Cell Tower REITs: An Alternative Way To Profit From 5G Secular Trends

With the roll out of 5G devices and services, investors have been keen to gain exposure to the latest secular growth story. Tech stocks are often the first area of the equity market to come to mind when thinking about 5G. While there are indeed some great tech names that offer significant 5G exposure, many investors tend to overlook another investment option that also stands to be a great beneficiary from the 5G roll out, and without which 5G devices would be useless. The cell tower REITs are the backbone of the latest generation of network technology infrastructure, and it is a sector that investors should consider adding exposure to within their portfolios. This research piece will cover the characteristics of the industry, as well as the strengths offered and risks incurred going forward.

Market Dynamics & Growth Drivers

Industry Composition

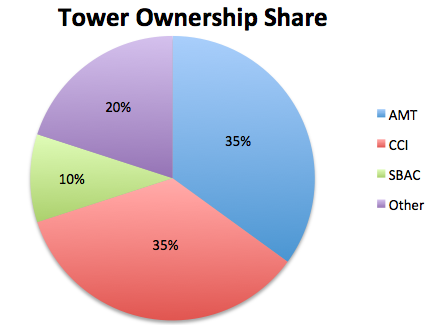

The four U.S. publicly traded cell tower REITs are American Tower Corporation (AMT), Crown Castle International (CCI), SBA Communications Corporation (SBAC) and Uniti Group (UNIT). Each REIT’s share of U.S. tower ownership, according to their latest earnings reports, is reflected in the chart below.

(Click on image to enlarge)

Data Source: Earnings Reports

AMT and CCI together control about 70% of the towers in the US. Moreover, out of all the REITs industries, cell tower REITs enjoy the highest concentration of asset ownership among a few giants, yielding them very strong pricing power.

5G Uses & Demand Growth

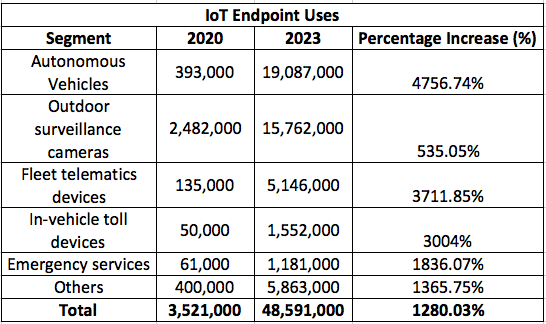

Global mobile data usage is expected to expand to 77.49 Exabytes per month by 2022, which implies a 573.24% increase from 2017. Apart from high-speed and high-quality mobile data services, 5G technology also offers various other capabilities for industrial, medical services and Internet of Things (IoT) purposes. IoT endpoints involve innovations such as Autonomous Vehicles and Outdoor Surveillance Cameras. The table below reveals the expected growth in global IoT devices worldwide between 2020 and 2023.

(Click on image to enlarge)

Data Source: Gartner

All these devices will be impossible to use without satellite connection, making cell towers vital infrastructure to support them. Therefore, the tremendous growth in applicable uses will boost demand for rental space on the cell towers, further strengthening their pricing power to maximize revenues. Given that these numbers are for worldwide IoT endpoint uses (not just US), REITs with international exposure will benefit the most from this global 5G utilization. AMT and SBAC are the only U.S.-listed cell tower REITs with a globally diversified portfolio, owning 128,977 and 14,641 international towers, respectively. AMT is clearly best positioned in the industry to exploit worldwide 5G deployment and surging global mobile data usage.

Cell Towers

Macro cell towers (macro cells) have been the most significant form of network infrastructure for satellites. However, small cell towers (small cells) have been given greater emphasis amid 5G deployment due to their ability to offer much faster connectivity services. Nevertheless, faster speed is the only advantage small cells offer over macro cells. It is important to note that macro cells offer relatively fast speed as well, and do so while offering a much wider range for connectivity. More importantly, the Cost Per User is considerably lower for macro cell towers compared to small cells, hence making them more suitable for providing more cost-effective services. Therefore, macro cells are very unlikely to become irrelevant amid the 5G rollout, thereby allowing giants like AMT (which dominates the macro cells market with 169,560 towers worldwide) to maintain its market-leading position in the industry over the next several years.

Strengths & Favorable Trends

Favorable Industry Dynamics

By nature, cell tower REITs witness high operating leverage; high fixed costs and low variable costs are incurred in generating sales revenue. Consequently, this implies strong operating margins (cell tower REITs operating margin average is 31.04%) and also means that growth in top line revenue amid 5G deployments will translate to a proportionally higher increase in operating profit (compared to industries with low operating leverage), paving the way for further profit margin expansion at these companies.

