Baby Boomers Beware: Target Date Funds Do Not Track Safe Scholarly Guidance

Summary

- Most target date funds (TDFs) do not follow academic lifetime investing theory, exposing retirees to more risk near retirement than theory.

- Academic research and the Federal Thrift Savings Plan recommend 70-80% risk-free assets near retirement, but most TDFs are 90% risky assets.

- TDF providers justify higher risk due to inadequate savings, but this contradicts the scholarly guidance they claim to follow.

- Baby boomers should exit TDFs and move to T-bills and TIPS now, as a market crash could devastate retirement savings due to Sequence of Return Risk.

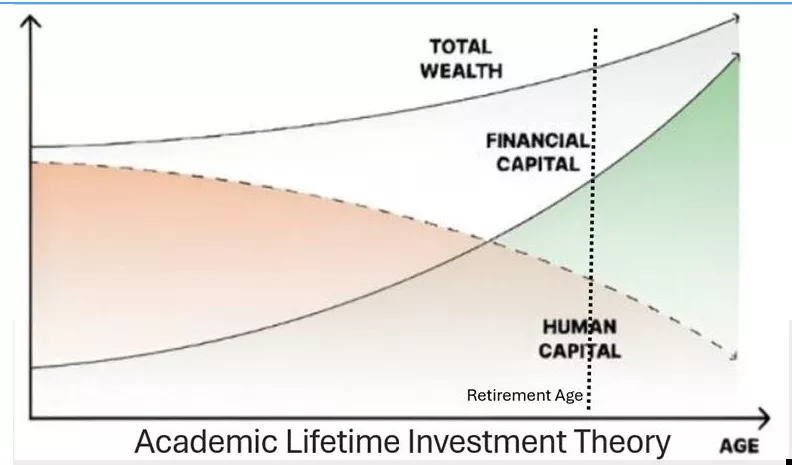

Target date fund (TDF) providers say they follow the academic theory of lifetime investing. As Human capital (present value of all wages) depletes, we rely more and more on our accumulated Financial capital (our savings). Makes sense.

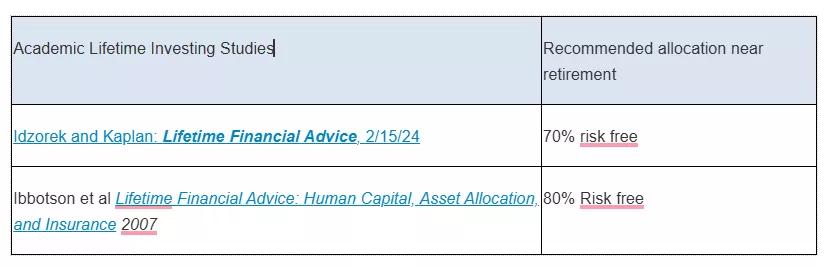

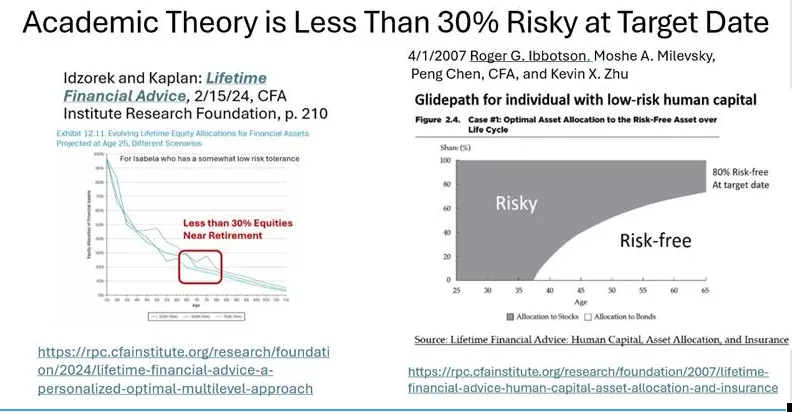

Here’s where you can read about the academic theory of lifetime investing:

In summary, the theory is very safe for people near retirement, with less than 30% in risky assets, as shown in the following excerpts from the 2 studies:

