Zero Rates And Equities

“U.S. interest rates will stay near zero for at least three years as the Federal Reserve enacts measures to prop up the economy. But are low-interest rates a new phenomenon? Interestingly, one study by the Bank of England shows that this pattern of declining interest rates has taken place globally since the late Middle Ages. In fact, it suggests that these downward-sloping rate trends have taken place even before modern central banks entered the scene—illustrating an entrenched, historical trend.” (Dorothy Neufeld, October 1, 2020)

In a world of zero policy interest rates, long-term bonds have been providing the only action available to fixed income traders.

The conventional wisdom is that investors are betting on steeper yield curves partly because they expect inflation pick up due to the major monetary and fiscal policy boosts which have been given to virtually all advanced economies because of the pandemic recession.

Economic theory and historical data also suggest that low-interest rates bolster stock prices in the short term, and there may even be secondary or hidden catalysts that provide for longer-term favorable impacts. On the other hand, given the crap-shoot nature of financial markets, zero interest rates also could trigger a catastrophic inflationary outcome.

Nonetheless, as long as the zero-policy interest rate environment continues, the search for higher yields will remain, and of course, this should boost equity markets.

The most important interest rate for the stock market is the US Fed’s benchmark rate, the federal funds rate. The federal funds rate is the rate commercial banks are charged for borrowing money from Federal Reserve banks.

And the Fed has signaled on many occasions that the federal funds rate will remain near zero at least through until the end of 2022.

Indeed, virtually all of the important central banks are similarly expected to keep the stimulus pedal to the metal in 2021 and 2022.

Although Fed policies act as an anchor on Treasury yields, we could see yields rising and the yield curve steepening as improving growth and higher inflation emerges. The real question is, at what speed will all of this occur.

During the interregnum of low-interest rates, investors will surely continue to prefer public equities to low bond yields. As well, there is little doubt that low-interest rates have driven stock prices much higher than they would otherwise have been.

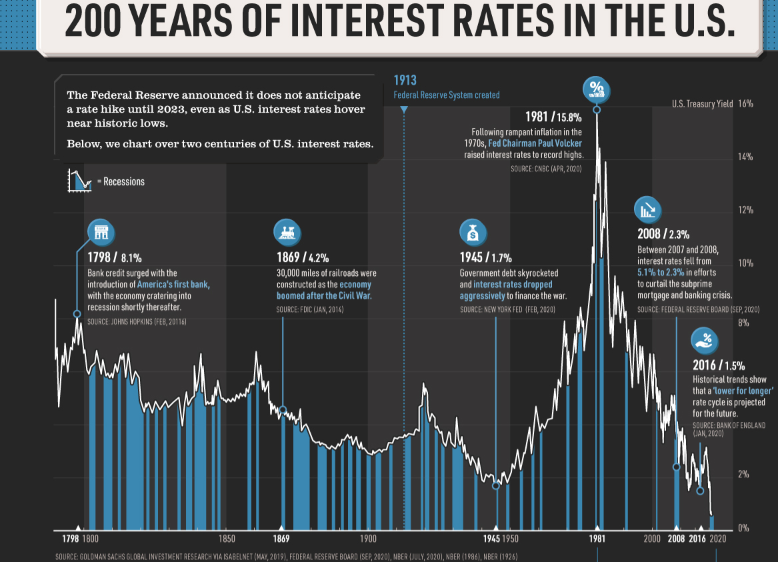

Finally, as the following chart illustrates, 10 year US government yields have been very volatile, and extremely interest rates are not an entirely new phenomenon.

For example, yields fell to 1.7% during World War II as the US government injected billions into the economy to help finance the war, and government debt ballooned to over 100% of GDP. There were other examples of prominent interest rate lows in the 18th and 19th centuries.

(Click on image to enlarge)

Quite interesting, and it brings up points that I had not considered.