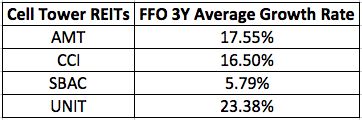

They also enjoy strong barriers to entry as the mass building of macro cell towers requires great financial resources and incurs lengthy permit processes. As a result, the publicly traded cell tower REITs, particularly the larger ones, are able to maintain their pricing power to drive revenue and Fund From Operations (FFO) growth going forward. The FFO 3-year average growth rates for the listed cell tower REITs have been calculated and specified below.

(Click on image to enlarge)

UNIT has delivered the fastest FFO growth, being the smallest and youngest company out of the group (founded in 2014). The larger giants AMT and CCI have also been delivering robust FFO growth, and this growth is unlikely to fade over the years amid 5G deployments boosting organic growth through telecom carriers spending on network densification (requiring more rental space on towers) and equipment enhancements. Given the high operating leverage of the cell tower REITs, this increased revenue will certainly translate to bottom line margin expansion as well.

Solid Cash Flow Generation

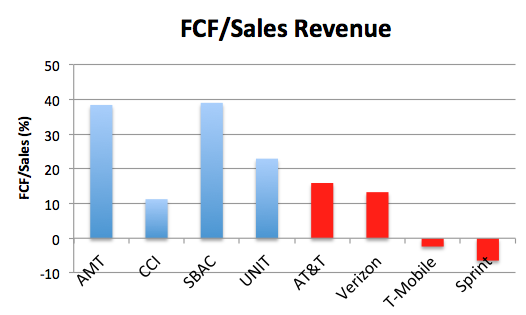

Cell tower REITs also offer predictable cash flow due to the nature of their client contracts. Their lease contracts with telecom firms range between 5 to 10 years with annual escalators for the rate charged. In fact, for globally exposed AMT, escalators for contracts outside the US are linked to local CPI readings, which not only offers a great hedge against inflation in emerging markets such as India, but also protects the firm’s revenues from foreign currency devaluations. These contract characteristics once again validate the pricing power the cell tower REITs hold, to the extent that they are able to protect their revenue generation from macroeconomics adversities, and thereby ensure solid cash flow generation. Cell tower property owners who do require immediate cash can opt for a cell tower lease buyout in order to get access to a large lump- sum payment. The dominant power of cell towers REITs over telecom companies is also reflected by the fact that their FCF/Sales Revenue ratios are notable higher. Although it is worth noting that other segments other than tower leases will also impact telecom companies’ FCF levels.

(Click on image to enlarge)

Data Source: Morningstar

Trading At Premiums To NAV

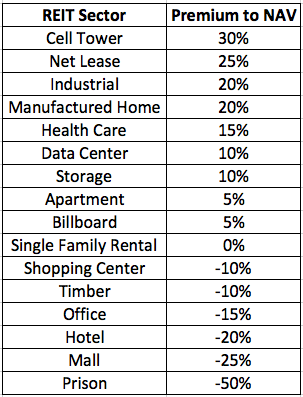

The table below compares the premiums to Net Asset Values for each REIT sector.

(Click on image to enlarge)

Data Source: iREIT

The cell tower REIT sector is the most expensive out of all, with a premium to NAV of 30%. REITs trading at premiums to NAV reflect the fact that the companies are believed to have strong growth potential ahead, which encourages investors to assign such higher valuations. In the case of cell tower REITs, 5G has been a promising growth story, encouraging investors to expect strong FFO growth ahead.

It is understandable for investors to be repelled from investing in cell tower REITs based on its rich valuation. However, the fact that it is trading a premium to NAV should actually be taken positively. REITs often tend to take advantage of their unit prices trading at premiums to NAV by issuing more units, allowing them to raise cheap capital to finance corporate expansions, such as in this sector’s case the acquisition/ development of new towers. Therefore, the fact that they are trading at such a large premium actually bolsters their leverage over smaller non-listed cell tower providers, given their healthy access to capital.

The issuance of more shares indeed dilutes its earnings per share, and thereby shareholder value. Although one should understand that as long as the 5G growth story remains intact, the REITs are likely to return to trading at premiums to NAV following such issuances as investors continue to seek exposure to this promising secular trend. Therefore over the longer-term shareholder value should persist to grow regardless of new issuances along the way.