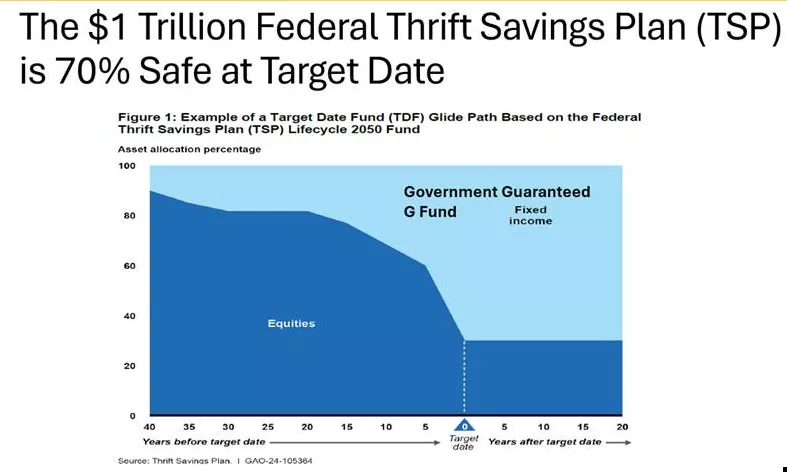

The theory is put into practice by the largest savings plan in the world. The TDF of the $1 Trillion Federal Thrift Savings Plan is 70% risk free at its target date.

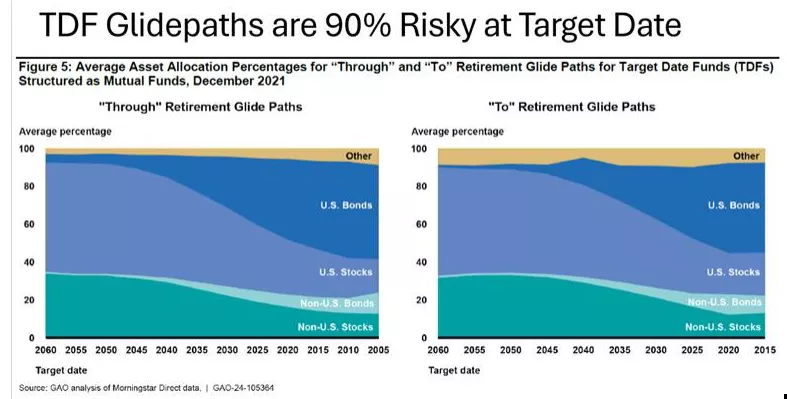

But the rest of the TDFs, with $4 Trillion, do not follow the theory, even though they say they do. They are 90% risky at their target date, with 50% in equities and 40% in risky long-term bonds:

Why are TDFs riskier than the theory they say they follow?

TDF providers say it’s because people have not saved enough so they need the “medicine” of risk, but they also say that they follow academic theory. They can’t do both. High risk has worked for the past 16 years because it’s been the longest bull market ever, so high risk has been good -- so far.

But Stein’s Law will hold —if something cannot go on forever, it will end. There will be a stock market crash that will change everything. Can $4 trillion in TDFs be wrong? Stay tuned.

Conclusion

Baby boomers are in the Retirement Risk Zone when Sequence of Return Risk is a threat. The next crash could ruin the rest of their lives. The problem is that TDFs will not change until and if there is pressure to change. This could happen after the next crash, but it will be too late for boomers. In 2008, TDFs for those near retirement lost more than 30%, prompting the first and only joint hearing of the SEC and Dol, but nothing changed.

This time $4 trillion is in play, much more than the $200 billion in 2008. So, there will be an uproar. Baby boomers cannot wait for that uproar. They need to get out of their TDFs now and move to the safety of T-bills and TIPS, following the guidance of academic theory because that’s the smart thing to do.

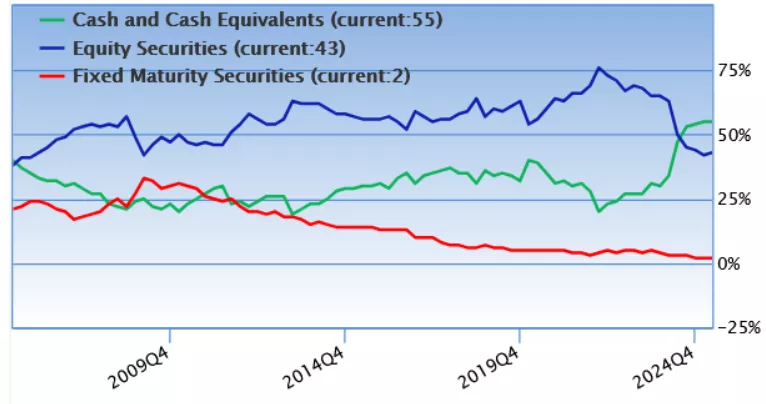

The need for safety near retirement is currently reinforced by a bubble in the US stock market that has moved Warren Buffet to cash (not bonds) in Berkshire Hathaway

Source: GuruFocus https://www.gurufocus.com/buffett_assets_allocations.php?1

Vanguard also acknowledges the bubble and has recommended a safe 70/30 bond/stock mix for the next decade. Risk management reinforces scholarly guidance.

More By This Author:

Replacing The Tail That Wags This Dog Is A Thucydides Trap

YTD Asset Class Performance Through August 2025

Tariffs Are Taxes