Vanguard Recommendation Would Make Target Date Funds Much Safer For Baby Boomers

Image Source: Unsplash

The definition of the word "Vanguard" is leading the way in new developments or ideas.

Investors in target date funds (TDFs) think they are protected against investment losses near retirement, but they are not. 75 million baby boomers are near retirement; those in TDFs are taking substantial risk, but they don’t know it.

Also, Vanguard has recently recommended a protective asset allocation.

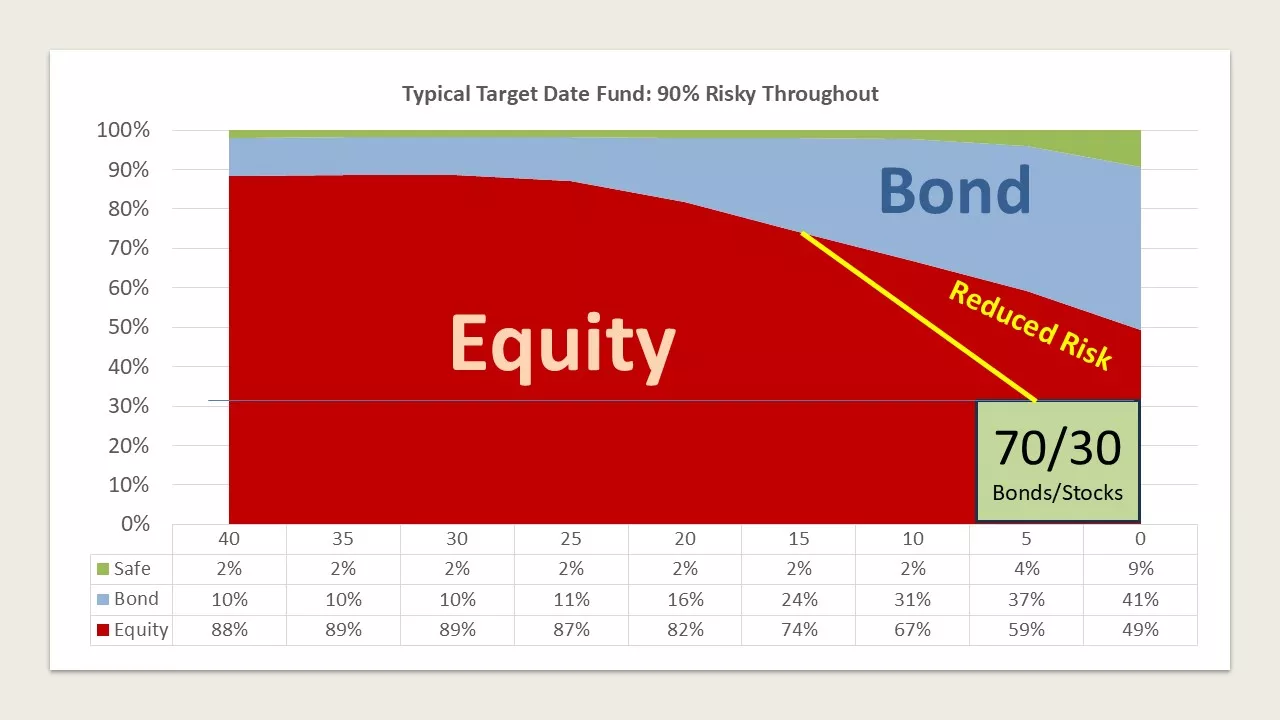

According to Vanguard's Latest Allocation Guidance Is Turning Heads, Vanguard is advocating 70/30 bonds/stocks for the next decade, even though its target date funds are a much riskier 55/35/10 stocks/bonds/cash for those near retirement.

Protecting Baby Boomers

So, the question is “Will Vanguard reduce the risk in its TDFs?” If it does, the TDF Industry will follow and here is what will happen:

- TDFs will move toward the Safe Landing Glidepath (SLG) and other safe glidepaths that I call the Safe Group. SLG is a benchmark called the SMART TDF Index on Morningstar Direct.

- Glidepaths will actually follow the academic theory that they say they follow. The theory is 80% risk free at retirement.

- TDFs will reduce risk along the yellow line in the following.

Most importantly, baby boomers in TDFs would be much safer during this critical time in their lives while they are in the Retirement Risk Zone that exposes them to Sequence of Return Risk.

The Rest of the Story

For the whole story about target date funds, please read my book that explains why TDFs need fixing, and how to fix them.

Who knows? Perhaps Vanguard will lead the way. as the vanguard for improvement.

More By This Author:

Playing The Odds On US Stocks In August & September 2025

Are Current Interest Rates Too High? What Is Normal?

High Earnings Growth Will Not Forestall Stock Market Losses

My Soteria software does protect baby boomers with an allocation that is 70% very safe at the target date.