Risks To The Outlook

While the rollout of 5G is certainly a bullish catalyst for the cell tower REITs, investors must also acknowledge the risks facing the sector.

Telecoms Building Own Towers?

Expensive lease rates undoubtedly encourages telecom companies to consider building out their own towers and thereby bypass the cell tower REITs, which is certainly a risk for industry. In fact, AT&T and Verizon have taken strides to have cell towers built specifically for them by Tillman Infrastructure, from whom they lease the towers. While such events are indeed threats to the cell tower REITs’ business, note that the telecom companies did not agree to purchase those towers built, but only agreed to lease them. Furthermore, in 2019 AT&T also entered into another agreement with Peppertree for a sale & leaseback of its assets. Owning and operating their own towers is clearly not part of the ambition for telecom operators presently, especially given the capital-intensive nature of the 5G rollout. Therefore, cell tower REIT investors should not be concerned of reduced demand for leasing space on their towers for the foreseeable future, as these telecom giants are very likely to continue leasing from them even when entering into lease agreements with other companies. The 5G rollout requires immense network densification, hence in addition to towers being specially built for them, telecom operators will continue to, if not increase, the amount of space they rent from the REITs, in order to be able to offer the best possible service to their clients in terms of connectivity quality and speed.

T-Mobile & Sprint Merger

In order for the cell tower REITs to be able to maintain their pricing power, it is ideal to have a telecom market with numerous competitors. In the US, the telecom market has indeed become rather concentrated in the hands of four operators. Moreover, cell tower REITs currently face the risk of a merger between T-Mobile & Sprint, which would bring the number of competitors down to three. Based on numbers from earnings reports, T-Mobile and Sprint collectively make up 26% of cell tower REITs revenue. If the merger is indeed approved by the Department of Justice (DoJ), then there is an expectation for the merged company to reduce the cell tower space leased to reduce any overlap. However, this risk may not necessarily materialize, given that the rollout of 5G requires considerable network densification, as discussed earlier. Hence there is a good likelihood the merged company would continue to lease space from cell towers even where overlap occurs, in order to support its 5G services.

Furthermore, while at first the T-Mobile and Sprint merger may be viewed as a negative for cell tower REITs, investors must understand that a scenario where there is no merger could be even worse, as the eventual bankruptcy of the struggling Sprint would also reduce the number of competitors to three. A more ideal scenario would be a stronger merged T-Mobile/Sprint that would be able to ensure competitive pricing among carriers, and continue to rent space from the REITs.

In fact, the DoJ is also committed to ensure the telecom market remains competitive, and therefore is adverse to the number of operators dropping to three. As a result, the T-Mobile & Sprint merger is contingent on the smaller telecom operator Dish being allowed to grow to become a new competitive force in the market. This requires compromises on behalf of the existing telecom giants in order to ensure a competitive market. Therefore, the DoJ is very likely to maintain, if not enhance, favorable conditions for the cell tower REITs. Investors should certainly not fear the possibility of a T-Mobile & Sprint merger.

The ideal scenario for cell tower REITs would be one where there is significant competition among carriers, leading to competitive pricing. We would want a scenario where the right balance is struck between financially healthy carriers that are able to commit to long-term rent contracts, but not too financially prosperous to the point that they begin to build out their own towers.

Is There An Existential Threat From Low-orbit Satellites?

Satellite and network service is highly reliant on cell towers presently, resulting in stable and growing tenant demand. However, companies such as Elon Musk’s SpaceX are already launching low-orbit satellites in Space, to offer network connectivity services. The emergence of this technology poses a threat to cell tower REITs, especially given the extremely wide range that low-orbit satellites are able to extend. The risk is that telecom providers, and other types of tenants, could decide to bypass cell towers in the future by using low-orbit satellite services instead, thereby reducing both lease demand and pricing power over the long-term.

However, while low-orbit satellites offer an alternative option for obtaining wide range network connectivity, they don’t come without shortcomings. Firstly, low-orbit satellites services are much more expensive than macro towers, hardly making it a cost-effective alternative for telecom carriers. Furthermore, cell towers also offer much better speed and latency, which are both key aspects for optimum mobile data services and 5G capabilities. Therefore, low-orbit satellites do not pose any significant threat to cell tower REITs’ business model in the near future, and thus investors can remain confident in cell towers’ superiority for offering network capabilities. Though investors should keep an eye out for future advancements in low-orbit satellite technology, and stay aware of any potential changes to industry dynamics over the long-term.

