Replacing The Tail That Wags This Dog Is A Thucydides Trap

Summary

- The US dominates global markets but faces rising challenges from the CRINK bloc (China, Russia, Iran, North Korea) and shifting world dynamics.

- Global economic power is dynamic; the US is not invincible, and history shows leadership shifts over time.

- US vulnerabilities include an expensive stock market, rising debt, aging demographics, and threats to dollar dominance.

- I recommend baby boomers protect against a potential crash by moving to safe assets like Treasury bills and TIPs during the Retirement Risk Zone.

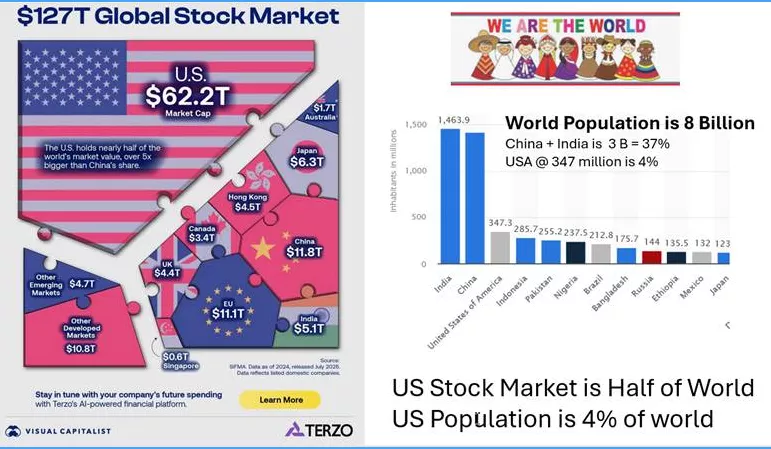

The US population of 340 million people is only 4% of the world, yet its $62 trillion stock market is about half of the world. The US is the tail that is wagging the world’s economic dog.

Source: Visual Capitalist

CRINK -- China together with Russia, Iran and North Korea -- want to replace the US as the world’s leader, creating a Thucydides Trap that forces a collision with the US, just as Athens once did with Sparta. CRINK’s population of 1.6 billion people is 5 times that of the US, so the US is grossly outnumbered.

India, with its 1.6 billion people, is not taking sides. Although its border with China is contentious, it has close ties to both Russia and the US.

A history of world dominance

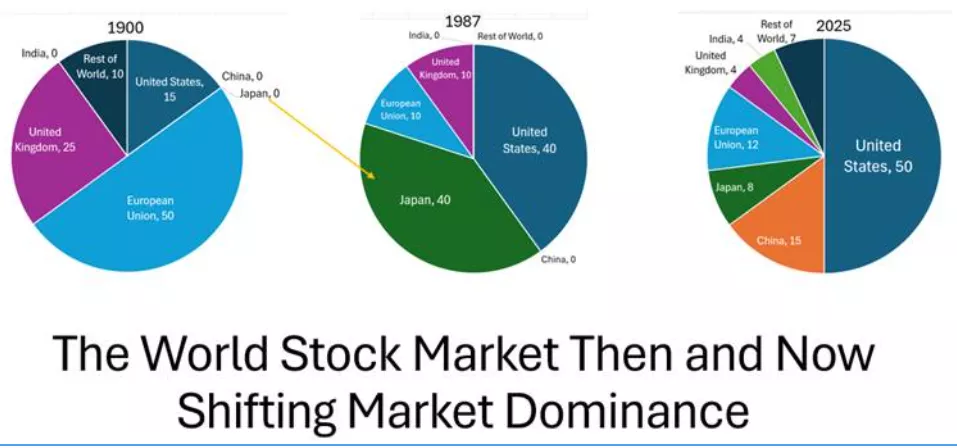

It’s helpful to recognize that the US wasn’t always the dominant economic power. As shown in the following, Europe had the lead in 1900, then by 1987 Japan and the US were co-dominant, and now it’s the US.

The point is that global economics are dynamic so the current situation will change even though it may feel like the US is invincible – it’s not.

Source: World Bank

A bimodal world economy

The CRINKs are distancing themselves from the US in a variety of ways including:

- Reduced reliance on the US dollar. China and Rusia are trading with each other in yuan and rubles, and they have created a digital currency to rival the USD.

- Alternative trade and energy networks. For example, the China-Russia Power of Siberia 2 gas pipeline delivers much needed energy to China.

- Challenges to US hegemony. The CRINKs undermine sanctions and alliances like NATO, and find ways around US tariffs.

While the US is dealing with its own domestic problems that include:

- A very expensive stock market, as measured in a variety of ways, threatening a correction.

- Tariffs that tax US citizens as a way to reduce significant deficit spending

- Potential loss of status as the world reserve currency as interest payments on its debt swell, devaluing the US dollar

- Reliance on the manufacturing edge in other countries, especially emerging markets like India. Tariffs might not bring manufacturing back to the US.

- An aging population. The US wants to protect its older citizens, and this requires help from the young.

Conclusion

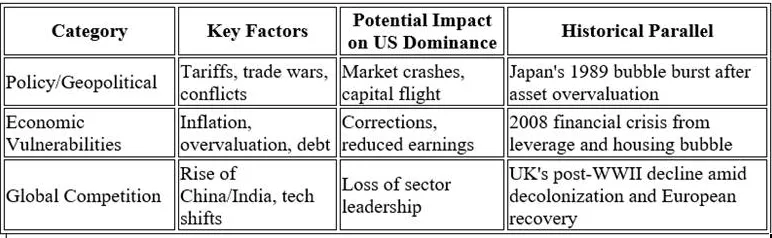

Here’s a summary of the economic factors in play that hopefully will be resolved peacefully

Source: Grok AI

Any one of these factors will cause a stock market crash that baby boomers should defend against now. Boomers should move to safe assets like Treasury bills and TIPS while they are in the Retirement Risk Zone that spans the 5 years before and after retirement. Younger investors with longer horizons are likely to survive a crash, but they won’t like it.

More By This Author:

YTD Asset Class Performance Through August 2025

Tariffs Are Taxes

Vanguard Recommendation Would Make Target Date Funds Much Safer For Baby Boomers