AgMaster Report - Wednesday, May 22

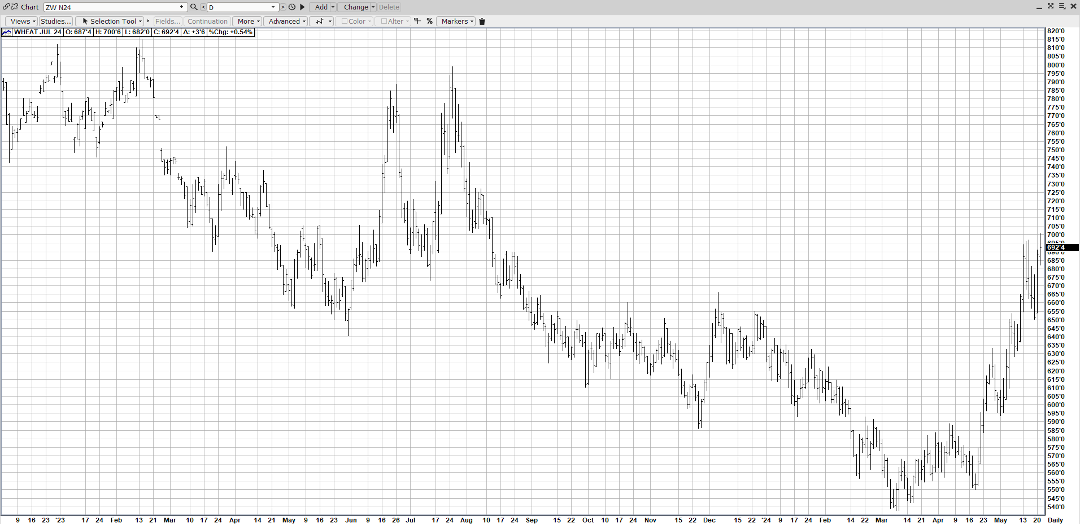

JULY WHT

(Click on image to enlarge)

When it takes a mkt only 2 days rally to recapture what it lost in 5, that speaks volumes about its underlying strength – and that indeed encapsulates July Wht! Weather woes in the Black Sea area including drought & frost have energized the former lackluster mkt to a sparkling $1.50 rally in just the past month! Helping the rally was historical cheapness & a huge Short Open Interest – both establishing wht as the Upside Leader at the CBOT! Russia’s wheat crop was downgraded today to 83.5mmt (prev-86)! And they are the biggest wht exporter in the world! A record DJI & a slumping US Dollar have helped to fortify the rally!

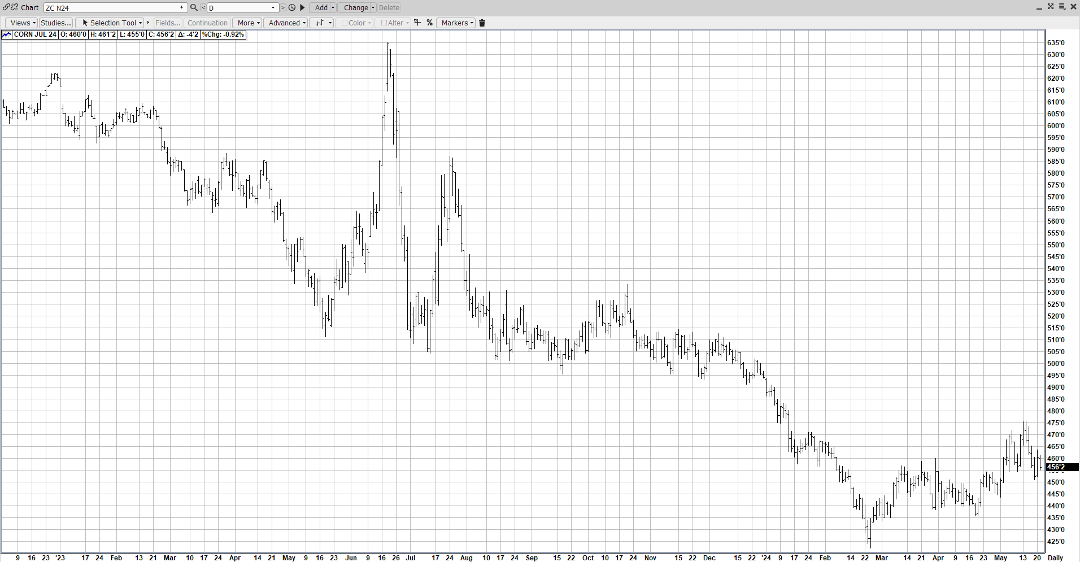

JULY CORN

(Click on image to enlarge)

Exports have been stellar so far in 2024 – already 35% over 2023! And this week’s reports have been very encouraging – Monday Inspections were 1.210 MMT & today we had 2 flash sales – 110,000mt – Spain & 113,000mt – Mexico! That coupled with a price level $2.00 under 2024! The adequate supplies have been dialed in by the price break! Planting delays in the central Midwest have some pundits talking corn acres down to 89 acres (prev – 90)! Planting progress jumped 21% to 70% (avg – 71)!Illinois is at 67%, Indiana at 54% & Iowa at 78%! Wht has aided the corn rallies – running up $1.50 in the past 4 weeks! As well, the Macros have supported with DJI at a record 4000 & the US Dollar has broken 200 points in the past 2 weeks – inviting even more exports!

JULY BEANS

(Click on image to enlarge)

Easily the weakest of the CBOT grains, July Beans nevertheless had a stellar technical day yesterday – rallying to 4 month highs! Despite very lackluster exports, Beans have drawn strength from rising Brazilian Export Premiums, planting delays, catastrophic flooding in S Brazil & spillover support from the Wht Complex! We feel with a declining US Dollar, the US bean exports will come around! Pltg progress is on par with 52% in (avg – 49) – Ill is 58%, Ind is 49% & Iowa is 61%! Even though Beans are the “weak link”, a rising tide floats all boats! So global weather issues favorably impacting Wht & Corn will also lift July Beans!

JUNE CAT

(Click on image to enlarge)

Even though, heavier weights have been offset by solid seasonal demand – keeping June Cat in a tight $6.00 range (173-179) of late, in the past 3 mkt days, in advance of Memorial Day W/E, demand has been revved up & daily slaughters low – both leading to a $3.00 upside explosion out of that snug congestion area! That leaves the 2024 highs just $3.00 away & easily within reach! The impressive above chart validates the June Cat strength!

JUNE HOGS

(Click on image to enlarge)

Despite breakout action in its Sister Mkt June Cat, June Hogs continue to struggle registering the lowest level yesterday since 2-21-24! Hog slaughter is up over last week & last year & the pork cut-out was down $1.36 on Tues. Long open interest has dropped to 56,128 from a record 92,731! Its very surprising that coming into Memorial Day W/E – a great demand period, that hogs haven’t gained any traction! However, one overriding bearish fundamental is the sharp export loss to China over the last 12 months! They have an adequate hog supply now & in fact have been liquidating heavily in the past 6 months!

More By This Author:

AgMaster Report - Wednesday, May 15

AgMaster Report - Tuesday, May 7

AgMaster Report - Tuesday, April 23