Interest-rate Sensitivity

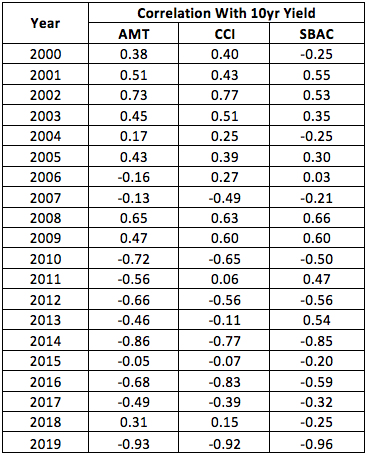

For all REIT sectors, it is important to examine how sensitive they are to changes in interest rates, particularly the 10-year yield. To assess how sensitive the stock prices of the cell tower REITs have been to changes in the 10yr yield over the long-term, the Pearson correlations between the two have been calculated for every year since 2000 (Uniti Group has been excluded due to only having been publicly traded since 2015). The results are summarized in the table below.

(Click on image to enlarge)

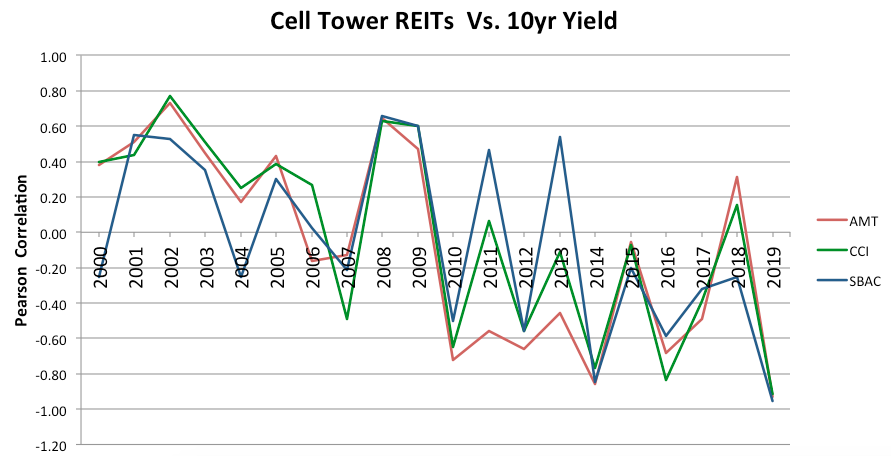

The chart below helps better visualize the trends in correlations since 2000.

(Click on image to enlarge)

For the most part, the correlations for each of the cell tower REITs have been moving in tandem. Interestingly, prior to the financial crisis, the REITs had notably positive correlations with the 10yr yield, whereby share prices would rise even during periods when the yield climbed higher. Nevertheless, since the recession the correlations have dropped and mostly remained in negative territory. In fact, 2019 marked the year of the strongest negative correlation, with the largest REIT, AMT, reflecting a -0.93 correlation. The strongly negative correlations mean that no matter how strong the fundamentals are or how promising the growth story is, investors should not invest in the this REIT sector without first evaluating the outlook for 10yr Treasuries. If this correlation holds and an improving economic outlook induces the 10yr yield to climb higher going forward, then it would pose a significant downside risk for cell tower REITs.

Cell tower companies by nature are not economically sensitive, as demand for telecom services are likely to stay relatively stable even during recessions. However, REITs are considered bond proxies, hence when the 10yr yield drops, it increases demand for alternative yield-sources such as REITs. Conversely, a rising 10yr yield encourages yield-seekers to dump REITs for the safe-haven Treasuries, causing cell tower stock prices to drop.

Nevertheless, the risk of the 10yr yield accelerating higher is quite slim for the foreseeable future. The Fed has made clear its unwillingness to raise rates until they see inflation above 2% for sustained periods of time. This in essence sends a signal to the market that in the absence of higher inflation, interest rates are unlikely to move much higher for an extended period of time given the expectation that inflation will remain subdued for the foreseeable future. As a result, this puts notable downward pressure on the 10yr yield, as reasons to raise rates in the future seem scarce.

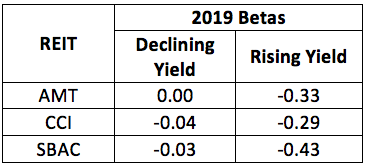

However, the separation of systematic risk into upside and downside betas of cell tower REITs against the 10yr yield offers us insight into their sensitivity to both favorable and unfavorable moves in Treasury yields. The Betas have been calculated for 2019 and summarized below.

