Yields Tumble After Stellar 7Y Auction Prices At Record Stop Through

After two ugly coupon auctions earlier this week, moments ago the Treasury sold $37 billion in 7y paper in what can only be described as a stellar auction.

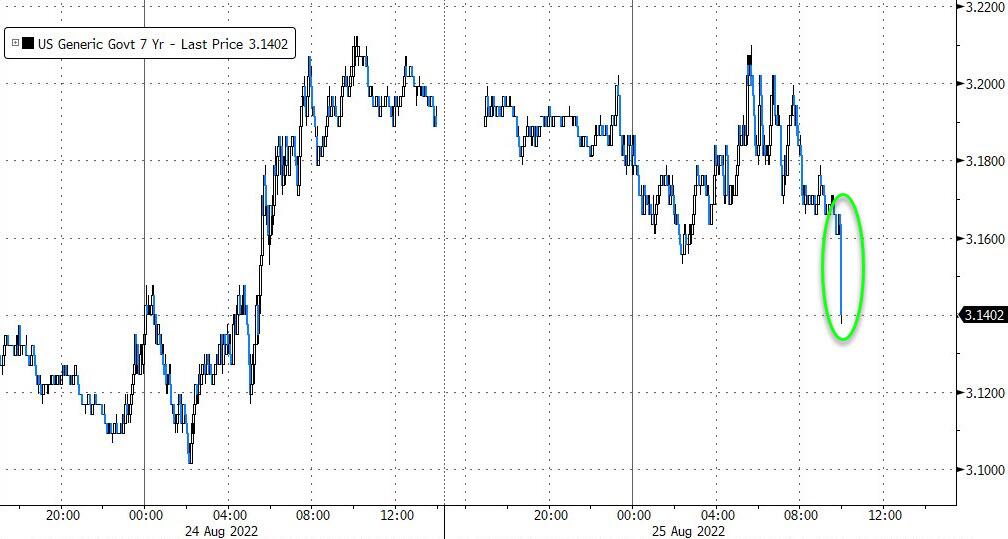

Stopping at a high yield of 3.130%, today's auction was softer than July's 2.730% but well below June's 3.280%. More importantly, the stop tailed the When Issued 3.158% by 2.8 basis points, which is the biggest stop through on our record going back to 2016 (and certainly far, far better than that catastrophic 4.4bps tail from Feb 2021 which sparked a multi-month Treasury selloff).

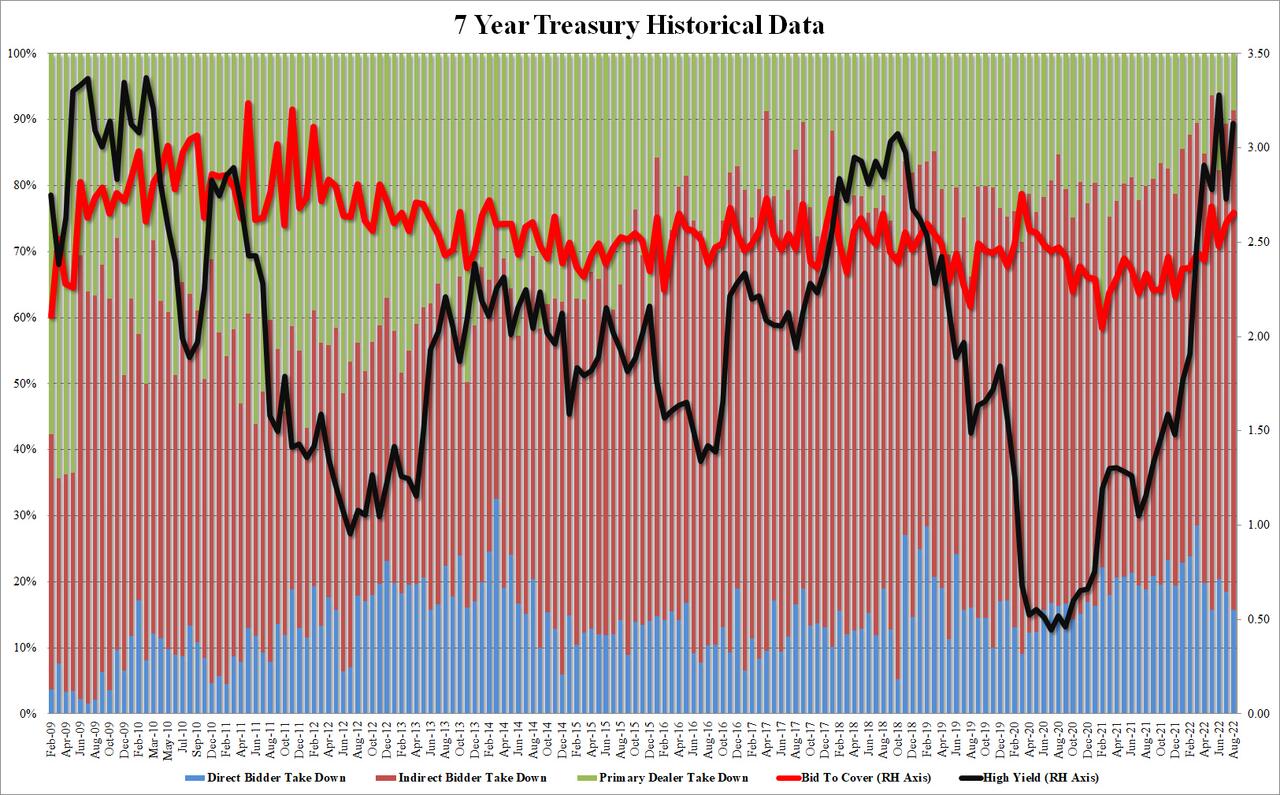

The bid to cover was also solid, jumping to 2.655 from 2.604 in July, and the highest since May (2.690), which in turn was the highest since March 2020.

Finally, the internals were also impressive, with Indirects awarded 75.7%, well above last month's 70.9%, and the six-auction average of 66.7%. And with Directs awarded 15.70%, Dealers were left holding on to just 8.6%, the second lowest on record with only May 2022 lower (at 6.4%).

Overall, a blockbuster auction that confirmed that at least in the bond market, nobody is afraid of a hawkish Powell surprise tomorrow (or if he does surprise, it will only accelerate the recession), and one which helped send 10y Yields, and the entire curve, down to session lows.

More By This Author:

"It's Not Enough": A Deeper Look Inside China's Latest 1 Trillion Yuan StimulusGrain Traders See Record Profits Amid Food Crisis, Prompting Calls For Windfall Tax

Home Price Drops In Pandemic Boomtowns Could Be First Sign Of Coming Real Estate Turmoil

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more