Compete Against The Target Date Fund Oligopoly By Innovating

Summary

- Target Date Funds (TDFs) need innovation to compete against the oligopoly by delivering better participant outcomes.

- A U-shaped glidepath offers smarter risk management, protecting near-retirees and outperforming the index over a 20-year test period.

- Personalization based on risk tolerance, not just risk capacity, empowers investors to manage their unique retirement lifepaths.

- With baby boomers in the Retirement Risk Zone, adopting U-shaped glidepaths and true personalization is crucial to avoid devastating losses.

“Me too” target date funds (TDFs) are languishing in obscurity against the oligopoly that manages two-thirds of the $4 trillion TDF market. To compete you need to innovate toward better participant results. You need to be different AND better. There have been no innovations to TDFs in their entire 19 year history. It’s time. This article introduces trailblazing innovations that improve participant results with:

- Smarter risk management along a revolutionary U-shaped glidepath that wins on both risk and return: safer and richer.

- Personalization based on risk tolerance that lets participants manage their own unique lifepaths because investing is personal.

Here are overviews of the innovations

Smarter Risk Management

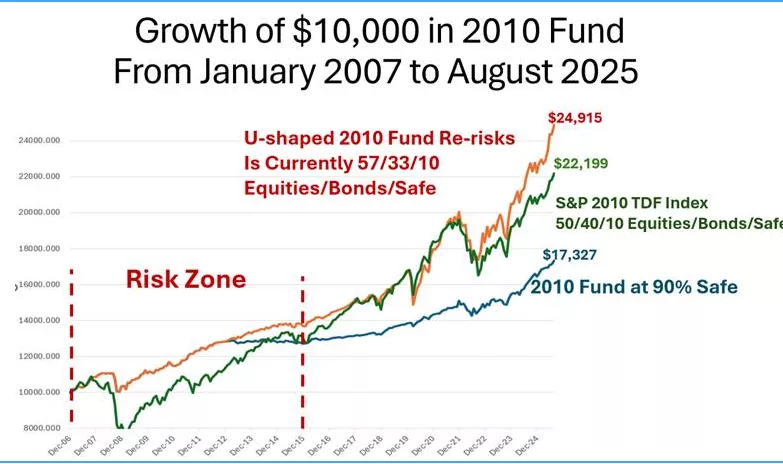

A U-shaped glidepath protects against Sequence of Return Risk near retirement by being very conservative, and then it re-risks in retirement to extend the life of investments. The typical TDF cannot re-risk in retirement because it is already very high risk at its target date. U-shape requires safety at the target date, which protects against Sequence of Return Risk. The U-shaped 2010 fund, with a 15-year post-retirement history, has come through this process with a very successful result as described in this article.

This innovation protects in the Retirement Risk Zone AND it outperforms the Index.

The U-shaped glidepath has delivered more wealth than the Index, and with controlled risk, especially for those near retirement in 2008 who did not suffer the losses experienced by other TDFs. The U-shape starts retirement very safely and then gradually takes on more risk as retirement progresses.

The point is that the 2010 fund is the first (and only) test of the U-shaped design so far. Start to finish, it’s 20 years. This particular 20 years started with a crash (easy win for a conservative design) , followed by the longest bull market ever (a challenge for the U-shaped design).

The encouraging news is that U-shaped wins – one in a row!! In 10 years from now we’ll know how the U-shaped 2020 fund fares in its 20-year journey. Time flies.

Personalization That Works

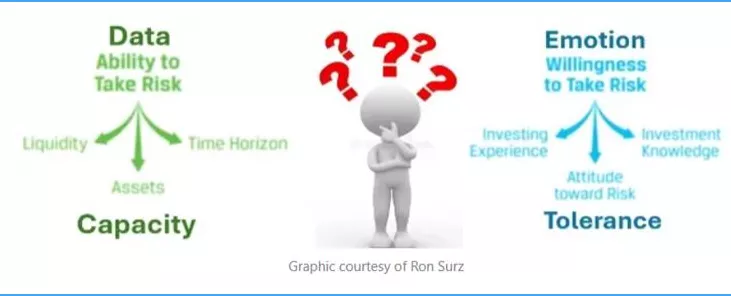

Personalization of TDFs has come to market as Personalized Target Date Accounts (PTDAs), but it’s based on the use of recordkeeper data that reveals risk capacity, which is the wrong basis – capacity is the ability to take risk. Sensible personalization should be based on risk tolerance – the willingness to take risk. Most rich people with high risk capacity want to stay rich, so their risk tolerance is low. Here’s an article on sensible personalization.

Which brings us to choices. Personalization gives participants the ability to manage their own personal lifepaths through time.

Personalized Choice

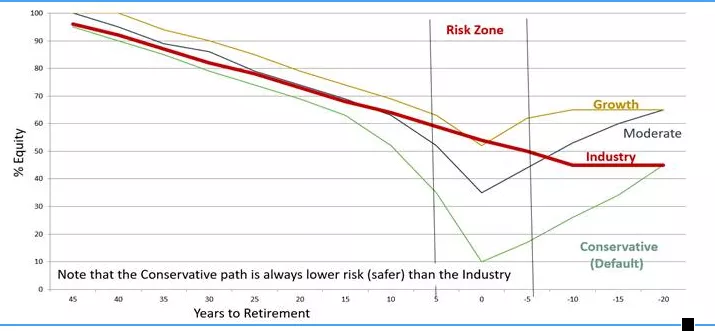

Unlike most target date funds (TDFs) with a single glidepath, PTDAs come with an array of glidepaths with varying risks, such as those shown in the following.

The “Industry” shown in the graph is the S&P target date fund index aggregate of all TDFs. It is 85% in risky assets at the target date. By contrast, the “Conservative” glidepath is 20% risky at the target date. It is like the glidepath followed by the Federal Thrift Savings (TSP) TDF, and others.

Conclusion

There are only a couple TDF innovations currently under consideration: a U-shape and personalization. The early results for U-shaped are now in, and they are very promising. Of course, the next 20 years won’t be like the last 20, but there are persuasive reasons to actually implement. The 2020 fund is now 5 years into its post-retirement path.

The past 15 years have been the longest bull market. Investors have become lulled into a sense of permanence—believing downturns are no longer part of the investment landscape. That mindset leaves portfolios – including typical TDFs -- exposed when a crash inevitably returns, pursuant to Stein’s Law that if Something Cannot Go on Forever, It Will Stop.

In this decade baby boomers are in the Retirement Risk Zone during which a crash could ruin the rest of life. Baby boomers in TDFs are in the 2020 and 2030 funds, both of which are typically not safe with 50% in equities and 40% in long-term bonds. By contrast, the U-shape at 80% safe protects them against Sequence of Return Risk now, and eases them back into higher expected returns as they leave the Risk Zone.

Personalization is also worthy of consideration because investing is personal, but it’s important to recognize the difference between risk capacity and risk tolerance. Sound personalization requires an assessment of risk tolerance.

TDFs for retirement savings investing were launched in 2006 with the passage of the Pension Protection Act. Not much has changed in the ensuing 19 years. It’s time for improvements. For those who would like to compete against the TDF oligopoly, you’ll need to be something other than just another “me too” fund.

More By This Author:

Baby Boomers Beware: Target Date Funds Do Not Track Safe Scholarly Guidance

Replacing The Tail That Wags This Dog Is A Thucydides Trap

YTD Asset Class Performance Through August 2025