AgMaster Report - Wednesday, April 3

MAY CORN

(Click on image to enlarge)

May Corn – after being held hostage for several weeks – in anticipation of the USDA Stocks/Seeding 3-28-24 Report – exploded last Thursday for a 15-cent gain as both acres – 90 MA (ly – 94.64) & stocks – 8.347 BB (exp – 8.427) were under expectations! However, the mkt was unable to follow-thru up Mon & today due general trader skepticism about the low 90 million acre # & general demand concerns emanating from the bird flu issue! As well, very supportive Macro Tailwinds have emerged in the form of record Gold prices & surging crude oil prices – validating a strong US economy! A rising tide, indeed, floats all boats!

MAY BEANS

(Click on image to enlarge)

Despite recent bearish reports, May Beans are posting double-digit gains today – to remain firmly entrenched in the tight consolidation pattern they’ve been in for the past month! The Stocks/Seeding USDA Report was neutral/bearish with an expected 3 million acre increase at 86.51 MA & slightly higher stocks – 1.845 BB (exp-1.828)! Monday inspections were a marketing year low at 414 MT, Brazil harvest is 75% in & the US $ is the highest since November! However, biofuel demand is quite high – underpinning the mkt! And strong oil & gold prices underpin the mkt – same as May Corn! The net is a mkt continuing to sideways trade awaiting US planting weather & progress & further South American Crop updates!

MAY WHT

(Click on image to enlarge)

For the past month, May Wht has been locked in a tight trading pattern (530-570) a neutral/unfriendly USDA Report last Thursday reflected stocks – 1.087 BB (exp – 1.044) & planting – 47.45 MA (exp-47.33, ly – 49.57)! The 1st Crop Conditions Report of the year reported good-excellent – 56% (ly – 28%) – as expected! Recent rains have helped alleviate dryness in the Central Plains! Yet despite these negatives, the mkt remains range-bound – indicating it may be cheap enough – as many of us have long felt! New exports & spill-over support from Corn & Beans could spark a rally!

JUNE CAT

(Click on image to enlarge)

A down-move originally ignited by a 10% placement # in the March Cattle-on-Feed report – was further exacerbated yesterday by a knee-jerk massive fund liquidation of longs in response to the Bird Flu Outbreak! Worries mounted for a large drop-off in meat demand – resulting in a $5.00 plummet in futures on Mon & new lows for the break in June Cattle! We feel the break is overdone & look for the mkt to stabilize from here! The $10 drop off the highs is probably enough with the Spring Grilling Season almost upon us – which is, of course, the best “demand period” of the year!

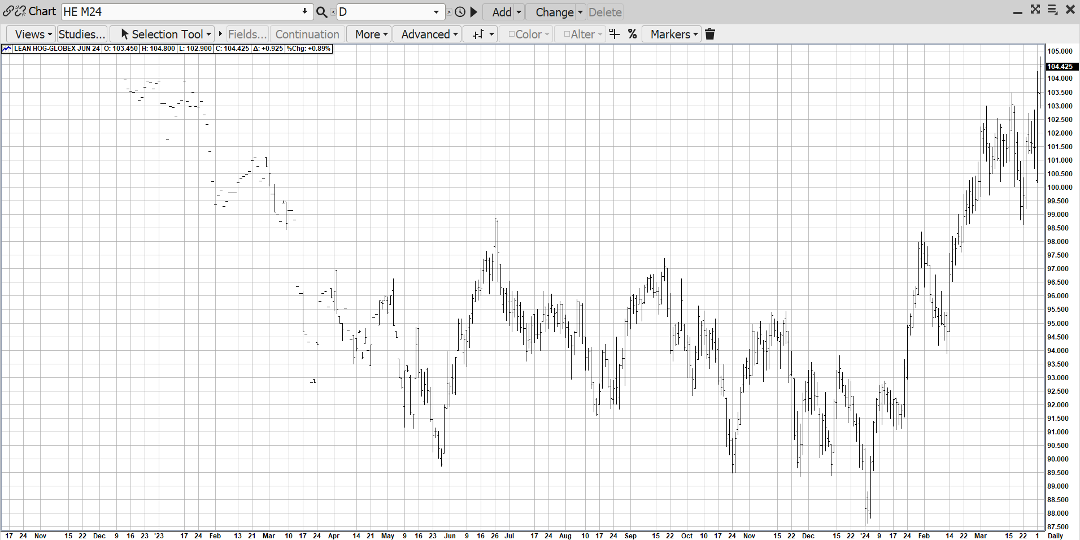

JUNE HOGS

(Click on image to enlarge)

There’s an old commodity cliché that “CATTLE PAIN EQUALS HOG GAIN” and yesterday’s mkt action perfectly personifies that! June Cattle plummeted $5.00 due to Bird Flu demand worries & June Hogs surged $2.00 on the perception that lost cattle demand would translate into additional hog demand! As a result, June Hogs forged new highs for its up-move! With the “grilling season” soon starting, this “demand shift” could be punctuated into the Spring Months!

More By This Author:

AgMaster Report - Monday, March 18

AgMaster Report - Tuesday, March, 12

AgMaster Report - Monday, Feb. 5