a month away! Finally recent fiscal action by the US & China has shored up their economies – lending support to all commodities – both grains & meats!

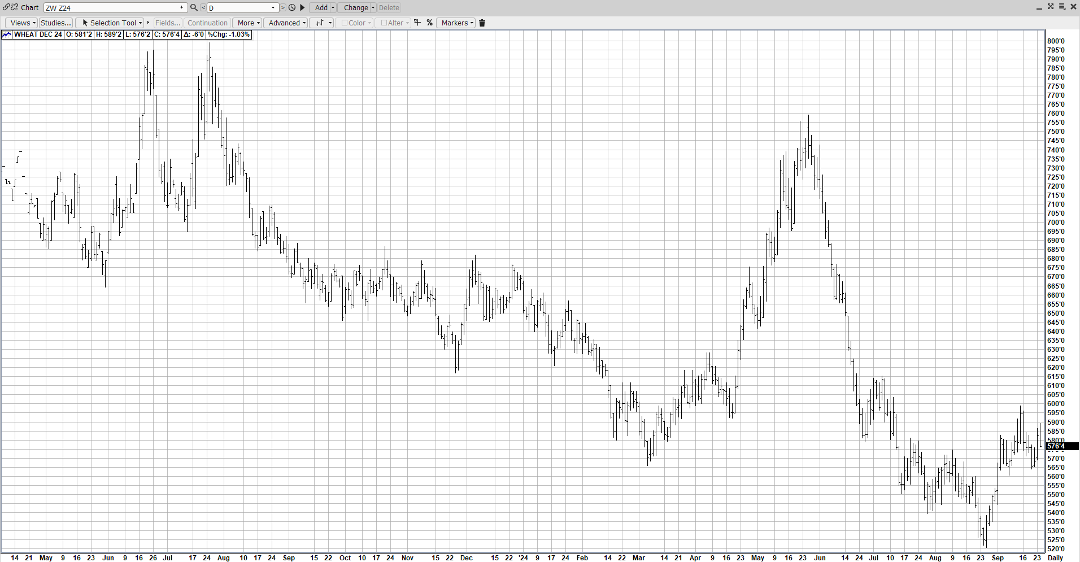

DEC WHT

(Click on image to enlarge)

Despite significant rains in the Texas Panhandle & western Oklahoma, Dec Wht rode the coattails of a surging Dec Corn & Nov Beans! As well, cumulative export inspections are running 35% over 2023! As well, global dryness in Argentina, Ukraine & Russia continue to underpin the mkt! Spring Wht harvest is at 96% & Winter Wheat is 25% planted!

DEC CAT

(Click on image to enlarge)

Dec Cat has staged a very impressive Post Labor Day Rally of $11.00 (173-184) despite the winding down of the outdoor-grilling-season, the best demand period of the year! Coming to the rescue & rejuvenating beef demand was the Fed’s recent decision to lower interest rates last week by .5% – which implies better domestic interest from consumers via a stronger economy & improved exports due to a declining $$ – as a result of lower IR’s!

DEC HOGS

(Click on image to enlarge)

Dec Hogs continued their recent upsurge – closing higher for the 6th day in a row. However, headwinds appear on the horizon – in the form of potential US Longshoreman strike which could significantly disrupt pork shipments! As well, 2 major gov’t reports are looming – the Quarterly Pig Crop & the monthly Cold storage – both on Thursday at 2pm! They may force some evening up in front of their release! Much like its sister mkt Cattle, Hogs are benefitting from the Fed’s IR lowering last week – which promotes both domestic & export demand!

More By This Author:

AgMaster Report - Wednesday, Sep. 18AgMaster Report - Wednesday, Aug. 21

AgMaster Report - Tuesday, July 23