(Click on image to enlarge)

The separation of Beta for favorable yield moves (declining yield) and unfavorable yield moves (rising yield) in 2019 has revealed a worrying trend. During times when the 10yr yield dropped, the REITs hardly offered a negative Beta, implying that the stock prices did not move notably higher on days the 10yr yield moved favorably. On the other hand, during times when the 10yr yield rose, the stock prices reflect a comparatively stronger negative Beta. This implies that the REITs reacted more strongly to unfavorable movements than favorable movements in 2019.

Of course, just because the REITs delivered a strong negative correlation and unfavorable Betas against the 10yr in 2019 does not mean it will continue to do so for the years ahead as well, given that the correlation table and chart earlier revealed how the correlations have continued to fluctuate annually since 2000. In fact, if the scenario materializes where the cell tower REITs have sold off heavily due to a rising 10yr yield, to the point where they are trading at equality, or even at a discount to their NAVs, then this should be considered a buying opportunity. The reasoning being that following such scenarios, the correlations against the 10yr yield are likely to weaken again, and the REITs will once again be driven by their growth stories. The market would be wrong to punish these REITs amid rising yields, because they have immense growth potential as a result of the widespread 5G rollout, and thus over the long-term will be more influenced by lease demand and next generation network advancements. Investors should keep an eye out for any potential mispricing going forward, and exploit such opportunities with a long-term outlook in mind.

Financial Performance & Metrics

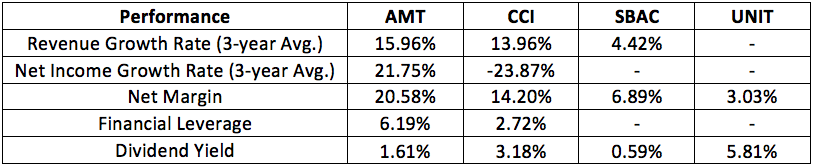

The table below details the financial performances and metrics for the cell tower REITs.

(Click on image to enlarge)

Data Source: Morningstar

It is interesting to find that the largest REIT, AMT, offers the best revenue and profit growth rates of 15.96% and 21.75%, respectively. It also offers the best net profit margin at 20.58%, which will continue expanding amid large-scale 5G capex by telecoms and the REITs’ high operating leverage, as discussed earlier. On the other hand, the smaller REITs, SBAC and UNIT, offer the least attractive growth rates and profit margins, reflecting that they may be struggling to compete against the two industry leaders, AMT and CCI.

Nevertheless, while AMT offers the best growth rate and margins, it also offers one of the lowest dividend yields, currently at 1.61%. Though its size and diversified portfolio also makes it a safer bet than its peers. Although it also has the highest leverage ratio at 6.19, more than double than that of its next biggest competitor, CCI. This higher leverage profile could make it more vulnerable to market downturns and risk-off sentiment among investors, though this in turn could also create interesting buying opportunities for long-term investors. Moreover, given AMT’s pricing power and the relative stability of rental income, and given telecom services’ defensive characteristics, this high leverage should not pose any serious threat to the company’s ability to meet debt payments for the foreseeable future.

Bottom Line

National and international 5G deployment creates vast new investment opportunities, and cell tower REITs are one of the best vehicles to profit from this secular trend. The continued growth in mobile data usage, and the diverse range of 5G uses creates strong lease demand for cell tower REITs going forward. Their high operating leverage allows them to translate strong revenue growth into profit margin expansion with ease.

Strong barriers to entry and high development costs means competitive pressure is relatively low in the US, and effectively makes them price makers. This pricing power ensures strong future revenue and FCF growth, which constantly enhances their ability to pay dividends and finance expansions.

While the cell tower REITs have strong growth potential ahead, they certainly face certain risks ahead as well. In 2019 the cell tower REITs became very strongly negatively correlated with the 10yr yield, such as a -0.93 correlation for AMT, making them more sensitive to rising yields. Though given the Fed’s reluctance to raise rates until the nation witness sustainable inflation above 2%, we are unlikely to witness any significant acceleration higher in the 10yr yield any time soon. Although any pullbacks in cell tower REITs, due to rising Treasury yields, should be considered buying opportunities given their long-term growth potential amid the 5G rollout and future next generation network advancements.

Good article. Hadn't thought about the cell tower REITs angle.