AgMaster Report - Tuesday, April 23

Image Source: Unsplash

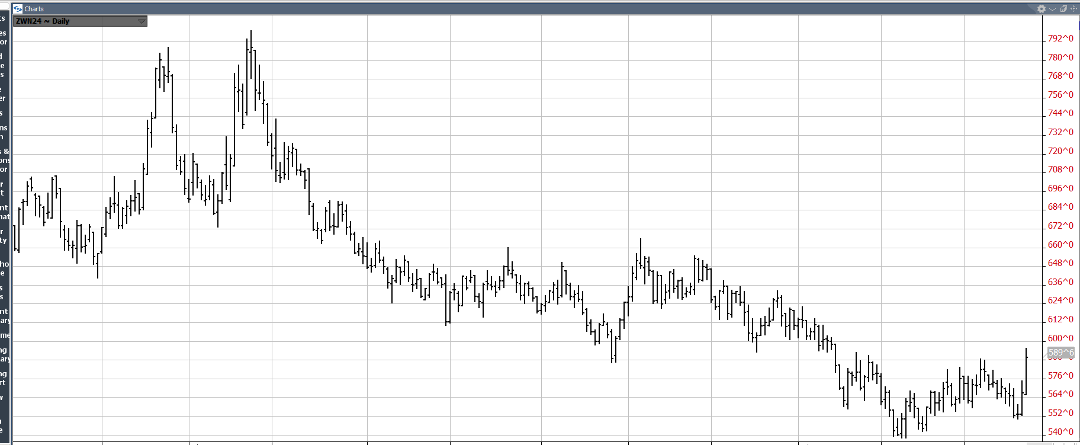

JULY WHEAT

(Click on image to enlarge)

A plethora of bullish fundamentals have driven July Wht to two-month highs – including historical cheapness, dryness in the US Southern Plains & Russia & military strikes into Ukraine perpetrated by Russia! Also, Russia has had recent difficulties with its export system! These factors coupled with a probable upside technical break-out could finally signal a long-awaited bottom in July Wht!

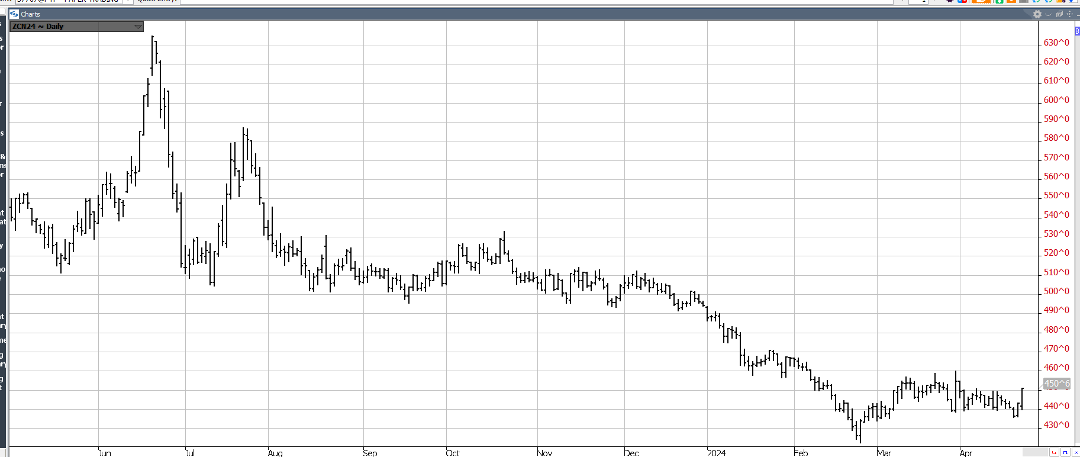

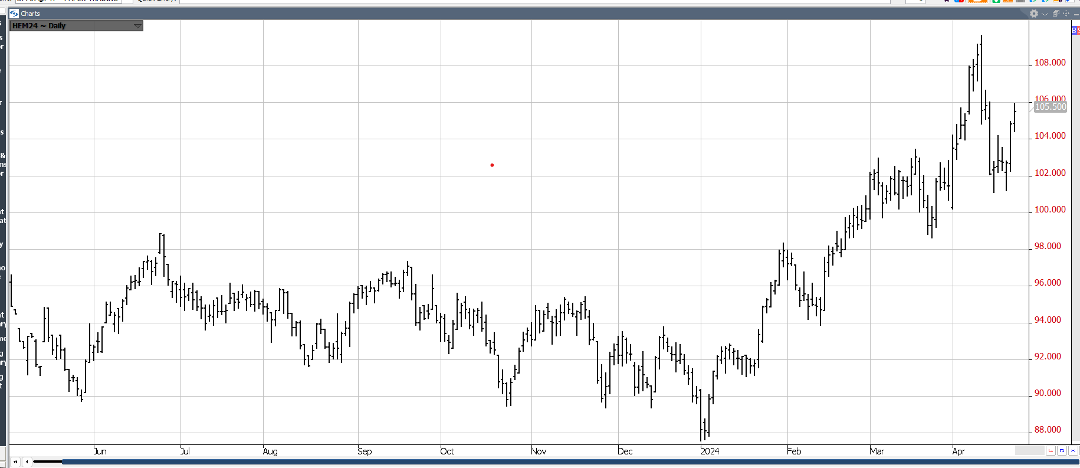

JULY CORN

(Click on image to enlarge)

July Corn was “down & dirty” at the end of last wk breaking out of its consolidation pattern on the downside, but it quickly reversed with solid gains Friday & today as the contract quickly marched up to the top end of its March trading range! Marketing year high export inspections of 1.623mmt also helped – as well as July Wht’s 20 cent upside explosion to 7 wk highs! The corn contract has dropped $2.00 since last summer -in the process factoring in a lot of bearishness – including adequate stocks & slack exports! Since the 1st, exports have run about 35% over 2023! At current levels, July Corn can allow no margin for error – should there be any glitches in the US Crop!

