YTD Asset Class And Portfolio Performance

Summary

- US stocks led asset classes in 2023 and 2024, but in 2024, gold and foreign stocks outperformed, highlighting the value of diversification.

- Diversification outside US stocks has added significant value this year, as evidenced by the strong performance of gold and foreign equities.

- Target date funds (TDFs) typically follow similar glidepaths, but a U-shaped glidepath offers better protection near retirement and promising results.

- With $4 trillion in TDFs at risk, innovation in glidepath design is crucial as diversification proves increasingly important in changing markets.

Asset Class Performance

US stocks returned 26% in 2023 and 24% in 2024, leading all other asset classes in both years by a wide margin. That’s a whopping 56% 2-year return. Plus, US stocks have returned 14% so far this year, which you might think is also dominating asset class performance, but it’s not.

Gold has returned an incredible 47% so far this year, reaching more than $3900 per ounce, followed by Foreign stocks at 28%. Something changed this year. This year diversification outside US stocks has added value as can be seen in the performances of portfolios.

Portfolio performance

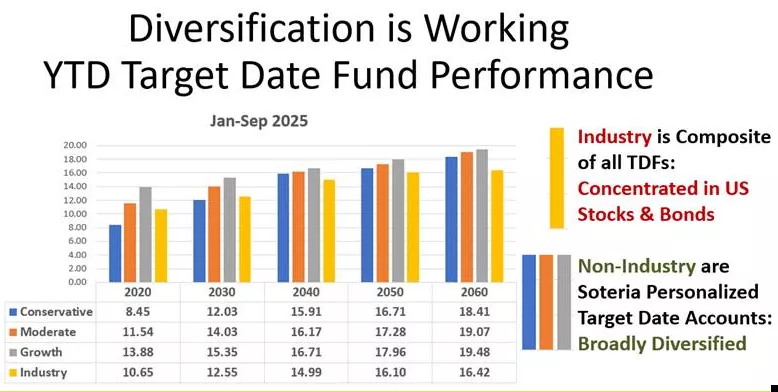

Target date funds provide benchmarks for evaluating your own performance because you can choose your risk and time horizon, as shown in the following:

Here’s how to use this graph. If your portfolio is limited to US stocks and bonds, choose the Industry result for your investment horizon. If you are diversified, use the return for your risk and horizon, noting that diversification helps this year. How did you do?

An update on target date fund glidepaths

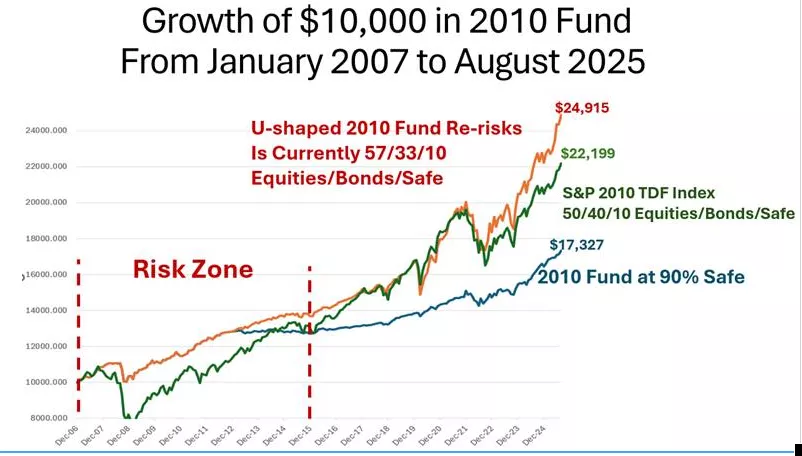

Most target date funds (TDFs) use similar glidepaths that end near retirement at 50/40/10 equities/bonds/cash, but a substantial deviation from this typical path is provided by a U-shaped glidepath that is very safe near retirement to defend against sequence of return risk and then re- risks in retirement.

The first U-shaped path has completed its mission and the results are very promising, as detailed in this article, and the following graph.

This is an important result because $4 trillion is invested in TDFs that have not evolved so those near retirement now are in jeopardy, but they would not be if they were in a U-shaped glidepath. TDFs need innovating.

Conclusion

Buddha said, “Impermanence is eternal.” This year US stocks have lost their dominance, so diversification outside the US is benefiting performance. Will diversification continue to “work”? What are your thoughts?

More By This Author:

Compete Against The Target Date Fund Oligopoly By Innovating

Baby Boomers Beware: Target Date Funds Do Not Track Safe Scholarly Guidance

Replacing The Tail That Wags This Dog Is A Thucydides Trap