AgMaster Report - Tuesday, May 7

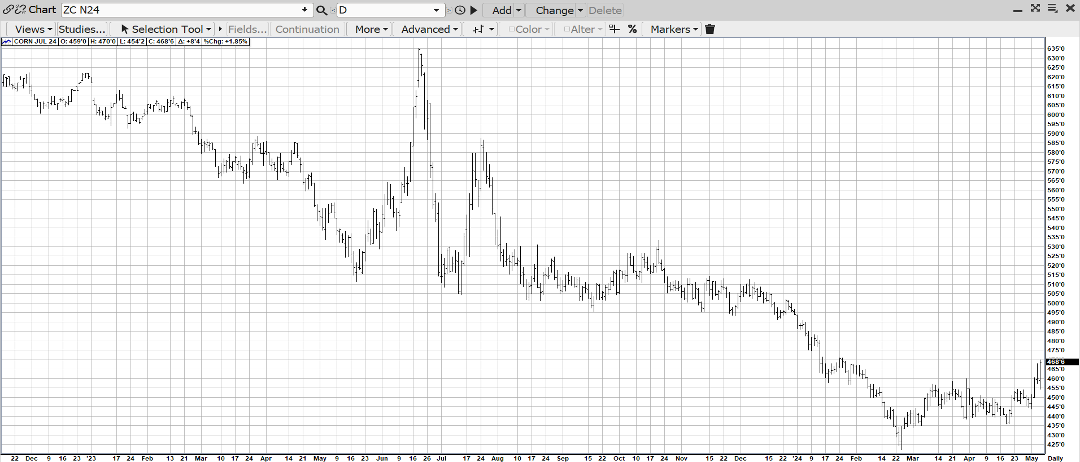

JULY CORN

(Click on image to enlarge)

The above chart speaks volumes about July Corn’s upside technical breakout from a coiling, consolidation pattern the mkt was in from Feb-April! And strong fundamentals validate the move – prices are $2.00 cheaper than last Summer – thereby dialing in the adequate carry-over, weekly exports are 35% over 2023, extreme flooding has hurt S. Brazilian crops, excessive rains have slowed US planting & dryness in Russia has shrunk their wht crop! Finally, supportive macros came from the Fed last Friday as weaker-than-expected job #’s resurrected hopes for an easier monetary policy! In addition, the El Nina-La Nina weather shift suggests a hot & dry summer! From current price levels, there is no margin for error!

JULY BEANS

(Click on image to enlarge)

Likewise, July Beans have authored their own upside price explosion – rallying nearly $1.00 in just 4 mkt days – responding to the historic flooding in S Brazil – the worst in 83 years! The crops down there were already on the wane – this will certainly exacerbate their situation! As well, Argentina has its own set of problems with a recent frost & the high probability their transit workers are going on strike! The Feds lower Non-Farm payroll #’s were under expectations Friday which has helped break the US Dollar 200 points in a week – which is friendly for our exports! Like corn, beans are $2.00 cheaper than last summer – which should bring in more exports – & biodiesel demand is strong! We have seen what a weather hiccup in South America at the very tail-end of harvest can do to bean futures! That impact would certainly be magnified should the same thing occur in our growing season this summer!

JULY WHT

(Click on image to enlarge)

Unexpected rainfall in the SW Plains opened wheat futures lower but persistent dryness in the Black Sea areas impacting Russia & Ukraine rallied all three wht contracts 22-23 cents higher! Russia has had the lowest precip for April in 10 years! Plus, spillover strength in corn (better exports, pltg delays) & beans (flooding in S Brazil) augmented the wht rally!

JUNE CAT

(Click on image to enlarge)

Persistent heavier daily weights & slaughter are offsetting the solid demand offered up by the “grilling season” keeping the June Cattle in tight trading pattern some $7-8 off its 2024 highs! Recurring Bird Flu rumors seem to stop any rallies but seasonal demand supports on breaks!

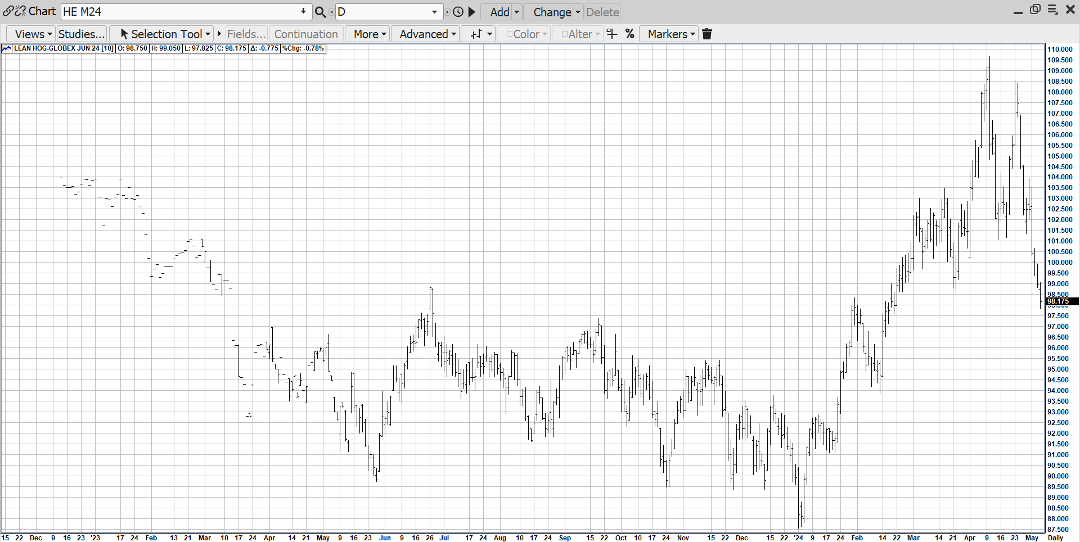

JUNE HOGS

(Click on image to enlarge)

June Hogs have been a virtual “train wreck” the past 2 weeks – dropping $10 (108-98) due to several factors – a record long open interest, heavier daily weights, lost demand to beef due to Bird Flu mitigation & poor exports as a result of China’s over-production! However, the mkt is currently very oversold & due for a correction – especially in front of export sales Thur & the WASDE REPORT on Friday!

More By This Author:

AgMaster Report - Tuesday, April 23

AgMaster Report - Wednesday, April 17

AgMaster Report - Wednesday, April 3