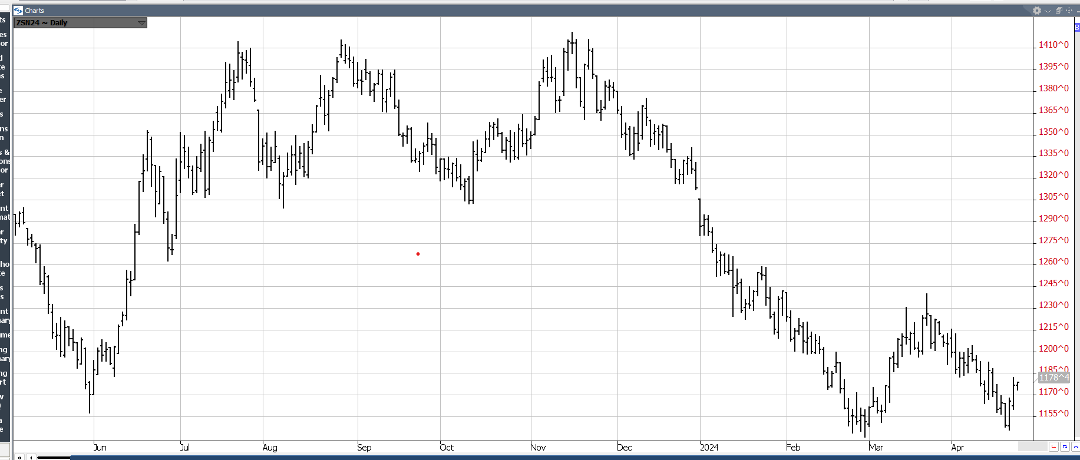

JULY BEANS

(Click on image to enlarge)

July Beans rode the short-covering wave that engulfed grains today as harvest is nearly complete in Brazil & dryness persists in Argentina! Flash sales have begun appearing regularly with 3 last week & the fund short position is quite large – as well, the mkt is $2.50 off last Summer’s highs! Spiller-over from wheat was prominent as global dryness in wht areas & geopolitical issues sent wht more than 20 cent higher! Bean stocks are not abundant & there is no weather premium in the mkt as planting is just beginning!

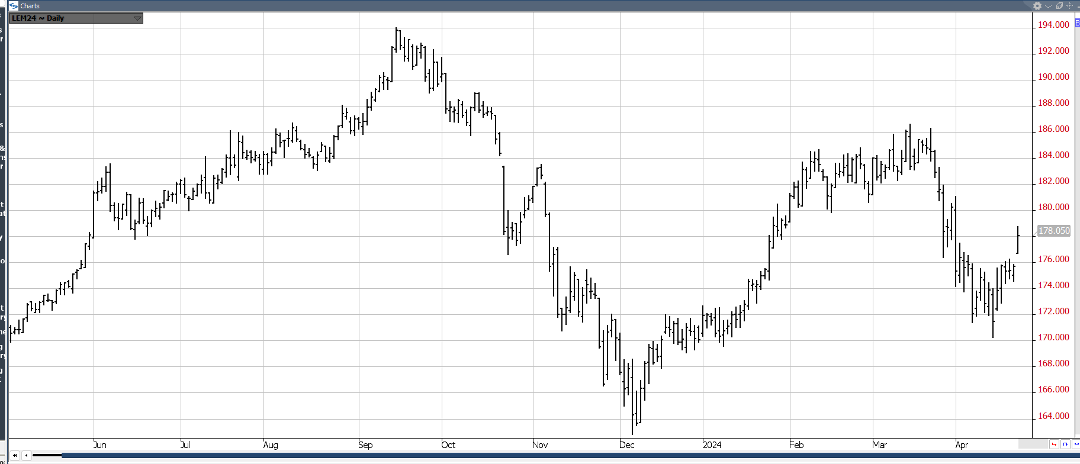

JUNE CAT

(Click on image to enlarge)

Cattle-on-Feed reports have been widely unpredictable of late & the April version issued last Friday at 2pm was no exception! Placements came in at 88% (est-93) after last months 110% which started cattle’s $16 slide! The expected reaction was a gap-higher, sharply higher close as the mkt rallied to the midpoint of the recent break! Two factors helped encourage the rally – one was the realization that the Bird Flu impact was mitigated & two is the grilling season we’re currently in – cattle’s best demand period of the year!

JUNE HOGS

(Click on image to enlarge)

June Hogs basically jumped on board the short-covering rally in grains & cattle posting modest gains but closing within $3.00 of the recent of its recent highs! They are also the beneficiary of an excellent demand as folks roll out their grills! Also, recent slaughter & avg weights have been down & exports up as China’s recent herd liquidation has leveled out!

More By This Author:

AgMaster Report - Wednesday, April 17

AgMaster Report - Wednesday, April 3

AgMaster Report - Monday, March 18